Propane prices retreat despite strong domestic demand

U.S. propane prices have returned to where they began the winter – in a price decline that has surprised many, given the strong domestic demand support that was present during the time of the price collapse.

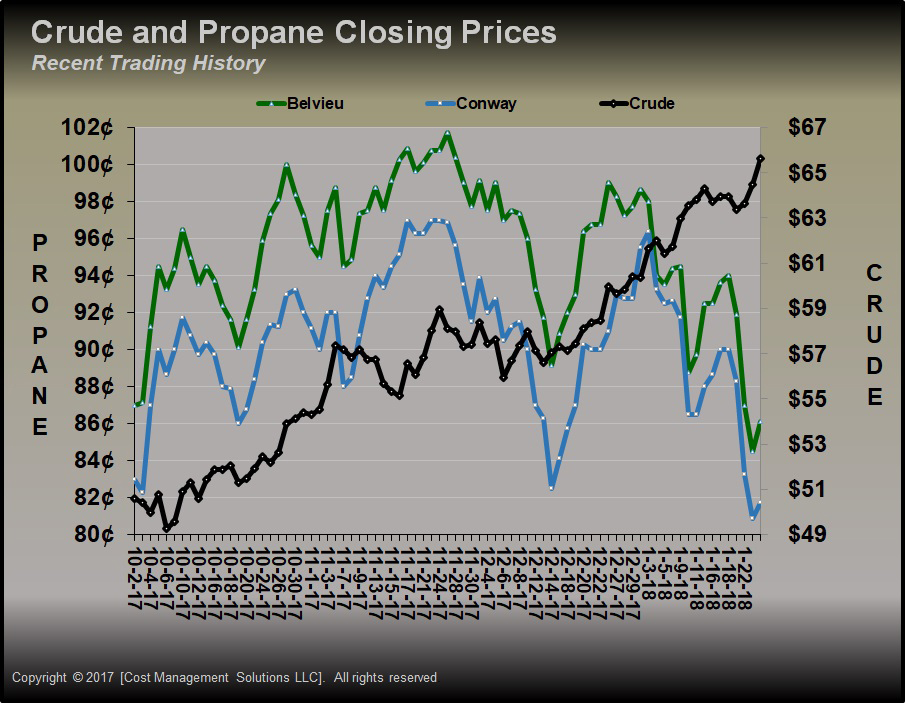

The chart above shows the closing prices of Mont Belvieu and Conway propane, along with crude, at the beginning of this winter. Of course, a chart of a propane retailer’s local supply point would look much different since the price spreads between the hubs and downstream supply points have widened due to logistical issues. This is a good example of why it’s in your favor to buy from suppliers on a price indexed to the hub instead of a local posted price.

Still, the situation could have been much worse had propane prices at the trading hubs also blown out this winter. Fortunately for retail propane marketers and consumers, such a blowout has not come to fruition.

The market appeared to be set up for such a blowout at the trading hubs. U.S. propane inventory at the end of 2017 stood at 67.976 million barrels, or 18.893 million barrels below where it was at the end of 2016. The inventory drop was a continuation of a trend over the last two years that brought U.S. propane inventories down from a record 106.202 million barrels in November 2015. Inventory at the end of 2015 was at 97.734 million barrels, almost 30 million more than at the end of 2017.

The highest winter demand in several years has hit the U.S. in January 2018, but propane prices at the trading hubs have been on a steep decline throughout that period. Despite strong domestic demand, the inventory situation has improved during the month of January. U.S. propane inventory is now just 14 million barrels below where it was at this point in 2017.

A sharp increase in U.S. propane supply, due to higher natural gas production in the fourth quarter, has been a significant reason inventories have held up as well as they have. Production jumped 107,000 barrels per day in October. Though the official numbers have not been released, weekly estimates suggest fourth-quarter production was strong.

However, we’ve also learned that foreign importers of U.S. propane appear to have flexibility in their supply sourcing. When U.S. propane prices increased, export volumes showed a lot of elasticity. Importers of U.S. product were apparently able to do without the supply, resulting in export volumes falling at critical points.

U.S. propane markets are seeing this elasticity and that has allowed all of the fear that was in the market early in the season to come out of prices. Thus, we see prices right back where they started winter at the trading hubs.

Now we will have to determine if prices have overcorrected. Mont Belvieu propane is down to just 55 percent of West Texas Intermediate (WTI) crude after reaching 80 percent of WTI’s value at its peak. Will this lower valuation increase export volumes and support higher prices? As the chart above shows, the precedent is already set for such a rebound this winter, as prices rallied hard off a similarly steep correction in mid-December.

Recent forecasts say we should expect good domestic demand in February. If exports rebound and domestic demand remains strong, it is highly probable that propane will move back to 60 percent or above of crude’s value. As the chart shows, WTI crude’s price has been very strong this winter and, so far, has shown little signs it wants to give up its value.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.