Propane exports rise: What that means for demand, pricing

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, revisits an unusual pattern in propane export data.

This week’s Trader’s Corner is about the rise of propane exports, whereas last week’s was about the fall of propane exports. If you didn’t get a chance to read last week’s Trader’s Corner, we suggest you follow this link and give it a quick read as a lead in to this week’s follow-up article.

For those who did read it, you will recall that we proposed two theories on why propane exports had fallen off so dramatically over the past few weeks.

One was that export volumes were not being reported promptly to the U.S. Energy Information Administration (EIA), resulting in U.S. domestic demand being overestimated. The EIA collects data on imports, exports, production and inventory and uses those to calculate or imply domestic demand. If one of the data inputs is off, it impacts domestic demand. It is one of the reasons domestic demand appears so volatile. In this case, the theory was propane exports were being underreported, resulting in the overreporting of domestic demand.

The second theory was that reporting was correct, but fog on the Houston Ship Channel was delaying exports. The theory raised the possibility that when exports started flowing again, there could be a significant increase in overall demand. Providing credibility to this theory, a reader of Trader’s Corner who flew into Houston reported observing heavy fog over the shipping channel. This theory has the potential to be very bullish for propane prices, whereas the first theory would tend to be neutral or even bearish for prices.

We suggested that readers monitor propane exports and domestic demand closely in the coming weeks to see which appeared to be correct to better guide our buying decisions. We pointed out that a big increase in exports that resulted in a closely corresponding decrease in domestic propane demand would suggest the reporting theory was more correct. The data this past week yielded exactly that result.

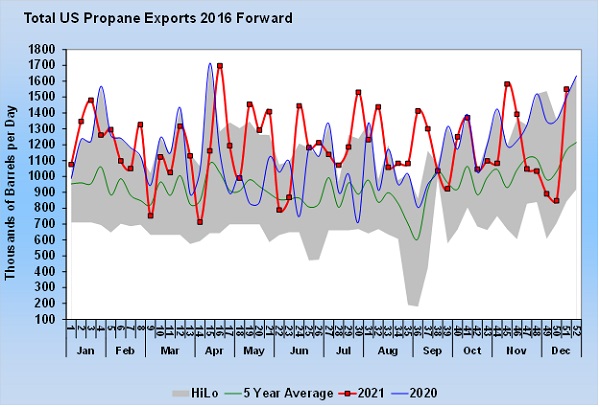

Chart 1 shows propane export volumes. They were up a staggering 703,000 barrels per day (bpd) last week. Was it because the fog lifted and exports moved out, or was it because exports that had already taken place finally got reported to the EIA?

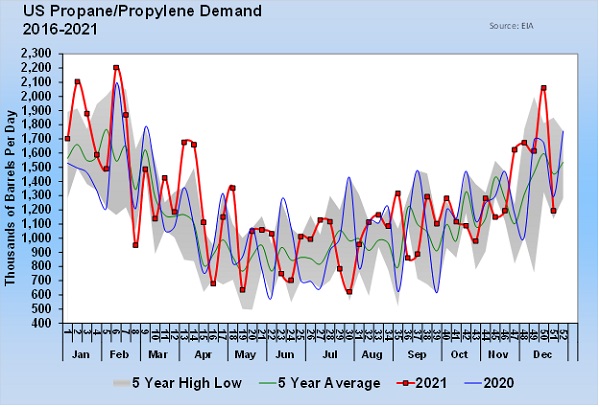

Chart 2 likely provides the answer.

During the same week that exports jumped 703,000 bpd, domestic demand dropped 867,000 bpd. It is only a very slim chance that the weather changed enough week to week to have that much impact on domestic demand. The net impact on overall demand was actually a negative 164,000 bpd.

So, the first data available since we proposed the theories last week suggests that there isn’t a lot of pent-up export demand that will increase overall propane demand, putting upward pressure on prices. It appears to have been a reporting issue given that overall demand was actually down last week.

This result does not suggest propane retailers should get more aggressive in protecting short-term supply needs from higher prices. However, we can’t stress enough that this is just one week of data, and there is at least empirical evidence that exports are being delayed. This week’s data suggests the reporting got back on track, but we still need to monitor for the possibility of an increase in overall demand.

The bottom line is this week’s data concerning propane demand does not warrant immediate short-term price protection action. But, due to the extreme change in the numbers this week, we probably won’t have a clear picture of export and domestic demand trends for a couple of more weeks, so stay tuned.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.