Propane fundamentals supportive of prices

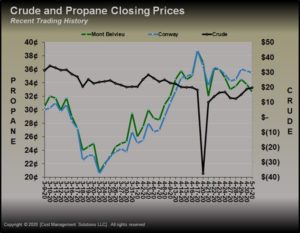

Propane prices turned lower over the last few days as export economics are not as good as they have been. Nonetheless, propane is trading at a record high relative value to WTI crude, which suggests traders see propane fundamentals as more supportive of its price than crude fundamentals are supportive of crude’s price.

Even with the pullback to close out the week, Mont Belvieu LST propane is trading 11.875 cents, 57.23 percent, higher than its 2020 low set on March 26. Conway is trading 15 cents, 73.17 percent, above its low for the year.

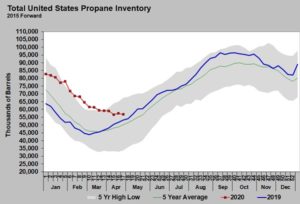

Total U.S. propane inventory is still relatively high, running well above last year and the five-year average. But as the chart below shows, inventories have been slow to begin their seasonal build.

For the week ending April 24, the Energy Information Administration (EIA) had inventory down 607,000 barrels against expectation by industry analysts for a build of 760,000 barrels. Over the last five years, inventory has averaged a 1.345-million-barrel build in week 16 of the year.

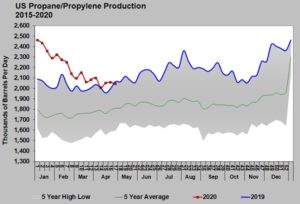

Since October 2018, propane prices have been under downward pressure because of too much supply. The United States experienced a dramatic increase in propane supply because more propane was being produced as a result of high crude and natural gas production. That production is slowing or falling now, as can be seen in the chart below.

Every week for the last couple of years, U.S. propane production has set a new high for the week being reported. That streak came to an end for the week ending April 24. Production was 2.044 million barrels per day (bpd). That was 13,000 bpd less than the same week last year.

Sequestering in an effort to slow the spread of COVID-19 is certainly a significant factor in the production slowdown. However, production was slowing even before COVID-19 as producers struggled to balance the need to maintain production levels and appease investors who have been patiently waiting for a return.

Shale producers face a formidable challenge due to the rapid depletion of their wells. They have to spend a lot of capital on drilling to replace depleted wells, much less grow production. If they stop their heavy capital spending, their production can begin to turn down, which hurts revenues.

At the same time, lenders and investors have their hand out. Lenders want to be repaid, and investors want to get paid. The industry has struggled to get to a point where it can balance all three: keep production up, pay down debt and provide a return to investors. For the most part, it has been one or two, but rarely three. Investors have generally gotten the short end of the stick with promises that their time is coming. Investors finally got to the point of saying their time is now.

The onslaught of COVID-19 has only exacerbated underlying issues in the industry. To a large degree, the industry has been its own enemy. It has forced too much of its high-cost crude into the market. The only reason crude prices hadn’t already collapsed because of this was that other producers were limiting their production to prevent the avalanche of U.S. production from crushing crude’s price.

Lenders are preparing for a huge number of bankruptcies in the energy industry. It is possible many players will never come back. We believe we have likely seen the high-water mark for crude production in the United States for some time to come.

If the growth in crude production slows or declines, we should expect the same for propane. Yes, propane comes mostly from natural gas production, but much of the growth in natural gas production has been coming as associated gas with crude production. If crude production slows, then natural gas production slows. If you slow natural gas production, you slow propane production.