Propane’s relative value drops to record lows

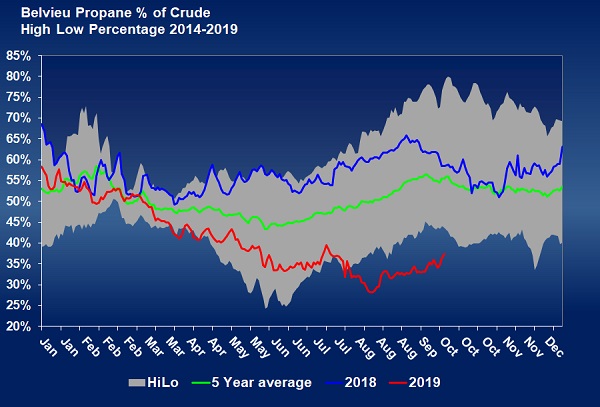

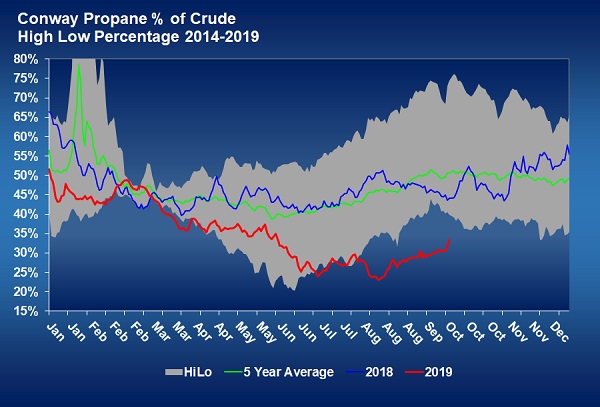

Propane’s relative value to crude is exceptionally low as winter approaches. Such low valuation reflects record-high production that is overwhelming both domestic and foreign demand for U.S. propane. The charts below plot Mont Belvieu LST and Conway’s relative value to WTI crude on a simple percentage basis.

More than 80 percent of U.S. propane supply comes from natural gas wells. When natural gas wells are drilled and begin production, they produce not only methane, which is sold to natural gas utilities and their consumers, but also heavier hydrocarbons known collectively as natural gas liquids or NGLs.

NGLs are not marketed relative to the value of natural gas, but rather the value of crude. The heaviest of the NGLs, butane and natural gasoline, are blended with crude during the refining process to make gasoline, thus the close relationship to crude prices.

Ethane and propane are not used in the refining process, and in fact, propane is a byproduct of processing crude into gasoline. That is why 20 percent of propane supply is available from refiners. In the past, the bulk of propane supply actually came from refining operations, another reason its value was established relative to crude rather than natural gas.

Back in the day, when the United States was a net importer of propane, its value was consistently around 70 percent of the value of WTI crude. Propane would sometimes go above 70 percent during high demand periods that pulled inventories down, but it didn’t stay below 70 percent for long. When propane went below 70 percent of WTI crude, chemical companies generally increased the use of propane as a feedstock, limiting the downside for propane prices.

The historical value relationship between propane and crude changed with proliferation of drilling in shale formations that caused natural gas production and consequently NGL production to surge. With each passing month, natural gas and NGL production reaches a new record.

Crude production has also surged during this period, but the supply and demand balance for propane has been altered more than the supply and demand balance for crude. Consequently, propane’s value has gone down relative to crude’s value.

As of Oct. 9, Mont Belvieu LST was valued at just 37 percent of WTI crude. Conway propane was valued at 33 percent of WTI crude. As the charts above show, propane at both locations has been setting new five-year lows since about the end of July, as propane inventories marched their way to over 100 million barrels.

Since 2015, Mont Belvieu LST propane has averaged 51.66 percent of WTI crude and Conway 49.98 percent. The days of the 70-percent value relationship between propane and crude is long gone. This year, Mont Belvieu LST has averaged just 41.13 percent and Conway 35.32 percent of WTI crude.

The United States is now the world’s largest exporter of propane, accounting for 44 percent of global propane exports – about 26 million barrels per month. The next closest is the Middle East at 18.6 million barrels per month. Since the beginning of 2018, U.S. propane production has averaged 2.007 million barrels per day (bpd), and imports have averaged 142,750 bpd, for a total supply 2.150 million bpd. During that time, domestic consumption for propane has averaged just 1.147 million bpd.

That means 1.002 million bpd of exports were necessary to keep supply and demand balanced. But exports have only averaged 952,000 bpd during that time, meaning that inventory has built an average of just under 51,000 bpd for the past 21 months. Hence, inventory has climbed to 100 million barrels, and propane’s relative value has dropped to record lows for this time of year.

The only way to change the relative valuation trend for propane is to change the inventory trend. The growth in propane supply is going to slow next year based on projections for the growth in natural gas supply. That slowdown could allow domestic demand and export volumes to catch up to supply, ending the inventory build and corresponding deterioration of propane’s value. But, with export volumes trending below current capacity and economic growth slowing, it is going to be a tall order for demand to catch up and keep up.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.