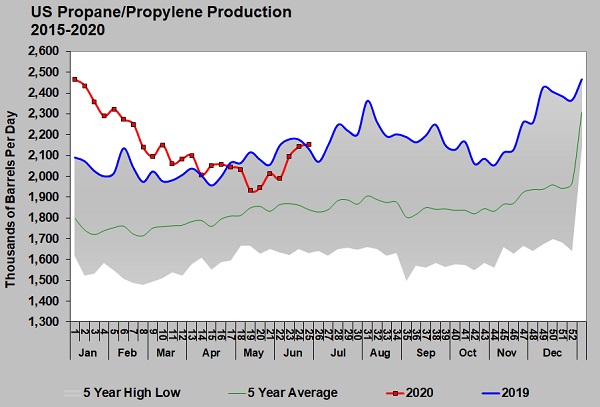

Propane production on rebound as refinery throughput increases

U.S. propane production has been on the rise over the past few weeks, putting a lid on propane prices. A key reason that propane inventories have dropped from over 19 million barrels above 2019 at the beginning of the year to essentially even at this point was a sharp drop in domestic propane production.

As crude producers reopen wells and refinery throughput increases, propane production has recovered. More crude production brings along with it associated natural gas and natural gas liquids. Natural gas processing accounts for 85 percent of U.S. propane supply, and more crude production increases natural gas processing. More crude production does not necessarily result in more crude being refined, however. In fact, we are mostly seeing U.S. crude inventories rise. They are setting five-year highs for this time of year.

Refining crude is what yields about 15 percent of U.S. propane supplies. How much crude is refined is determined by demand for refined products. Demand has been improving, causing an increase in the amount of crude being refined. Refiners processed a low of 12.383 million barrels per day (bpd) in May, but was up to 13.840 million bpd last week. That is still 3 million bpd less than where it was at the beginning of the year. The uptick in refined fuels demand is being threatened by an increase in COVID-19 cases. Of course, if refineries aren’t processing crude then crude inventory will continue to build, driving prices lower until producers start shutting in production again.

It is in this uncertain environment, that is largely dictated by a virus, that both buyers and sellers are trying to navigate. Just a few weeks ago, with states ramping up economic activity, the market was bullish. Both crude and propane were on strong runs. The assumption was a straight-line recovery in economic activity and thus energy demand.

But that is no longer the case. With COVID-19 cases on the rise, governments are being forced to either reverse course on or at least slow plans for opening up economic activity. Refinery margins are under pressure and the recent gains in refinery throughput are in jeopardy. If they are in jeopardy, then crude prices could fall, which could cause some of the crude wells that have been opened recently to be shut again.

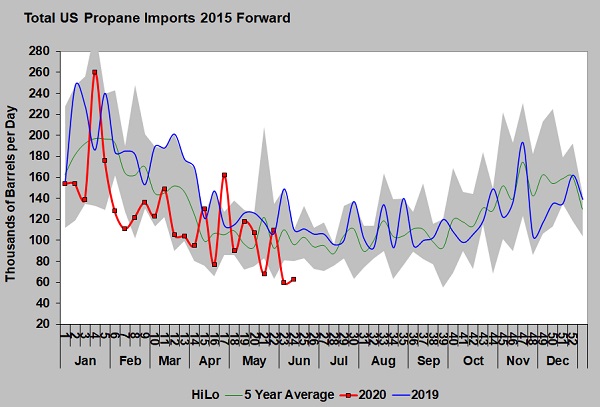

Meanwhile imports, the other piece of the propane supply picture, continue to lag last year.

So far this year, U.S. propane imports have averaged 123,000 bpd, down 41,000 bpd from the same period last year. As the chart right shows, imports have set five-year low marks during several weeks of this year. In each of the last two weeks that has been the case, so there is no indication the trend in imports is ready to reverse.

The recent upswing in propane supply is developing into a headwind for propane prices. Propane buyers see the upswing, and their enthusiasm to buy more price protection is dampened. While caution is certainly warranted by the upswing in production, it is important that buyers not become complacent. If the number of COVID-19 cases continues to rise, we could soon see the conditions that drew down inventories over the first half of this year resume.

Even with its recent rebound, domestic production is still 310,000 bpd lower than the high set at the beginning of the year. Should the rebound in production slow or end, with imports already off, fundamental support for propane could improve quickly.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.