Propane inventory just keeps building

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, reviews propane fundamentals.

Catch up on last week’s Trader’s Corner here: Don’t let price creep steal your margin

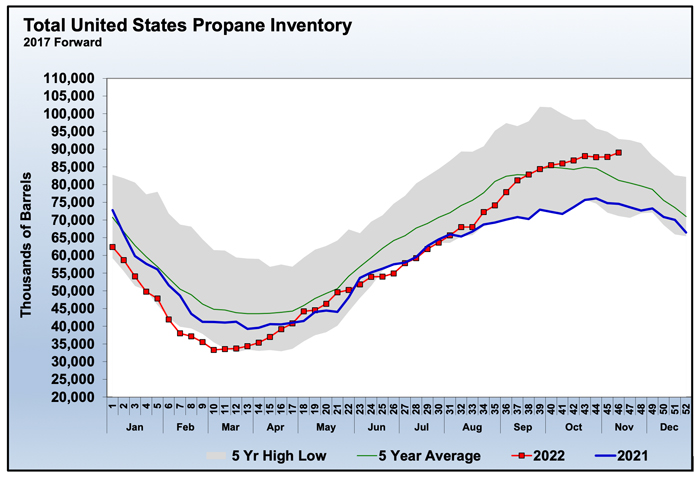

Just before the Thanksgiving holiday, the U.S. Energy Information Administration released its 46th Weekly Petroleum Status Report for the year, covering the week ending Nov. 14. That report showed U.S. propane inventory increasing by a surprising 1.216 million barrels.

Industry analysts had expected a 33,000-barrel draw on propane inventory. It was a week that had averaged a 1.697-million-barrel draw over the last five years. That means we essentially had a 3-million-barrel swing in propane inventory between this year and the five-year average in just one week.

The build put propane inventory at 89.029 million barrels, which was 14.461 million barrels more than last year, a 19.4 percent increase. Propane inventory is 9.7 percent above its five-year average. We have only seen inventory higher than this four times in the past 19 years. There are also only three years in the past 19 where inventory was still building at this point in the year.

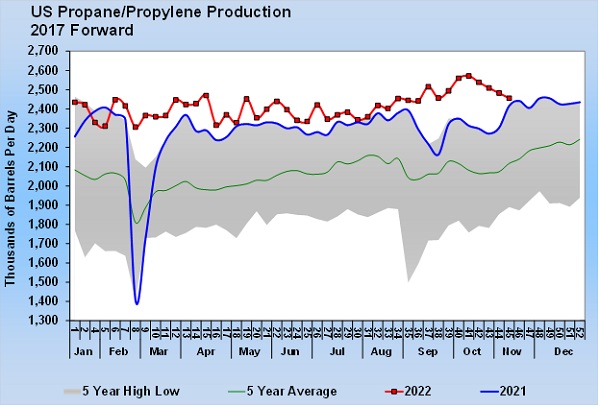

High propane production has been a key element in the builds. But over the last four weeks, production has been on the decline, which makes the builds even more remarkable.

Production has dropped 116,000 barrels per day (bpd) below where it was four weeks ago. However, for the year, production has still been 135,000 bpd higher this year than last.

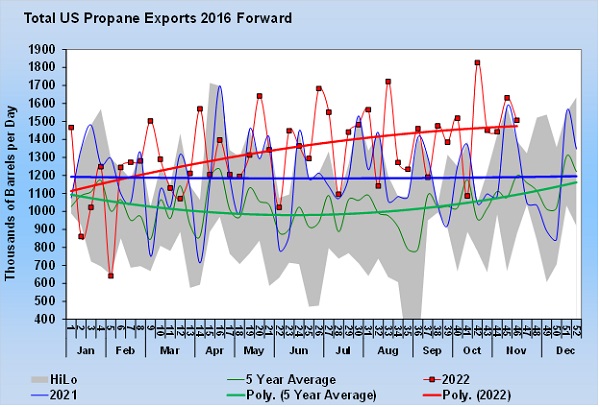

Yet, that production increase has been just enough to keep up with the growth in propane exports, which have been robust in their own right. Propane exports have been 139,000 bpd higher than last year, or 4,000 bpd more than the increase in production. And the exports have not been offset by imports this year as much as last year. So far this year, propane imports have averaged 108,000 bpd, down 12,000 bpd from last year’s 120,000 bpd.

The high inventory levels have propane prices relatively low. Propane is trading at 43 percent to 44 percent of West Texas Intermediate (WTI) crude. Last year at this time, it was trading at 75 percent of WTI crude. At that relative value, propane would be about $1.39 currently. That simply illustrates how much better propane fundamentals are this year compared to last.

At this point last year, on Nov. 22, 2021, Mont Belvieu ETR propane closed at 108.25 cents and Conway at 109.5 cents compared to closes of 83.5 cents and 84.75 cents, respectively, on the same date this year. At this time last year, a remainder-of-winter swap strip was striking at 118 cents compared to 85 cents now. A 12-month strip would have been 110 cents compared to 85 cents now. Propane remains one of the cheapest Btus in the energy game, with gasoline at the equivalent of $1.86 and heating oil $2.29 propane.

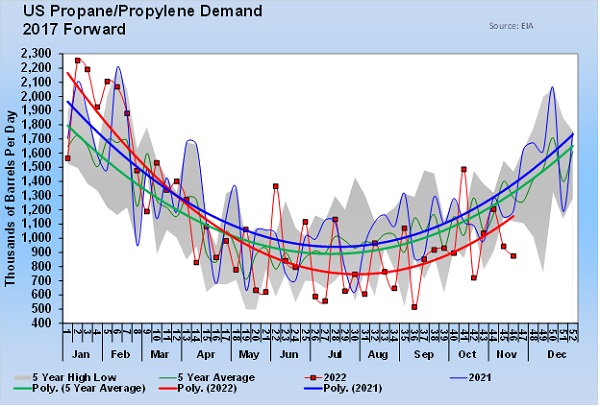

This is all great with one very notable exception: domestic propane demand.

Domestic propane demand has averaged 1.114 million bpd this year compared to 1.204 million bpd during the same period last year. That is a 91,000 bpd, 7.5 percent, drop in domestic demand. Industry data shows U.S. petrochemical demand down only 19,000 bpd from last year, meaning that the bulk of the demand shortfall, around 72,000 bpd, is likely coming from retail propane demand.

Of course, this means that most propane retailers that are selling propane at the same margin as last year are losing revenue. All too often, we can get locked into a specific gross margin that doesn’t take into consideration the overall market conditions. A 75-cent margin one year is not the same as a 75-cent margin the next. Not only is the lower volume at the same gross margin a hit to revenue, high inflation has been an additional hit to profit.

Propane retail needs to consider both when establishing the value proposition with the customer base. Don’t forget that propane is one of the cheapest Btus in the marketplace. Propane prices are lower than last year, while almost everything else our customers are buying is up. It makes us all very proud that our industry is not contributing further to the challenges consumers are facing. However, we need to find a balance. If we let lower sales and higher cost crush our revenue and profit, then we soon stop having the proper equipment and other things necessary to reliably and safely supply our customers.

So don’t get locked into one margin target. Look at the overall conditions, and adjust the margin target to fit those conditions. Hitting revenue and profit targets will likely take some adjustment to the margin target in years like this one. Retail propane, like all business, needs to do everything it can to provide a fair value to its customers, which includes making sure it is reliable and safe. Part of that is being a viable and healthy business.

There is much to be thankful for in terms of the price of our commodity compared to others this year. But we need to use that good fortune to make sure we are as healthy and resilient as possible when tougher times come our way because they most certainly will.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.