Propane rallies amid crude pricing struggles

May West Texas Intermediate (WTI) crude has fallen below $20 per barrel. That is the lowest price for WTI since 2002. The weakness in front-month crude is attributed to the rapid filling of U.S. commercial storage and reduced refinery runs, which lowers demand. With no place to go with production, producers are now being forced to shut in production.

ConocoPhillips announced last week that it will lower its crude production by 30 percent this year, or about 225,000 barrels per day (bpd). Other producers have mentioned cuts as well that, combined with the ConocoPhillips cutback, will amount to about 854,000 bpd in production cuts. It is highly likely that there will be more announcements of production cuts in the coming days.

Our assumption on U.S. production had been that low prices would lower capital expenditures, resulting in lower drilling activity, which would slowly lower U.S. crude and natural gas production as depleted wells would not be replaced. We expected that to lead to a gradual slowdown in propane supply. But the impacts of COVID-19 have created a much more acute oversupply situation, resulting in shutting producing crude wells.

Lower crude production means less associated natural gas and natural gas liquids production. Further, the drop in refinery throughput has been dramatic. For the week ending April 10, U.S. refineries processed just 12.665 million bpd of crude, down 3.413 million bpd from the same week last year. Lower refinery runs mean less propane.

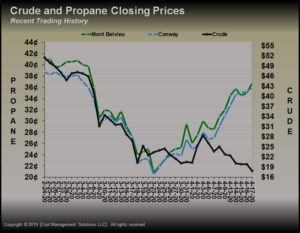

The oversupply in crude is leading to reduced propane supply, which is causing the value of the two commodities to separate.

The separation of propane and crude prices began on March 23. Since that date, Mont Belvieu LST propane has gained 16 cents. That is an astounding 77.11 percent. The gains in Conway have been equally significant, rising 15.5 cents, or 75.61 percent. Over the same period, WTI front-month May crude is down $5.44, or 23 percent.

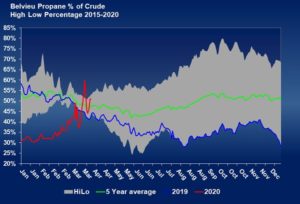

We shared this same chart last week, which shows the relative value of Mont Belvieu LST propane to WTI crude. Last week’s chart showed MB LST at 51 percent of WTI crude, still in the gray area of the chart. As we write, it is 86 percent. Not only is this easily setting a new five-year high relative value for this point in the year, it also is setting a new five-year high for any point in the year.

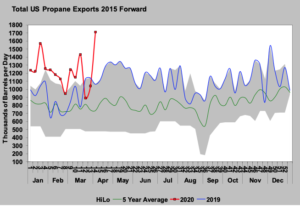

There are reports from traders that China is now buying U.S. propane. China put tariffs on U.S. propane, which stopped any direct propane sales between the United States and China. But the Chinese government is now providing waivers, allowing some of its companies to buy U.S. propane without having to pay the tariff. Plus, Saudi propane prices are rising, making U.S. propane more competitive.

Last week, the U.S. Energy Information Administration reported U.S. propane exports at a record 1.714 million bpd. Traders are reporting buying for export directly to China and elsewhere is high.

It is remarkable how quickly the supply/demand situation for propane has changed. For two years, there was so much supply that demand was overwhelmed, and inventories were building. Now propane/propylene production is down to near 2 million bpd after starting the year at over 2.4 million bpd. Imports are down and exports are up.

Since this is a dynamic situation that will change, it is tough to forecast where prices will go. Rising prices will impact all of the supply/demand inputs. However, conditions are certainly present to see more appreciation in propane prices this year.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.