Propane production outpaces demand

We have discussed ad nauseam the high level of U.S. propane production. Production has been running at record highs, putting pressure on the demand side to keep up, or risk building inventories and depressing propane prices. Demand has not been meeting the challenge. Thus, inventories are rising, putting propane prices under significant downward pressure.

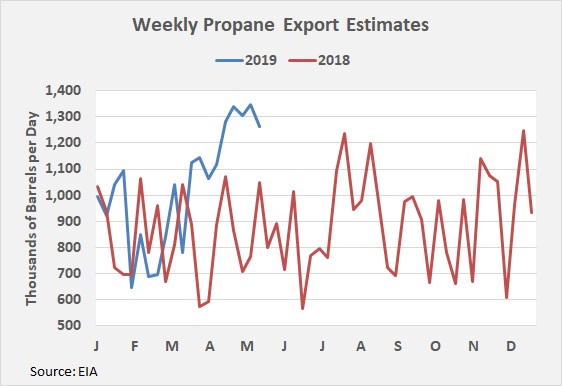

At first glance, propane exports have risen to the challenge, but domestic demand has not.

The chart above shows weekly export estimates from the Energy Information Administration (EIA). Note how exports surged at the end of March and have been high since. Exports have been over a million barrels per day (bpd) for nine weeks in a row. Previously, exports had never held above a million bpd for more than five weeks in a row. During this nine-week stretch, new export highs have been reached several times.

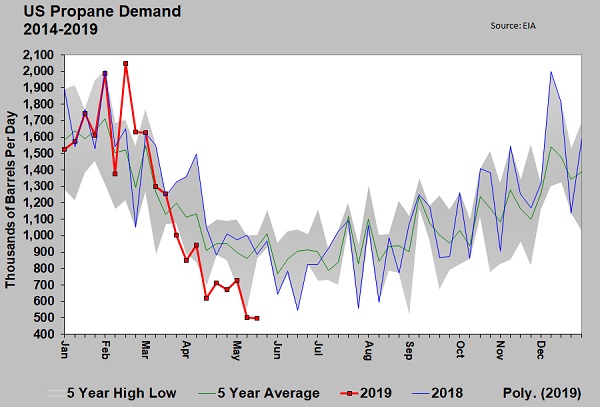

While exports appear to be robust, domestic demand has gone in the opposite direction.

Note how as exports surged, domestic demand fell sharply. It is the time of year that domestic demand normally falls, but it has been below average for … wait for it … nine weeks in a row. Over the last six weeks, domestic demand has been setting fresh five-year lows.

It is quite possible exports have been exceptionally strong over this stretch since export economics have been very good. It is also possible domestic demand has been exceptionally weak. With prices falling, retailers could be holding off on buys. Petrochemicals are certainly favoring ethane over propane.

But, we have to wonder if there isn’t another contributor to these trends. Domestic demand is an implied number. The EIA does not gather reports from retailers and petrochemical companies concerning their propane usage. It gathers information on inventory, exports, imports and production. With those numbers in hand, it calculates or implies domestic demand. If there are changes in the data collected, it will be reflected in the implied demand number.

Three months after the weekly estimates (that are so closely watched) are reported, the EIA releases official data. Historically, the official monthly data has shown more exports than the weekly data. That means domestic demand was implied at a higher number when the weekly estimates were provided than was actually the case.

We know the EIA has been working very hard to improve its data collection. We are making an educated guess that the weekly export estimates, and thus the implied demand numbers, are going to be more closely aligned with the official monthly data in the future. We will get a chance to prove that theory when the March data is released and perhaps even better when the official April data is released.

If this theory proves wrong, then propane export volumes have truly entered a new realm. If they remain consistently above a million bpd and domestic demand bounces back to more normal levels, then the inventory builds will get back to more normal levels as well.

When we first saw propane exports breaking records and staying well above a million bpd on a consistent basis, we concluded it would be bullish for propane prices. But it hasn’t been. Then, we began to focus on the equal and opposite movement on the domestic side. We could only speculate why domestic demand would suddenly be so anemic.

Over the next couple of months, this situation will become clear to us as our theory will either be confirmed or disproved. Until then, we know this: Combined domestic demand and export volumes are not keeping up with the increases in propane production. The result is building inventory and falling propane prices. Until both domestic demand and exports are robust at the same time, that is going to continue.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.