Propane pricing will hinge on crude production

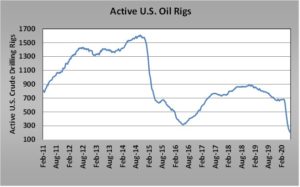

For the week ending June 12, Baker Hughes reported that active rigs drilling for crude oil in the United States dropped to 199, a record low since it began keeping the data in 2011.

At the height of drilling activity in the United States, the number of active rigs drilling for crude hit 1,609 during the week ending October 10, 2014. Active crude rigs are down 589 over the last 12 months alone.

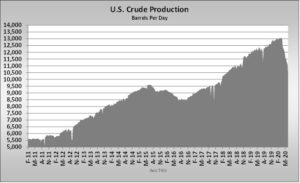

During that same period, U.S. crude production had risen from 5,597 barrels per day (bpd) to 13.1 million bpd as late as March 13. The U.S. Energy Information Administration (EIA) reported U.S. production at 10.5 million bpd for the week ending June 12. For reference, U.S. crude production had dropped to just 3,813 bpd during the week of September 30, 2005, before high crude prices made recovering crude from shale formations profitable.

U.S. producers voluntarily shut production during April when crude prices collapsed due to much lower demand related to sequestering to slow the spread of COVID-19. The drop in crude production and the associated natural gas liquids (NGL) loss dramatically impacted propane fundamentals.

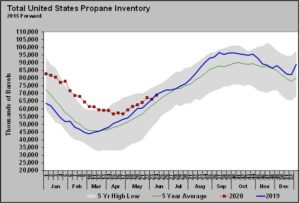

During the first week of 2020, U.S. propane inventory was 19.160 million barrels higher than during the same week in 2019. For the week ending June 12, the EIA reported U.S. inventory was 563,000 barrels below last year’s levels.

In addition to lower NGL production at the wellhead, there was less propane supplied at the tailgate of refineries. Lower demand for gasoline and distillates caused refiners to dramatically cut refinery throughput, resulting in lower propane production as a byproduct of the crude refining process. It has been a double whammy for propane supplies, which has caused the dramatic elimination of the surplus in propane inventory. Lower propane inventory has provided upward pressure on propane prices.

Some of the crude and NGL production is resuming now that West Texas Intermediate (WTI) crude has reached $40 per barrel. That price is at the lower end of breakeven for crude produced from shale formations.

As crude production rebounds from its current 10.5 million bpd, propane supplies will increase. In fact, there is already some recovery in propane production as refinery throughput increases. Propane production had dropped to 1.932 million bpd five weeks ago from a high of 2.464 million bpd at the beginning of the year. Production has increased in four of the past five weeks and stands at 2.142 million bpd. This recovery should accelerate in the short term as crude wells that were shut in April reopen and as refinery throughput improves.

This development should help stabilize propane inventory levels and perhaps take some of the upward pressure off prices in the short term. But the long-term outlook for propane supply is going to depend on the resumption of drilling activity in the United States. We simply should not assume that U.S. crude, natural gas and NGL production is going to quickly recover to pre-COVID-19 levels anytime soon.

Crude producing and exporting nations that make up the membership of a group called OPEC+ are producing 9.7 million bpd below their baseline production to support crude prices. Their efforts have raised prices enough to bring shut U.S. production back online, but the price likely is still too low to cause a resumption in drilling activity. These producers are going to slowly increase their production back to baseline levels, keeping prices as high as they can without triggering more U.S. drilling. If they are successful, the lack of new drilling will cause lower U.S. crude production because depleting wells will not be replaced.

If we could recommend one data point to watch for propane retailers, it would be U.S. crude drilling activity. As long as the number of active crude drilling rigs stays near the 200 level or below, there is a good chance of tighter propane supplies once current crude production is restored and natural well depletion takes place. The longer active rigs stay near this level, the more retailers should prepare for the potential for upward pressure on propane prices.

Conversely, if the price of crude rises, triggering a resumption of drilling activity, then propane fundamentals may become less supportive. But don’t forget to consider that higher crude prices alone could provide some support for propane as long as they are rising, even as propane fundamentals become less price supportive.

Crude producers are going to be performing quite the dance for the rest of 2020, and it would behoove propane retailers to get the popcorn ready and watch the competition. They could certainly pick up some pointers on the toe-tapping they will need to do relative to propane price protection.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.