Propane rejection and its causes

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains the concept of propane rejection and its relationship with the recent cold weather.

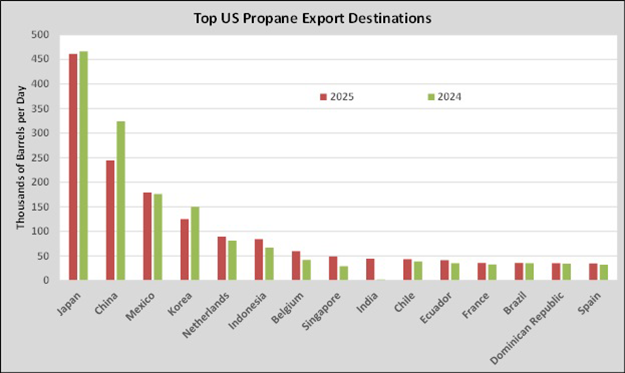

Catch up on last week’s Trader’s Corner here: Breaking down US propane exports by destination

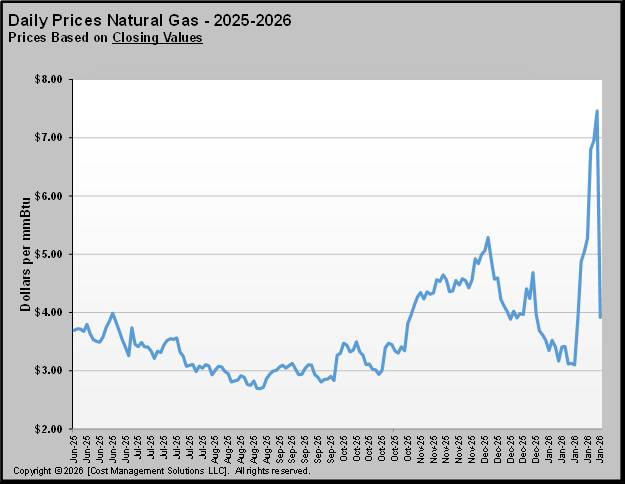

During the recent Arctic cold front, temperatures plummeted and demand for heating sources of all types increased. As demand increased, natural gas prices surged.

On Jan. 28, the front-month February natural gas price hit an intraday high of $7.8270 per MMBtu before closing at $7.46 per MMBtu, which is plotted on the chart above. With the expiration of the February futures contract and March assuming the mantle of front month, prices have retreated significantly. As we write on Friday morning, Jan. 30, front-month March natural gas is trading at $3.918 per MMBtu.

Propane prices did not run higher with natural gas, given that propane fundamentals are in great shape, with high inventories, good production and tenable export demand. Consequently, the value of natural gas and propane started converging.

In our daily reporting, we convert other products into a propane Btu equivalent for the purpose of apples-to-apples comparisons, so we know how propane stacks up. Essentially, we are taking the values of other products per British Thermal Unit (Btu) and converting them to a propane Btu equivalent.

Natural gas’s value was running at the equivalent of 30 cents per gallon of propane during the summer. But during the spike, we noted that it had risen to the equivalent of 62 cents per gallon of propane, which was almost exactly where Conway propane was priced at the time.

This is so rare these days that we immediately knew we wanted to take the opportunity to discuss propane rejection. Though it hasn’t happened often recently due to rather mild winters, it used to be a normal occurrence. And we think that with propane being so oversupplied and natural gas less so, it could begin happening more frequently.

To properly discuss propane rejection and its impact, we need to do a quick review of the crude and natural gas production processes.

There are crude and natural gas production fields scattered around the country. A field is a concentration of wells in an area where crude, natural gas or both were discovered and are now being exploited.

As production comes out of the wells, it first goes to separators that allow the light hydrocarbons like methane, ethane and propane to be sent into one transportation and processing system and heavier hydrocarbons like crude into another system.

When the light hydrocarbons leave the separators, they go to a natural gas processing plant, generally located near the production area. At the natural gas processing plant, the methane (commonly referred to as natural gas) is separated and put into a pipeline that transports it to natural gas utility companies.

The heavier natural gas liquids like ethane, propane and butane go into a separate pipeline that takes them to fractionators. At the fractionators, those heavier natural gas liquids are separated into their marketable forms. This process is done because the heavier natural gas liquids, which get their base value from crude, are generally more valuable than methane. The costs of transporting and fractionating are more than offset by this increase in value.

However, during periods when methane prices spike, as was the case in January, there can come a point where methane and propane prices become close enough in value that the extra cost of transportation and separation is no longer justified. It is at that point that propane rejection can occur.

Propane rejection means the propane is not separated from the methane at the natural gas processing plant. Instead, the propane, up to what is contractually allowed, is left with the methane and is sold to natural gas utility companies, providing them with more supply/Btus.

While this may be just hunky dory for natural gas utility companies, it can be quite the pain in the “Btu” for propane consumers. Because of rejection, it is essentially impossible for propane prices to go below natural gas prices. Rejection is almost always going to be simultaneous with high heating demand conditions, which means that propane is in high demand as well, making it particularly detrimental in the minds of propane consumers.

During extremely cold weather, production of all hydrocarbons generally declines as wellheads and other production and processing components struggle to deal with the cold. So that hurts supply. At the same time, the cold increases demand. Then, in the case of propane, if we throw in the impacts of rejection, the combination can cause significant decreases in propane inventory and drive prices higher.

In the current case, we have not seen significant rejection because propane is oversupplied. The deal is not completely done, though. The impact of these situations is often seen in Energy Information Administration (EIA) data several weeks after the event. So, we would not be surprised by significant draws on propane inventories reported in the next couple of EIA data releases. That could cause a temporary uptick in propane’s price.

The good news this time around is that no matter how significant the draws on propane inventories are, they are almost certain to exit the winter inventory drawdown period and begin the inventory build period at a record high. But that doesn’t mean propane retailers should not be aware of rejection and its potential impact.

If propane remains oversupplied and natural gas supplies remain relatively tight, the potential for rejection increases. All it will take is a winter with prolonged above-normal heating demand.

That probably sounds like a fantasy spawned by memories of yesteryear, but it could happen.

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.