Propane inventory continues to build at a below-average pace

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, addresses propane inventory and production trends.

In last week’s Trader’s Corner, we looked at the trend in propane inventory. Unfortunately for propane buyers, the trend didn’t improve. For the week ending July 9, U.S. propane inventory increased 1.592 million barrels. That doesn’t sound too bad until you look at what normally happens during week 28 of the year. Over the past five years, propane inventory has averaged an increase of 2.391 million barrels.

The relatively light build marked the fifth week in a row of propane inventory building at a below-average pace. For the second week in a row, inventory has posted a five-year low for this time of year. Not surprisingly, the inventory deficit compared to last year also grew. Total U.S. inventory is now 20.785 million barrels, or 25.9 percent, below this time last year and 18 percent below the five-year average inventory position for week 28.

A look at propane’s relative value to West Texas Intermediate (WTI) crude will show there has been concern about propane supply far longer than the past five weeks.

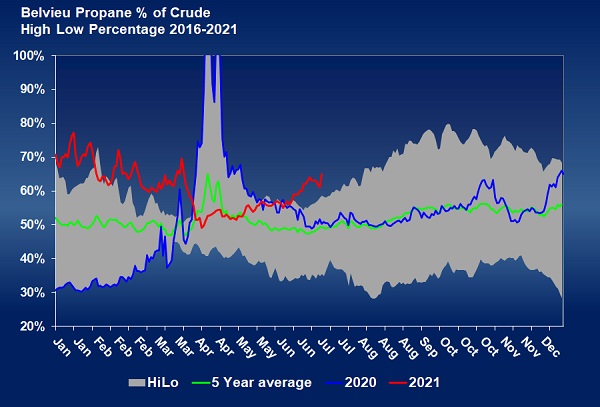

This chart plots the percentage that Mont Belvieu (MB) LST propane is valued relative to WTI crude on a simple percentage basis. Looking at the green line, we can see that propane has averaged around 50 percent of the value of WTI crude over the past five years – to be precise, it has been 52 percent.

If we look back to the first week of 2020 – the blue line – we see propane values were way below normal relative to WTI crude. Crude prices were also low during that time, causing historically low propane prices. During the first quarter of last year, MB propane averaged 37.47 cents per gallon, and WTI averaged $45.78 per barrel. MB propane set a low of 20.75 cents on March 23, and crude fell into the teens by April and even traded at a negative $37.63 on April 20.

The collapse of crude in April and a rebound in propane prices with some winter support caused a major turn in relative value. Propane went from trading at 20.75 cents per gallon on March 23 to averaging 32.82 cents in April, while WTI crude only averaged a remarkable $16.70 per barrel. After the craziness in April, the two commodities’ values started getting back in line, and by July, propane was valued around the five-year average relative to WTI.

It was near the end of 2020 that we began to see the fundamental landscape changing for propane. Even with crude in the midst of a very strong rally that took off in earnest in early November when vaccines were developed, propane was gaining in relative value to crude. Yes, it was winter, but as you can see, propane began to trade significantly higher than its five-year average and stayed there until April of this year.

It was a strong second half to winter, which put upward pressure on propane valuations. That pressure came off briefly at the end of winter, but it didn’t stay off long. That brief dip turned out to be the best buying opportunity of the year.

But propane fundamentals were not healthy. Inventory levels were lagging in 2020, and there was a sense they were going to struggle to recover, with both exports and domestic demand strong. Propane production that had recovered well from the pandemic offset the higher demand for a while. As we showed last week, by late April, propane production had plateaued, and the inventory builds began to lag. As the 2021 red line shows, propane’s relative value to crude started climbing, and it has remained largely on that trend since.

Unfortunately, propane retailers didn’t obtain much price protection for this upcoming winter during that April respite. We largely blame that on the exceptionally low prices during 2020. With 20.75-cent propane just a year earlier, it was hard to get excited about locking in 70-cent propane in April. Even as prices continued to rise, most buyers didn’t want to let go of the hope that prices would somehow return to 2020 levels.

We want to refer you back to a Trader’s Corner we published on April 19 about setting a buying criteria and a possible opportunity the market was presenting.

We have been doing this a long time now, and one thing has been very consistent over all of those years. There is a very strong tendency to let what happened last year have entirely too much weight on expectations for the coming year. Our daily reports are filled with charts and graphs showing where key criteria that could affect the price of propane currently stand and how it stacks up against history. We provide things like crude price forecasts and trend analysis.

Yet, old information (what happened last year) tends to hold more weight for far too many buyers than current conditions and forecasts.

To be sure, the best analysis, data and forecast will not always result in the right buying decision. Nonetheless, we know for certain it greatly increases the chances of success, and if used year after year, the buyer will come out on top by making decisions based on what is currently happening. And, with almost the same certainty, we can say that decisions made based on what happened last year will be overwhelmingly wrong.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.