Propane inventories decline more than average

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, examines the recent greater-than-average decline in propane inventories.

Catch up on last week’s Trader’s Corner here: Propane rejection and its causes

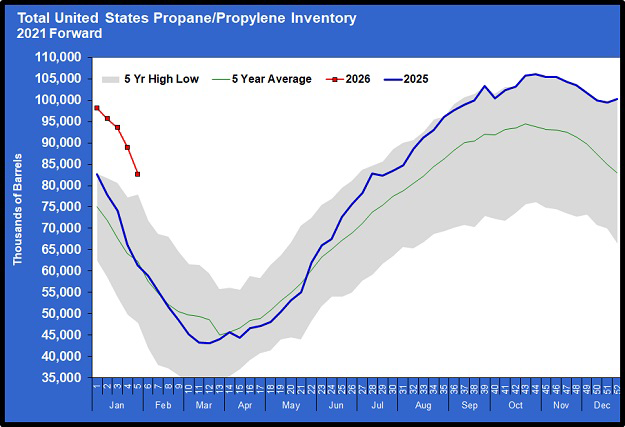

On Wednesday, Feb. 4, the Energy Information Administration (EIA) reported that U.S. propane inventories declined 6.236 million barrels for the week ending Jan. 30. The draw was larger than the five-year average draw for week five of the year and exceeded expectations for a 5.2-million-barrel draw.

The large draw was not unexpected. We had said before the report that anything less than a significant draw would be bearish for propane markets. The expectation was that Winter Storm Fern would cause a major spike in demand, resulting in hefty calls on inventories.

Fern certainly had an impact, but it affected supply more than demand.

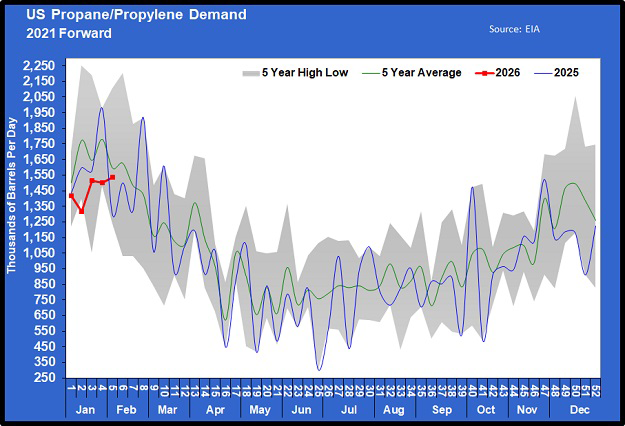

Propane inventories declined by about 7 percent. But demand was only up slightly, according to the EIA’s calculations.

Propane demand was up just 35,000 barrels per day (bpd) to 1.535 million bpd. That was about a 2 percent increase. The change in propane production was far more dramatic.

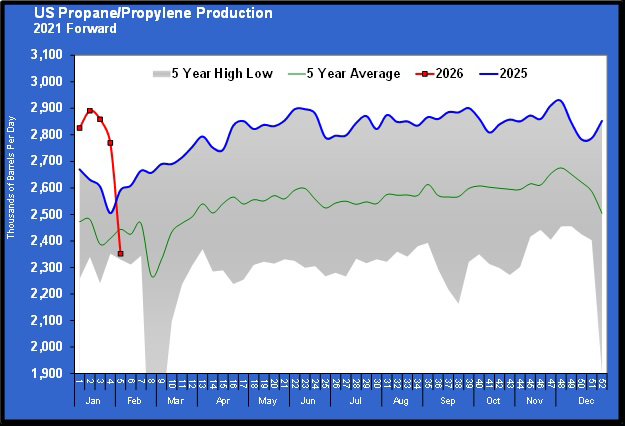

Production tumbled 418,000 bpd or 15 percent. Production went from record highs to below the five-year average in a matter of three weeks, with most of the damage done during the week that ended Jan. 30.

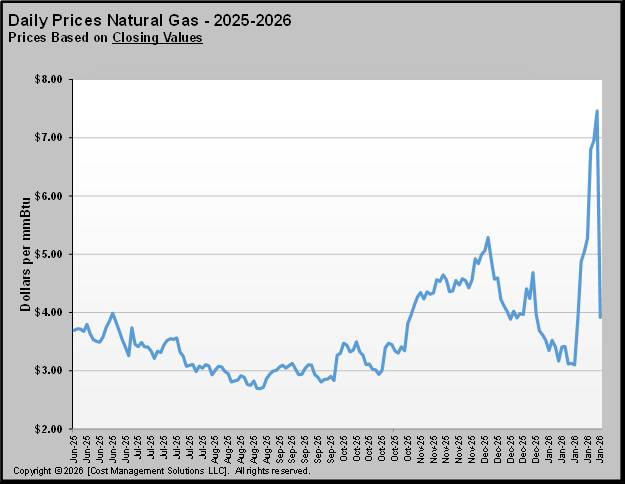

The sources for propane are crude and natural gas wells. Unfortunately, we don’t have an estimate of natural gas production specifically for the week ending Jan. 30. We do know that natural gas inventories declined 12.75 percent that week. It is unknown how much of that draw was caused by demand and how much was caused by a loss of supply due to cold weather hurting output from wells.

We do know that the EIA estimated U.S. crude production was down 3.5 percent. Crude wells are a major contributor to natural gas production. Remember, natural gas (methane) and natural gas liquids (ethane and heavier hydrocarbons) are produced as associated production with predominantly crude wells. Crude wells contribute about 37 percent of natural gas supplies, and we can assume about that much of natural gas liquids supplies.

Natural gas wells (predominantly light hydrocarbons) generally operate at higher pressures than crude wells, and production passes through chokes that limit the volume to control the well’s output and not damage the formation from which the natural gas flows.

The producer wants the sand and rock that the gas flows past in the formation to stay still. If the production rate is too high, the sand and rock can move toward the surface along with the hydrocarbons, causing the well to plug, resulting in its permanent loss or an expensive workover to make it functional again.

In the United States, most oil and gas wells are produced through no larger than a 1-in. choke. Chokes are sized by 64ths of an inch. So, a 1-in. choke is a 64/64 choke. Most natural gas wells are produced through much smaller orifices than 1 in. For example, a high-pressure well might be produced through a 10/64 choke. The high-pressure, low-production orifice used to control the well results in a significant pressure drop at the choke. That pressure drop causes freezing problems. Even in the middle of summer, you can sometimes see ice forming on the outside of choke boxes on natural gas wells. So, when temperatures fall outside of the choke box, the freezing issues are compounded and can cause the well to stop producing.

There is no doubt that Winter Storm Fern’s frigid temperatures caused some natural gas wells to freeze and stop producing. That, of course, would have decreased propane production, contributing to the 15 percent drop last week.

However, we can infer that, given that the drop in crude production was just 3.5 percent, the overall loss in natural gas production was probably less than the 15 percent drop in propane production.

For that reason, we believe that demand for natural gas (methane) by natural gas utility companies was significant enough to cause propane rejection at natural gas processing plants. That was the topic of last week’s Trader’s Corner. If you didn’t get a chance to read that Trader’s Corner, it might be even more meaningful to read now, given the significant drop in U.S. propane production last week.

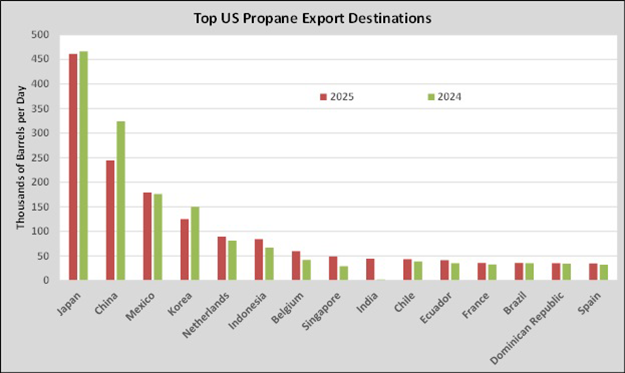

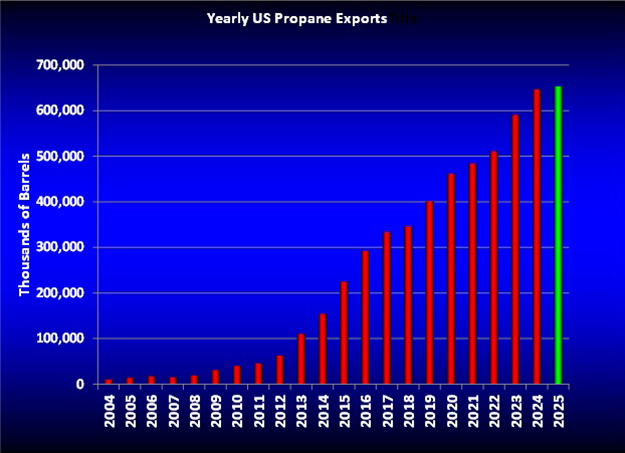

Charts courtesy of Cost Management Solutions.

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.