Protecting margins when propane prices rise rapidly

In last week’s Trader’s Corner, we contrasted the pricing environment between the start of last year and this year. Near the end of the article, we said the following:

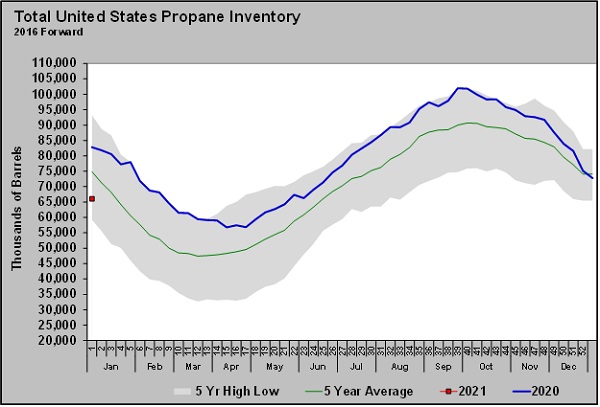

Inventory ended 2019 at 82.188 million barrels and ended 2020 at 72.777 million barrels. Current inventory is still solid, but the 9.411 million-barrel, year-over-year decline creates a more bullish pricing environment.

Chart: Cost Management Solutions

Just a few days after that statement, inventory suddenly felt a lot less solid. Last Wednesday, the U.S. Energy Information Administration (EIA) reported a 6.729 million-barrel draw on U.S. propane inventory.

The draw exceeded industry expectations for a 4.13 million-barrel draw. It dwarfed the five-year average draw of 1.4 million barrels for week one of the year. With that draw, U.S. propane inventory is now 15.756 million barrels, or 19.3 percent, below where it was at the end of week one last year.

The EIA reported a weekly increase in propane demand of 674,000 barrels per day (bpd). U.S. domestic demand was up 402,000 bpd, and export demand was up 272,000 bpd. The combination of strong domestic demand and exports is simply overwhelming current supply, requiring the large pulls on inventory. Those large inventory draws are pushing prices higher.

Since last week’s Trader’s Corner, Mont Belvieu LST propane is up 12.5 cents, or 14 percent, to 97.25 cents. Conway has been even stronger, surging 16.25 cents, or 19 percent, to 98 cents. This type of rapid increase can cause problems for propane retailers.

The 370 percent increase in propane prices since March of last year can certainly upset customers, which is bad enough. But the quick gains in propane prices like those experienced this past week can have an immediate impact on a retail company’s bottom line.

Retailers tend not to raise propane prices for customers as quickly as the wholesale market passes increases on to retailers. This situation usually occurs during high-demand periods, so bringing prices down when wholesale prices drop in the future rarely recovers the loss.

There is a risk management tool to use in this situation that is simple and effective. At the end of the previous month, buy a financial swap for the upcoming month. The volume should be what you expect to deliver in the upcoming month or less.

When you buy the swap, you do so at current market price. This is known as the strike price. The swap will settle against the monthly average. At the end of the month, the buyer of the swap will get the difference between the monthly average and the strike price if the monthly average is higher.

In a rising market, the monthly average is going to be higher than the strike price. When the swap settles, the retailer will get a check that can help offset the revenue lost because retail prices were not raised quickly enough.

For example, at the end of December, a retailer could have bought a January swap with a strike price of about 76.25 cents. Through Jan. 13, the monthly average was 84.4 cents. The difference is 8.15 cents. Let’s say the retailer had bought a volume of 100,000 gallons. The settlement would be $8,150.

Obviously, January’s actual monthly average is likely to be a lot higher with propane prices rising the way they are. Should the monthly average be lower than the strike price, the retailer would pay the difference. This would be a situation when the retailer would try to delay lowering prices to generate more revenue that could then be used to offset the swap loss.

A financial swap as described above can be established in a matter of minutes when you are set up with trading partners. We can help you establish those relationships if you don’t already have them.

In “The Art of War,” ancient Chinese military general Sun Tzu writes: “Know your enemy and know yourself; in a hundred battles you will never be in peril.” As propane retailers, we know our tendency is to delay passing sharp price increases on to our customers, thus hurting our bottom line. By knowing the tendency, we can counteract it by using financial swaps to protect our profits.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.