Propane inventory build is a shocker

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, makes sense of the surprise build in propane inventories from the end of 2025.

Catch up on last week’s Trader’s Corner here: Reflecting on the past year of propane

The Energy Information Administration (EIA) released its last Weekly Petroleum Status Report (WPSR) for 2025 on Dec. 31 for the week ending Dec. 26. The report showed a surprising build in propane inventories.

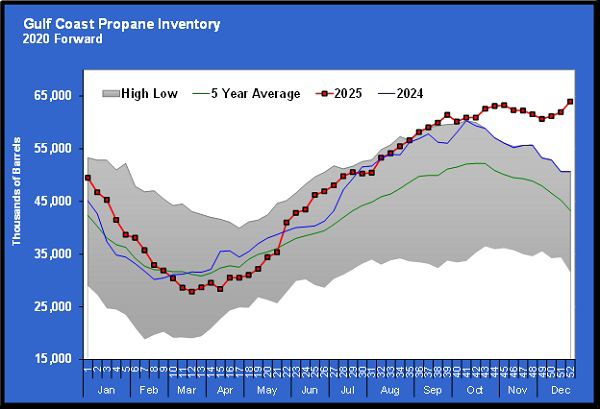

Propane inventories had been falling as usual during the winter heating demand period. Though falling, they remained at record levels, well above last year and the five-year average for this time of year.

Almost everyone is expecting propane inventories to end the winter drawdown period and begin the summer build period at a record high. That expectation is being reflected in propane pricing on the first day of the new year, with prices falling.

Still, a December build in inventories was not expected, which motivated sellers to lock in the price of future production at even lower levels than were already available. The average price of Mont Belvieu ETR (Energy Transfer/TET) propane futures through the end of 2027 is 62 cents, and it drops to 60 cents in 2028. Conway futures are around 60 cents.

With the build, propane inventories moved back over the century mark to 100.324 million barrels. The average inventory position over the last five years at the last WPSR of the year has been 77.996 million barrels.

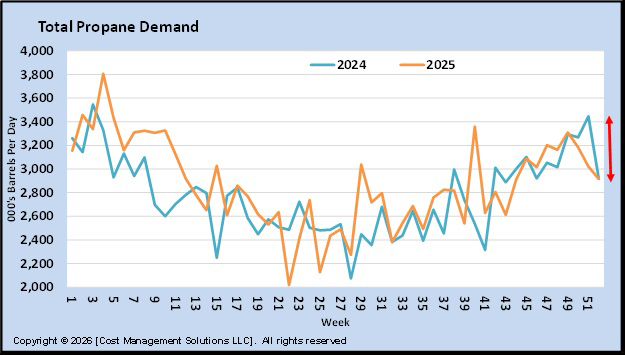

The surprise build can be largely attributed to a significant drop in propane demand over the last couple of weeks.

Combined, exports and domestic demand fell to 2.916 million bpd on average for the four-week period ending Dec. 26. Remember, the domestic demand portion is calculated on what was reported to the EIA for production, exports, imports and inventory levels. So, if inventories are reported higher than they actually are, the EIA will calculate a lower demand number to balance the supply-demand equation.

The fall in demand apparently occurred on the Gulf Coast.

The Gulf Coast was responsible for the rise in inventory, with a massive 2.012-million-barrel increase. Inventories declined in other regions, which is typical for this time of year, making such a large build in Gulf Coast propane inventories even stranger.

In fact, inventories have been building on the Gulf Coast for three weeks in a row now. Yes, it has been extremely mild in the South this year, but this is still highly unusual.

When we see such anomalies, we always worry that reporting errors are occurring. It has happened before with an adjustment that changed market dynamics in an instant. We certainly hope that doesn’t happen this time around. The current conditions are great for propane buyers.

There are reasons to believe this data is right on the money, given high propane production, mild weather and modest exports. Even so, the situation has presented a great long-term buying opportunity for propane buyers. The 10-year calendar-year price average at Mont Belvieu ETR is 75.2411 cents. At Conway, it’s 67.7528 cents.

The market will respond to the EIA data as if it is accurate. We shouldn’t make a decision based on the remote possibility of an adjustment, even though there is precedent.

But we think it is important to point out just how unusual the three weeks of builds during December have been for Gulf Coast inventories. Even if an adjustment doesn’t occur, a nice opportunity for buyers appears to be present. Should a reporting error be discovered and an adjustment made, the opportunity would likely look even better.

Charts courtesy of Cost Management Solutions.

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.