No dip in propane prices this December?

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explores the possibility that the annual December propane price dip might not occur this year.

Catch up on last week’s Trader’s Corner here: Lower propane prices drive winter outlook

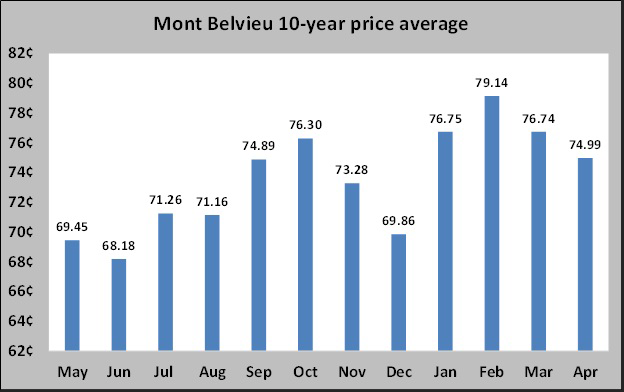

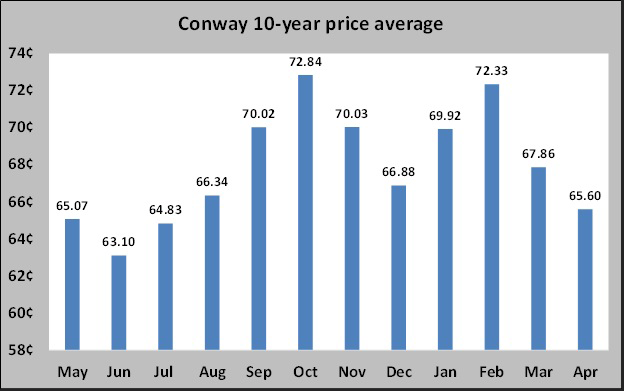

Let’s begin this Trader’s Corner by looking at the 10-year monthly price charts for Mont Belvieu, followed by Conway.

The pricing pattern at both hubs is the same, so we could have gone with one chart, but we think the specific 10-year monthly averages for each hub are handy to have, depending on which hub the propane buyer’s supply is based.

We want to focus on the month of December and then argue the possibility that the December price dip might not occur this year. But first, let’s establish why it might be there at all. We have discussed this in previous Trader’s Corners, but a review never hurts.

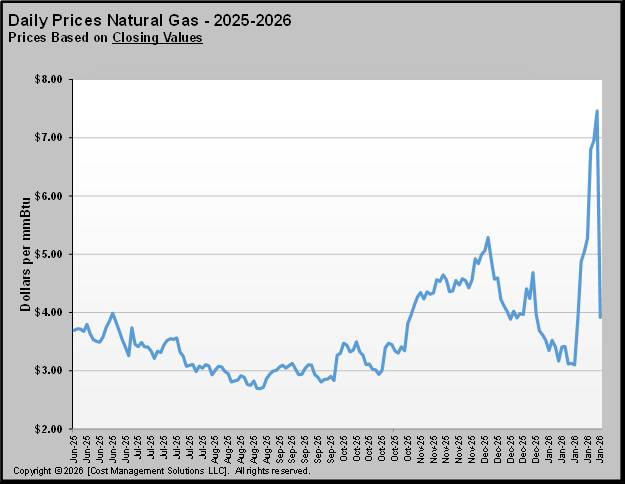

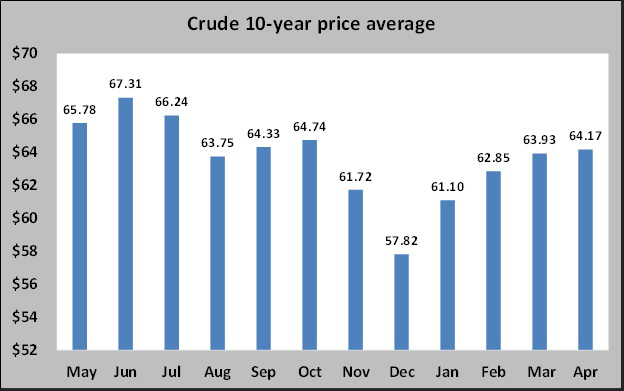

Chart 3 shows the 10-year monthly price average for crude. Note how December has averaged the lowest price by a substantial amount. The high-demand period for crude is in the summer, so its price is higher as inventories are drawn lower. But at the end of the summer driving season, refineries start shutting down for seasonal maintenance. This shift generally allows crude inventories to recover, and more importantly, there just aren’t as many buyers of crude with refineries idled, so prices fall.

Crude’s price is a major influence on propane’s prices, which sets the foundation for the weakness in propane prices in what most would think would be a high-priced month for propane. But there is more at play than crude’s seasonal pricing. If propane were undersupplied and winter demand were strong, propane prices would separate from crude’s price and go higher regardless of how crude is priced.

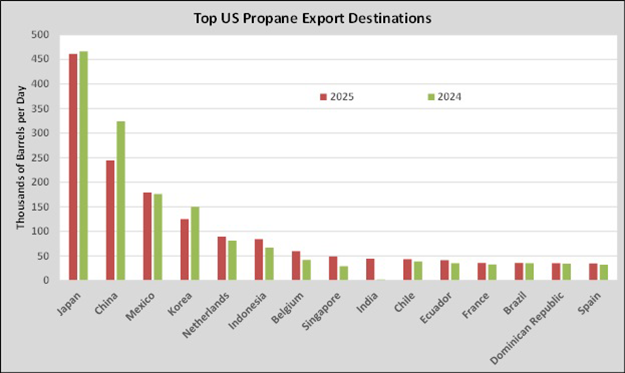

However, over the last 10 years, propane has been oversupplied, and winters have generally been weak. This year is no exception. Heating degree-day (HDD) calculations reset on July 1. Since that date, there have been 299 HDDs on a national population-weighted average. That is already 95 HDDs (25 percent) below normal.

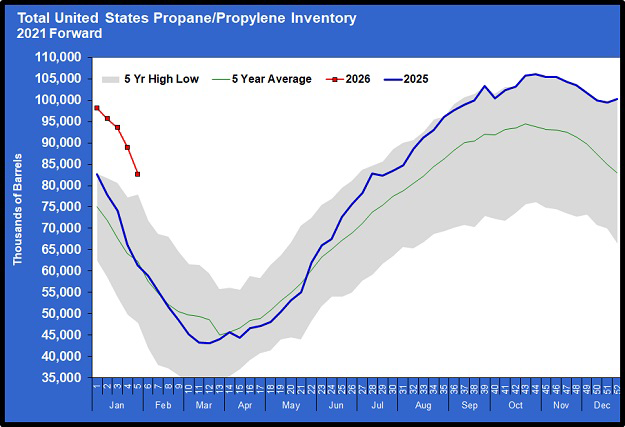

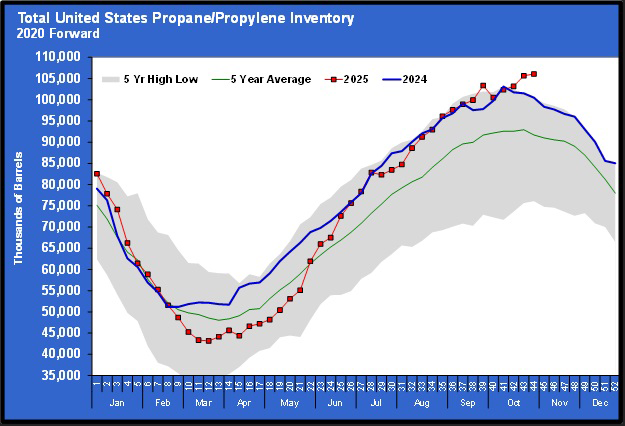

What about supply? Well, propane inventories are only setting an all-time high.

So, it certainly seems things are set up for the December price dip to occur again. But we are going to provide a few reasons why the December dip may not happen.

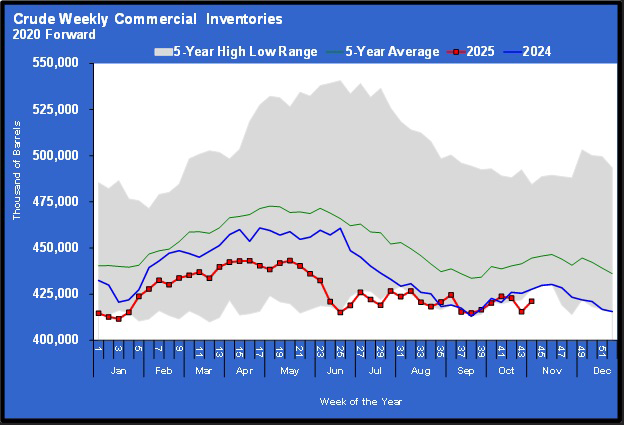

1. U.S. crude inventories are setting five-year lows, and U.S. refined fuels inventories are low as well. That takes away the incentive to drive prices lower.

2. Both the U.S. and Chinese governments are buying crude to put into their strategic reserves. That provides an unpinning of prices that might not normally be present.

3. The United States has recently implemented new sanctions on Russia, trying to limit its crude exports. Though many such efforts have failed, the early reviews suggest the current round of sanctions might be working. Russia’s most loyal buyers are looking for crude supplies elsewhere to avoid U.S. sanctions, and crude stored in oil tankers (ships) is on the rise.

4. Propane is already trading at a very low percentage of crude’s value. Mont Belvieu closed the day at 44 percent of West Texas Intermediate’s value, and Conway was at 41 percent. The average for this point in the year is 51 percent and 50 percent, respectively.

5. Propane prices are already 7 to 9 cents below the 10-year price averages for December.

6. December propane at Mont Belvieu and Conway traded at 62.375 cents at 59.25 cents, respectively, as of writing this article on Nov. 5. December propane was at 81.125 cents at Mont Belvieu and 77.5 cents at Conway on this date last year.

While we can’t rule out more downward pressure on propane prices going forward, it is possible that the December dip may have come early this year. Don’t forget to check under the tree just to make sure your Christmas gift isn’t already there.

Charts courtesy of Cost Management Solutions.

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.