Propane’s relative value to crude facing upward winter pressure

Thanksgiving has come and gone. It is perhaps the last lull before the long winter grind begins in earnest for propane retailers. Propane prices often go through a bit of a slump between the middle of October and the Thanksgiving holiday.

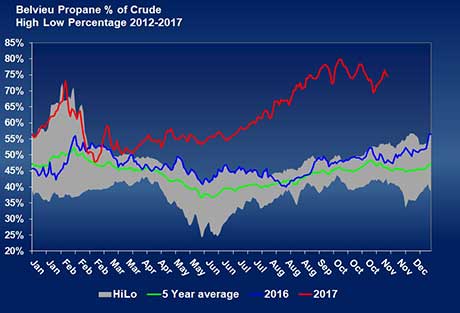

This year was no exception, as propane’s relative value to crude slipped a little over the last six weeks. Mont Belvieu propane reached 80 percent of West Texas Intermediate (WTI) crude in early October, but fell to 69 percent at one point in November.

At this point in the season, we expect there to be more upward pressure on propane’s relative value to crude. For the most part, we think the run in crude prices for the winter is near its peak. Meanwhile, seasonal influences are bearing more on propane and are likely to remain that way for several months.

We are already seeing separation this week, with propane up more than 1 percent and WTI crude down more than 1 percent. With propane inventory relatively low compared with the last few years and export volumes remaining robust, the risk remains to the upside for propane prices.

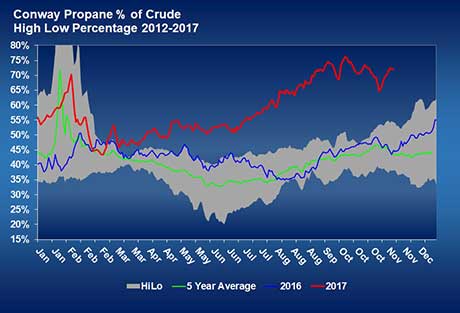

Conway’s relative value is running on the same pattern as Mont Belvieu, though at several percentage points lower. For example, Mont Belvieu is at 74 percent of WTI, while Conway is at 71 percent.

Coming out of the Thanksgiving lull last year, propane’s inventory was around 102 million barrels, compared with about 73 million barrels this year. At that time last year, propane’s relative value to crude was 48 percent for Mont Belvieu and 45 percent for Conway.

Looking at both of the charts above, we want to focus on what happened to relative values at the beginning of this year when we were dealing with the latter stages of winter 2016-17. Propane’s relative value jumped from about 55 percent of WTI to 70 percent of WTI as winter pressures rallied prices.

We’re concerned that propane’s relative value is already above the top of last year’s spike in relative value to crude. Even if propane’s relative value climbs the same 15 percentage points it did in the latter stages of last winter, it would put propane’s relative value at around 90 percent in Mont Belvieu and 85 percent in Conway. If WTI crude stays steady at $58 per barrel, that would put Mont Belvieu at 124 cents and Conway at 117 cents.

When the spike in values occurred during February 2017, propane inventory was still around 53 million barrels. With inventory currently 28 million barrels below where it was last year at this time, it doesn’t take much to imagine how much lower inventory could be in February 2018.

It seems like the conditions will present an even higher gain in relative value this year than last year.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.