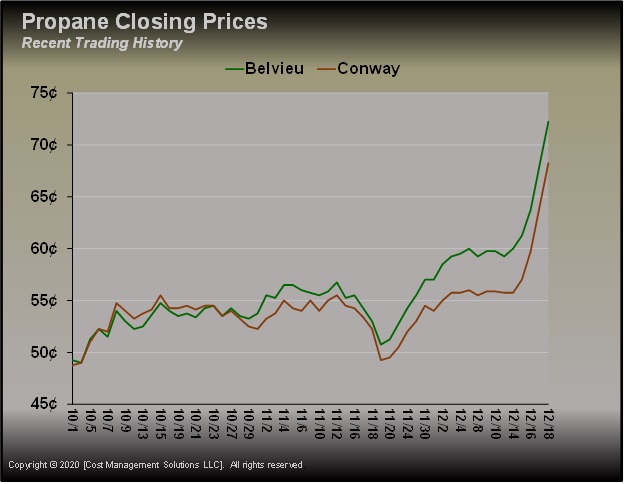

Propane prices on a rally this winter

Chart courtesy of Cost Management Solutions

Despite ample inventories, U.S. propane prices have appreciated markedly this winter, with most of the gain coming in the last few weeks.

On Oct. 1, Mont Belvieu LST propane closed at 49.25 cents and Conway propane closed at 48.75 cents. Through Dec. 18 – after which propane prices dipped – Mont Belvieu LST propane had gained 23 cents, or 46.7 percent, to 72.25 cents. Conway gained 19.5 cents, or 40 percent, to 68.25 cents.

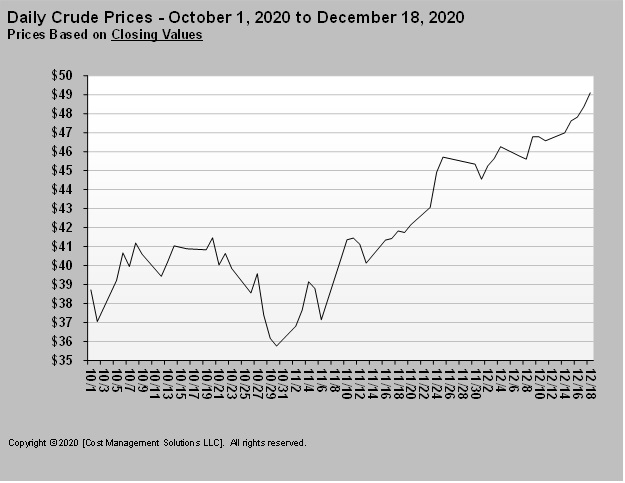

The basis for the propane rally has been a major rally in crude’s price starting in November.

Crude started its rally when Pfizer announced it had a vaccine that was around 95 percent effective against COVID-19. Despite weakness in crude fundamentals, crude traders became focused on what they believe will be tight crude supplies in the second half of next year. From Oct. 1 through Dec. 18, West Texas Intermediate (WTI) crude gained $10.38 per barrel, or 27 percent. WTI was up $12.29 per barrel, or 33 percent, since the vaccine announcement.

Chart courtesy of Cost Management Solutions

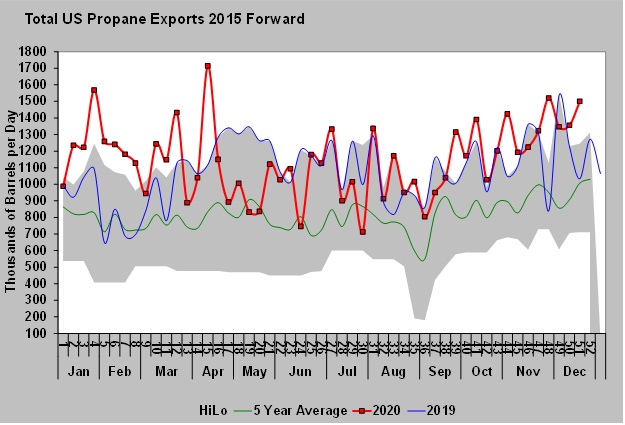

While the gain in crude is the foundation of the propane rally, since propane has outpaced crude’s gain, propane must be getting more support from its own fundamentals. The key fundamental support for propane has come from strong exports during this winter.

For the year, propane exports have averaged 71,000 barrels per day (bpd) more than they did in 2019. However, since Oct. 1, propane exports have averaged 137,000 bpd higher than during the same period of 2019. Propane exports are setting five-year highs during many weeks this winter.

Even with the strong rally in crude and strong exports, mild U.S. winter temperatures had kept propane prices under control. But with the crude rally and strong exports in place when cold temperatures finally hit in mid-December, propane prices had a trifecta of support pushing them sharply higher.

Chart courtesy of Cost Management Solutions

Recent forecasts are already showing some moderation in the weather support, and crude is struggling to keep its upward momentum going with new cases of the coronavirus surging. In fact, a new strain of the coronavirus has hit Britain, raising even more alarms about crude demand in the short term. Propane exports remain robust with the EIA reporting that for the week ending on Dec. 18, propane exports easily set a five-year high for the week at 1.501 million bpd, up 145,000 bpd from the previous week.

If crude flattens out here and temperatures continue to moderate, the worst of the surge in propane prices could be behind propane retailers and their customers. But propane export economics remain strong. As long as that remains the case, it may be hard for propane prices to totally collapse, even if winter weather support evaporates.

If winter temperatures remain supportive in the second half of winter, we might expect propane to hold doggedly to its recent gains and perhaps add to them as inventory levels are likely to take continued hits in that scenario.

An extremely bearish case for propane would require a downward correction in crude, a moderation in temperatures and a dramatic shift in export economics. While such a scenario is not out of the question, current conditions would have to change considerably for it to unfold.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.