Propane demand pattern suggests need for price protection this winter

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, reviews propane demand in 2022 so far.

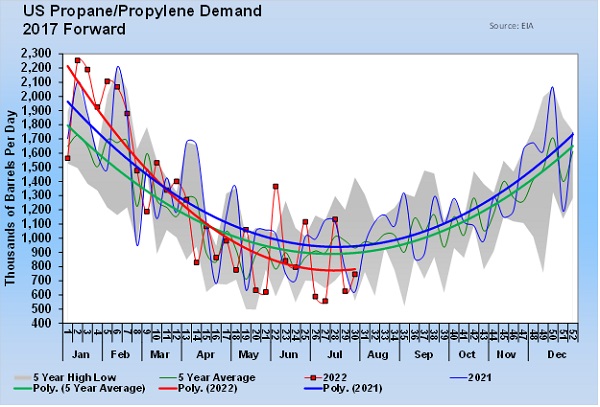

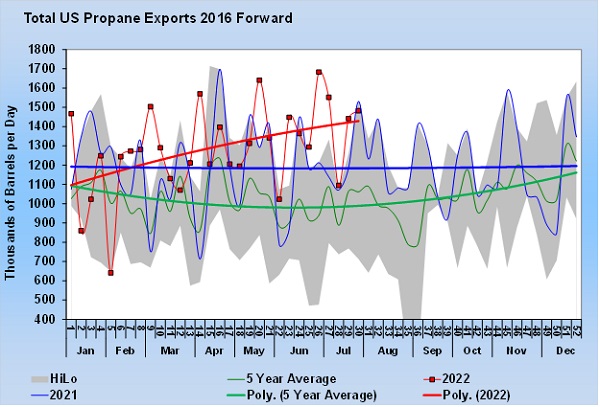

In this Trader’s Corner, we look at how propane demand has been running in 2022. Demand is broken down into domestic and export demand. The domestic demand can be further divided into retail and petrochemical demand.

As we look at domestic demand, don’t forget that it is a calculated or implied number. The Energy Information Administration (EIA) does not collect reports from propane retailers or petrochemical companies to determine how much propane was demanded during a particular week. Instead, it collects reports on propane imports, exports, production and inventory positions. It then calculates how much demand there must have been, using the other data.

Consequently, if there is any reporting error in any of the other data collection areas, it skews the demand number. The result is that there can be a lot of volatility in the week-to-week demand number that is reported. For this reason, sometimes we use the four-week average in demand in some of our reporting to help adjust for the weekly volatility. At the end of this report, we will look at propane days of supply. In that case, we use the four-week average.

Instead of using the four-week average for the total demand number reported by the EIA, we are adding a trend line to our chart to make comparing this year to last year and the five-year average easier.

Focus on the smoother red demand line for 2022. You can clearly see it running below last year and the five-year average, the blue and green lines, respectively. So far this year, demand has averaged 24,000 barrels per day (bpd) less than last year.

Note that last year was consistently above the five-year average. It has been our contention that the pandemic was a net positive for domestic propane demand. During the pandemic, industrial plants, schools and commercial establishments were closed. Most of those use natural gas rather than propane. People staying at home were more likely to use propane, and thus, it is logical to conclude that propane consumption saw a relative increase. Now that the economy is opening back up again, and folks are spending more time at work and school, demand could be affected. The significantly higher prices are also going to affect demand.

Industry data, which tends to be back-adjusted, shows petrochemical demand down 22,000 bpd, which would account for the bulk of the year-over-year loss. Petrochemicals are extremely price sensitive, and they have been leaning toward cheaper ethane as a feedstock where they can. Ethane consumption is up over the first six months of this year, supplanting propane in some cases.

As a propane retailer, we don’t want to hear about the potential for lower demand from our consumers. Yet, the lower domestic demand does help reduce upward pressure on propane prices. You will see how necessary that is when you look at the export numbers in Chart 2.

In Chart 2, we once again added the trend lines to make the year-over-year comparisons easier. Propane exports were off in January but have picked up since. Exports have averaged 96,000 bpd more this year than last year. Exports were strong and steady during all of last year. New propane dehydrogenation plants around the world have been increasing overall propane demand, and the U.S. is an important source for this new demand. We are not sure that Russia’s invasion of Ukraine on February 24th had a direct impact on demand for U.S. propane, but the timing of when export demand picked up would make one at least consider that possibility. Strong export demand has been a key reason that propane inventories, which were building at an above-average rate during March, April and May, were largely below average in June and July.

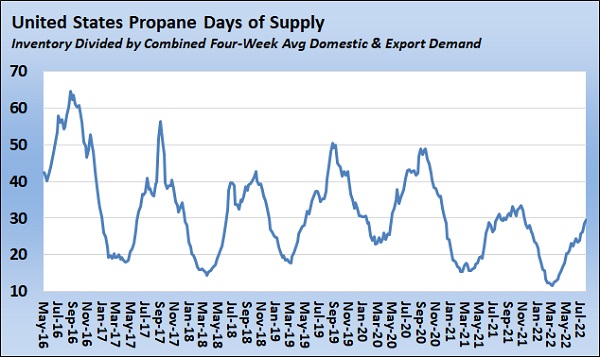

In calculating days of propane supply, the four-week average for total domestic and export demand is divided into current inventory.

Currently, days of propane supply are at 29, which is only a couple of days below where it was at this time last year. That is a bit encouraging until you look at domestic demand over the last four weeks. It has been particularly weak at 776,000 bpd. During that same four week stretch over the last three years, the average demand has been 229,000 bpd higher than that.

High prices and high temperatures are certainly a factor but, when we see such a significant short-term drop off, we are always concerned it is causing pent-up demand that will have to be satisfied down the road. It could mean that days of supply aren’t nearly as good as they look.

In summary, propane export demand is very strong, and there isn’t a lot of reason to believe that is going to end very soon. At this point, the trend line is going up, and propane prices have been coming down. Export demand weathered some pretty high propane prices, so it doesn’t seem this is heavy in discretionary consumption. Domestic demand is off, but not hugely, and you have to be concerned that consumers are living off of inventory hoping for price relief. If so, we could see an above-average jump in demand as the heating season forces more consumption.

As we said last week, propane buyers should not get lulled into a false sense of security concerning propane prices. Yes, propane prices have been in a very nice downtrend that has them about 50 cents off the year high. Propane fundamentals are not suggesting that we should count on that trend continuing. There are reasons for concern about propane supply for this winter, and consideration of price protection for this winter should be made at this point. We said months ago that propane anywhere near a dollar was probably going to be a good buy for this year given overall conditions. Prices are there, and we still hold that view.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.