Propane shakes off growing list of headwinds

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, discusses propane pricing trends and the impact of heating-degree days.

In last week’s Trader’s Corner, we discussed propane prices’ sudden turn lower and listed four developments that could have contributed to the downturn. This week, we are going to add a few more items to that list.

First, here is the short version of last week’s list:

1. U.S. propane production increased 187,000 barrels per day (bpd) in two weeks, recovering much of the 217,000 bpd that had been lost over the previous four weeks.

2. U.S. propane producers became more aggressive sellers, perhaps sensing the uptrend was playing out.

3. Russia announced it would provide more natural gas supply to Europe, potentially decreasing the need for propane to replace or augment natural gas supplies.

4. Lower propylene and polypropylene prices, potentially lowering the demand for propane as a feedstock for propane dehydrogenation plants that turn propane into propylene.

A new development revealed itself this week. Butane has become price competitive with propane for residential and commercial use in some foreign markets. That could cause more U.S. butane loading and less propane loading for export to foreign markets, but so far, that hasn’t showed up in the data as propane exports increased this past week.

The second item has been ongoing this fall but getting significantly worse with each passing day: a lack of heating demand in the U.S.

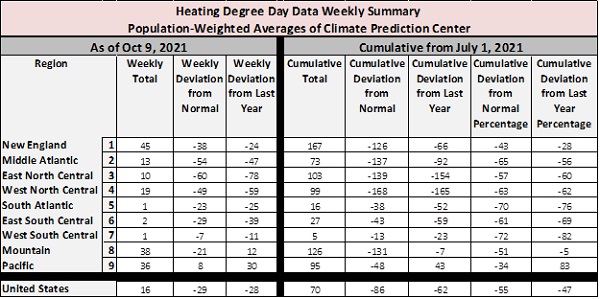

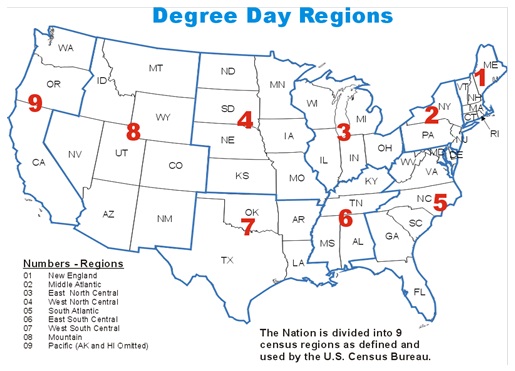

Table 1 shows population weighted heating degree-days (HDD) by region. The map of regions is below.

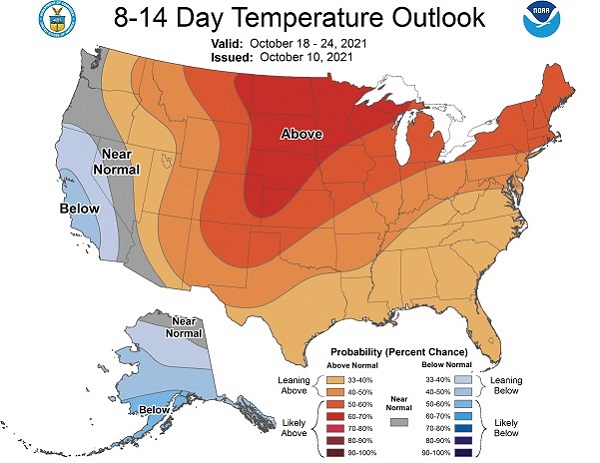

So far this year, there have only been 70 HDDs nationwide. That is 86 HDDs below normal and 62 HDDs below last year. It is incredible to think that, at this point, we are actually behind normal by more HDDs than we have actually posted. And it doesn’t look like the situation will get better anytime soon. Map 2, below, is a temperature probability map from the National Oceanic and Atmospheric Administration.

Map 2 covers the Oct. 18-24 time frame. Almost the entire nation has the probability of having above-normal temperatures in that time frame.

Obviously, this is not good for propane retailers in any way save for the fact that it briefly helped take some of the upward pressure off of supply prices. But we can’t make any margin on gallons we don’t sell, so higher prices and high demand would be preferred to what is playing out so far.

If this year is going to have fewer HDDs than normal and last year, it makes protecting margin on the gallons we do sell all the more important. Some retailers see sales volume decrease and start getting aggressive with prices, trying to push more gallons. That strategy is counterproductive toward keeping the retail business financially healthy.

Instead, the focus needs to be on squeezing the best margin possible out of every gallon sold. Despite the short pullback in prices from all of the headwinds we mentioned, the resulting price correction was short. The underlying issue of low inventory remains. Though Mont Belvieu LST propane’s price corrected 10 cents lower over a week’s time, much of that correction has already been retraced. Mont Belvieu LST dropped from a year’s high of 152 cents on Oct. 4 to 142 cents on Oct. 13. The price is back up to 148.25 cents as we wrote last Friday morning.

When we recommended the one-month margin protection strategy at the end of September, we could have struck an October swap at 143 cents. At this point, October’s month average is 147.2 cents despite the one-week correction. A retailer implementing the short-term margin protection strategy is up 4.2 cents per gallon on his October swap. The retailer has the option of holding prices firm despite the increased cost of supply because the projected swap payment at the end of the month will offset the increased cost of supply. Of course, there are still 11 trading days remaining in October. Things can change a lot in that time, but at this point, the margin protection strategy is working as planned.

Don’t forget inventory is still 28.197 million barrels, or 28.2 percent, below this time last year. If the weather turns around and demand picks up, we could still see a potential run higher in prices this winter.

Also, don’t forget about call options if you think the downward correction in propane’s price could resume. By the end of October, a retailer should be able to strike a November call option with a premium of around 4 cents. If you are worried about prices falling when we get to the end of this month, the call option may be better than buying a swap to protect your margin.

Remember, with a swap, we can’t lower our retail price once we have established our price for the month with that swap. We need to make the extra margin to pay the swap loss in a falling price market, thereby protecting our margin. As we said last week, buying the swap and setting a retail price for the month protects the retail margin but takes away the ability to lower our retail price.

A call option, however, provides both the margin protection and leaves the flexibility to lower prices to our customers should propane supply costs fall again. The retailer pays the premium for a call option that transfers the risk to the option provider, giving the retailer this added flexibility.

As we write, November propane at Mont Belvieu is trading at 149 cents. Let’s say it stays that price until Oct. 29, the last trading day of the month. If retailers were to use the swap to protect margin, then they would use 149 cents, plus the price differential between Mont Belvieu and their locations, plus transportation cost to bulk tanks, plus desired margin to set November sales prices and protect retail margin.

Let’s say the numbers look like this: swap strike 149 cents + differential 10 cents + trucking 5 cents + margin 100 cents = October sales price of 264 cents. If prices go higher during the month, the customer price does not need to go higher because the swap gain will offset the margin loss.

However, retailers are stuck with that retail price throughout the month, even if prices fall. If retailers lower retail prices, they cut into margin because, at the end of the month, they will have a swap loss to pay.

If retailers use the call option, they should add the premium cost to their November sales price calculations: call option strike 149 cents (note same as swap) + premium 4 cents + differential 10 cents + trucking 5 cents + margin 100 cents = October sales price of 268 cents. If prices go higher during the month, retailers can stick with the 268-cent sales price because the option will offset the difference in supply cost just like the swap.

The big difference between the swap and the call option comes in a falling market. Let’s say the price of propane drops 15 cents to start November. Retailers have the ability to lower retail prices by that amount since they will have no obligation on the option at the end of the month. They would drop their prices for customer retention purposes. They don’t have to drop their retail prices at all or may only drop it partially, thus increasing their actual margin.

If prices are falling, that probably means volume is still lagging and thus adding margin to every gallon sold would be very important. So perhaps retailers would lower their retail prices by 7 cents, leaving 8 cents to improve margin. If winter demand remains low in the winter of 2021-22, retailers may ultimately make less profit than they made during the winter of 2020-21. That would make the extra margin gained from the call option important for keeping retail businesses financially healthy.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.