Propane exports drop: What to expect next

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explores why propane exports posted an unusual drop.

The theme of our daily Propane Price Insider (PPI) report on Thursdays is propane fundamentals. On Mondays, we look at what speculative traders are doing with propane, crude, heating oil and gasoline trades. On Tuesdays, we focus on natural gas because the supply of natural gas determines the supply of propane. On Wednesdays, we focus on crude since crude’s price has such a strong influence on propane’s prices.

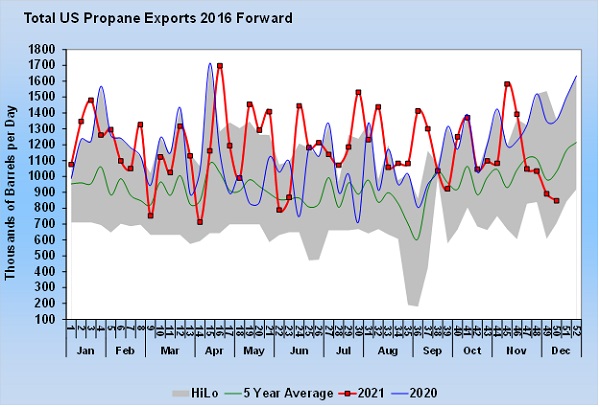

As we put together the data for these reports, we are looking for things that stand out and perhaps should be explored more thoroughly. We are looking for anomalies that could provide insight on the future price of propane. As we put together the propane fundamental data last Thursday, Chart 1 stood out.

For the week ending Dec. 10, U.S. propane exports dropped to just 847,000 barrels per day (bpd). To put that in perspective, it was 509,000 bpd less than the same week last year.

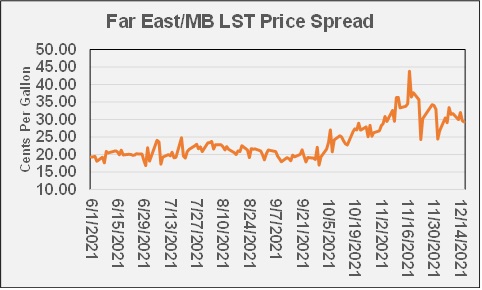

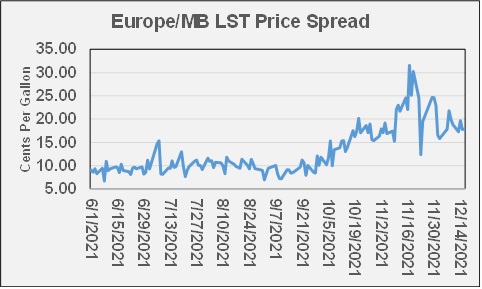

The first thing to look at in trying to explain this is the economics between the U.S. and export destinations. Charts 2 and 3 show the spread or price premium two key foreign markets have over the U.S. Mont Belvieu price.

The Far East/Asia and Europe are the two primary export markets for U.S. propane. The price spread is not as high as it was last month, but it is still higher than it was when exports were running much higher earlier in the year.

Traders say the arbitrage window is open, meaning there is an economic benefit to sell U.S. propane into these markets, yet export rates are falling.

There is propane to export, there are economic benefits to export it, and yet, it’s not happening. We asked some traders what they thought was going on. There were a couple of schools of thought that emerged.

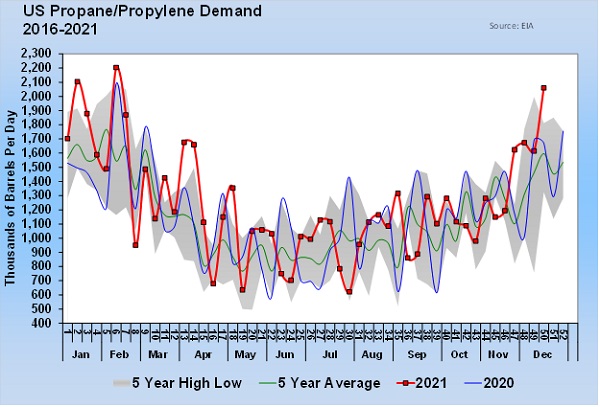

One was simply that reporting has been off the past few weeks, and things will adjust soon enough. When reporting is off, it generally causes crazy numbers to occur in domestic demand. Chart 4 shows U.S. demand for propane.

At a time when U.S. propane exports are near a five-year low even though export economics are favorable, U.S. domestic demand is setting a five-year high for the week reported. This certainly gives some legitimacy to the reporting theory.

Domestic demand is a calculated number; no reports come into the U.S. Energy Information Administration (EIA) that reveal domestic demand. Instead, the EIA collects data on imports, exports, production and inventory changes. From those reports, it calculates what U.S. domestic propane demand must have been given the activity in other areas. If exports are underreported, it would mean that domestic demand is likely being overreported.

If this is the case, and one could certainly draw the conclusion from the charts that it is, it would have very little impact on propane’s future price. It would mean that overall demand is correct, and therefore, no surprise is looming on the horizon.

However, more than one source mentioned another cause for the lack of propane exports. The mild temperatures in the South are causing fog on the Houston Ship channel, which is delaying export cargoes. The implication is that overall demand is being suppressed in the short term due to a weather phenomenon. The assumption is that exports are being reported correctly, and thus, domestic demand is also likely correct.

If this theory is correct, it is likely bullish for propane prices. If cargoes are being delayed due to fog, then there is pent-up export demand. When the fog lifts, exports would likely surge before settling back near their long-term rate of around 1.2 million bpd. If domestic demand is good during this time, it could certainly put upward pressure on propane prices.

Propane inventory has been eliminating some of its deficit to last year over the past few weeks, and that has taken upward pressure off of prices. If the fog theory is correct, the inventory deficit to last year could rise again, and that would almost certainly cause upward price pressure.

Over the next few EIA reports, we want to watch the data for clues on which theory is correct. If we begin to see improvements in exports but domestic demand drops off correspondingly, then there probably won’t be a need to take any additional precaution against higher prices. It would be an indication the reporting theory was more accurate. However, if exports start jumping, and domestic demand holds in a normal range, then we may want to take additional action to protect against higher prices as it would mean the fog theory was likely correct.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.