National leaders prepare for supply and logistics impacts

High crude oil inventories amid declining demand for petroleum products. Falling oil prices. Dwindling drilling rig counts and planned production cuts.

How is a propane retailer to make sense of it all, especially during a pandemic?

“Price will always tell you what’s going on,” says Dale Delay of Cost Management Solutions (CMS), noting how propane this year has moved from the low 20-cent range in March up to the mid 40s in May.

Mark Rachal of CMS recently laid out one scenario in which his projected 8-million-barrel build in propane inventory for this winter becomes an 18-million-barrel draw, creating potential supply concerns for the industry and an upward price environment. View his outlook in the video here.

Mark Rachal offers insight on propane supply for winter 2020-21

Some propane industry leaders are beginning to take notice and consider what these market dynamics might mean for propane supply this winter.

National Propane Gas Association (NPGA) President and CEO Steve Kaminski says NPGA is beginning those discussions around propane supply and logistics.

“As we move from the health care phase of this crisis to the economic phase of this crisis, we are hearing initial concerns about supply, with respect to oil prices and a lack of demand and how that could affect the propane industry,” Kaminski said in April.

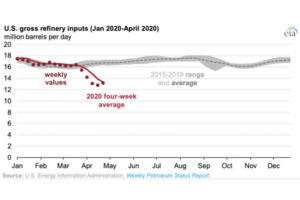

The NPGA Propane Supply and Logistics Committee, along with leaders from the Propane Education & Research Council, has been active lately, says UGI Corp.’s Steve Kossuth, chairman of the committee. Kossuth says the committee began meeting and discussing the latest issues about a month ago. Because propane is a byproduct of crude oil refining (and natural gas processing), about 15 percent of its supply comes from an industry that is highly dependent on transportation-based demand. With pandemic-related demand hits to gasoline, diesel and jet fuel, and the response by refineries to curtail throughput, the reduction of LPG is inevitable, Kossuth says.

“If typical supply flows are going to be disrupted, there’s going to be an inherent impact on the logistics marketplace – pipeline, rail and truck,” he adds.

Of course, there won’t be a shortage of product in the United States, says Kossuth, noting how the country exports nearly twice as much LPG as it consumes, but there could be constraints of product in certain regions, causing a crunch on logistics.

Propane industry leaders are working to get ahead of any potential supply and logistics situations and are planning to revise and redistribute a white paper about lessons learned from the challenging winter of 2013-14. In addition, the “ABCs of Supply Preparation” will encourage propane retailers to consider a host of factors about their businesses – including what to know about suppliers; winter/summer ratios; days of inventory and storage options; and filling customer tanks early – and help them gauge whether they are prepared for supply and logistics shortcomings.

“Our industry has been extremely resilient. No one says the polar vortex year was easy, but we made it through as an industry,” Kossuth says. “We’re leveraging the lessons learned from that time frame as we approach the upcoming winter in regard to logistics.”

Look for more from the industry’s national leaders throughout the year. The NPGA board of directors will convene for a virtual mid-year meeting June 15. “We have a vested interest in thinking about this together,” Kossuth says.

Production drops

Notable from last week was U.S. Energy Information Administration (EIA) data showing propane/propylene production falling by 100,000 barrels per day (bpd), which would equate to 36.5 million barrels of propane, says Delay at CMS.

While Delay points out the bpd volume isn’t all fuel-use propane and that total propane inventory has risen to more than 61 million barrels, about 19 percent higher than the five-year average, “That opens your eyes to where you say, ‘Hey, I better be cautious here.’ That’s a lot of product to come out of the system.”

With the coronavirus pandemic impacting crude oil markets, Delay says, some people might think propane is immune to any negative effects because about 80 percent of it comes from natural gas processing.

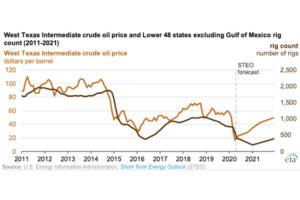

Delay reminds us that an oil well still produces associated natural gas, so less drilling activity means less propane. The number of active drilling rigs was down to 355 on May 8 after totaling 753 in February, according to Baker Hughes data cited by the EIA.

Winter prices fall

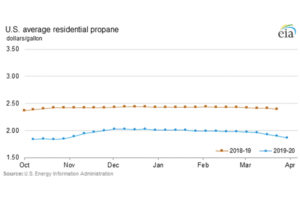

The EIA issued its final propane price update April 1 before the next heating season begins in October.

As you can see here, average residential propane prices held steady throughout the 2019-20 winter and were 24 percent lower than in the previous winter, the EIA says.

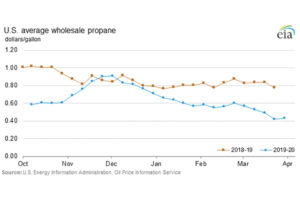

The average wholesale propane price trended downward after the new year. The only real issues last winter came when high demand for agricultural and space-heating accounts, specifically in the Midwest, and disruptions in rail shipments from Canada sent wholesale prices upward in November and December.

*Featured image: ehrlif/iStock / Getty Images Plus/Getty Images