Propane inventory build goes from bad to worse

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains propane inventory trends.

This past week, Mont Belvieu LST propane pushed higher, setting a new high for 2021. Conway was keeping up with Mont Belvieu but was still shy of the 134-cent high set in February when prices spiked during the winter storm.

The inventory positions and fundamental trends for propane have been supportive of higher prices for much of the summer. With the crop drying and heating season upon us, the situation got even worse with the last Weekly Petroleum Status Report from the U.S. Energy Information Administration (EIA).

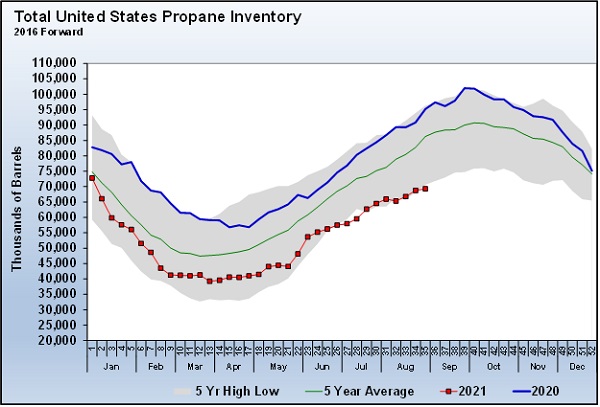

Chart 1: Cost Management Solutions

On Wednesday, the EIA released the data it collected on Aug. 7. It showed U.S. propane inventory up just 533,000 barrels. Industry analysts had expected a 1.37- million-barrel build. That was a bad miss, but the build was far worse when compared to the five-year average build of 3.536 million barrels for week 35 of the year.

That was a 3-million-barrel miss – not what you want to see with very little build period left and inventory already relatively low. Inventories usually peak sometime in October, but you would expect builds, if they occur, to be smaller from this point forward.

With the disappointing week 35 build in the books, U.S. propane inventory is 25.94 million barrels, or 27.2 percent, below this time last year. Inventory is 19.7 percent below the five-year average. Given that Conway propane spiked to 134 cents last year, with the nation having about 26 million more barrels to start the fall demand period, one can’t help but be worried.

Obviously, we all have to pray there isn’t a winter storm like the one in February that stretches far enough south to disrupt supply. Strong demand is one thing, but what made last year particularly bad was the supply disruptions during the Deep South deep freeze.

One data point that stuck out this past week was U.S. domestic demand. The EIA had it up 231,000 barrels per day (bpd) at 1.316 million bpd. That was 693,000 bpd higher than the same week last year.

There is a lot of weekly variation with demand, but that is a big difference. We still believe that more people staying at home due to COVID-19 is helping propane demand. Our argument is that a higher percentage of homes are heated with propane than schools, industrial and commercial buildings. While these facilities may be seeing less use, folks at home are consuming more energy and thus relatively more propane.

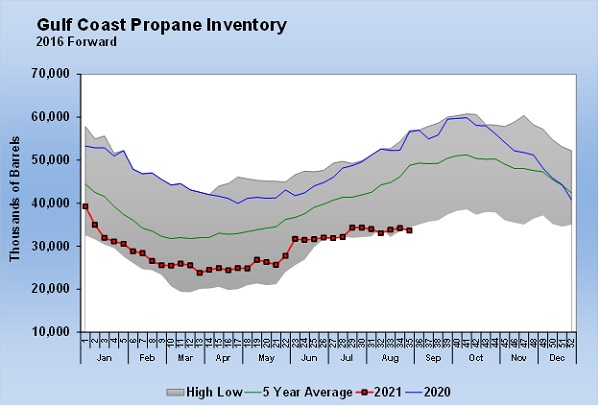

Chart 2: Cost Management Solutions

Another area that stood out was the magnitude of the draw on Gulf Coast inventory. Gulf Coast inventory was down 544,000 barrels last week. Unfortunately, that hasn’t been the only inventory draw in what should be the inventory build period this year.

In chart 2, take a look at the divergence in Gulf Coast inventory this year (red line) compared to last (blue line) and five-year average (green line) – simply not a good trend that is leading to five-year inventory lows.

Any way we look at it, the chances for price spikes are going to be high this winter. We have to hope for a winter where demand stays steadier over its entire span rather than all at once.

Obviously, getting bulk tanks and customer’s tanks filled before the higher demand period begins will be important. In fact, a letter to customers telling them that propane inventory will be starting this winter at a five-year low might be beneficial toward getting some to take action.

Mont Belvieu propane was at 50 cents and Conway at 45 cents on this date last year. Prices are right at 120 as we write.

No one will be able to avoid much higher prices this year, but getting prepared and staying prepared might give folks a little cushion during potential price spikes that could a make a bad situation much worse.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.