Pullback in propane prices may indicate buying opportunity

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, discusses price protection in the context of a pullback in propane prices.

Propane is heading back to pandemic lows of around 20 cents. Propane over 150 cents was only a mirage, something we should not believe possible or repeatable. But 20-cent propane is totally realistic and believable. Propane buyers should absolutely expect that to happen.

Sorry. We had just walked through magic fairy dust before we sat down to write, and its effect had not quite worn off.

Let’s rub our eyes and try to get the stars that are blurring our vision to fade away so we can find the road out of fantasy land. After all, what we are dealing with is not a work of fiction. It’s based in facts whether we like those facts or not. Granted, in today’s world, it seems that many believe you can rewrite history, but in the propane business, we generally just have to learn from it.

On March 23, 2020, Mont Belvieu LST propane closed at 20.75 cents, and Conway closed at 20.5 cents. Yes, about a year and a half ago, that was the reality for propane prices. Raise your hand if you wish you would have bought every gallon of propane possible for as far out as possible at that time. We were at the beginning of a pandemic – hopefully a once-in-a-lifetime event – that had caused major lockdowns in travel and economic activity that resulted in massive drops in energy demand. Energy production had not slowed down as fast as demand and inventory accumulated, eroding prices of most, if not all, energy sources.

We want to focus on that “once-in-a-lifetime” part so perhaps we can get that 20-cent propane price out of our heads. It was probably the worst thing that could have happened in terms of preparing for this winter. It created some kind of delusional euphoria. As an industry, we need intense psychotherapy or memory blockers that make it go away so we can move on.

In April 2021, we were advocating right here in the annals of Trader’s Corner that 75-cent propane was a good buy. But that price was woefully unappealing compared to 20-cent propane. We just weren’t ready to accept the reality of 75-cent propane. We just needed patience, and we would “score” big again. Not only did propane’s price not go down – it doubled. Now, there are all of these boogeymen behind every propane tank, in every transport load of propane, in every tree, just waiting for us to make a mistake.

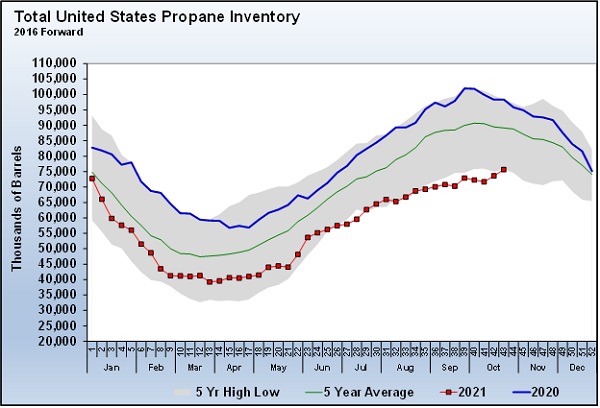

Mont Belvieu LST propane reached a yearly high of 152 cents on Oct. 4. On Oct. 5, Conway reached its high of 151.75 cents. Light annual crop drying demand, a very slow start to winter heating demand and a slip in export demand sent propane into a price correction. Then, over the past couple of weeks, the U.S. Energy Information Administration has reported well-above-average inventory increases in the 2-million-barrel range.

By Oct. 28, Mont Belvieu LST had dropped to 136 cents and Conway to 136.5 cents. Those high prices had sobered us up a bit, but did this pullback look like an opportunity? Instead, didn’t the pullback just cause flashbacks of 20-cent or even 75-cent propane?

When propane was climbing to 150-plus cents, we were all in disbelief. Despite the low inventories, we just didn’t want to believe it was or should be happening. But with this pullback, it is amazing how quickly we want to believe prices will continue to go lower.

No one can say with certainty that they won’t. In fact, no one can say they won’t drop to 75 cents or even 20 cents. But we suggest that we should perhaps not believe they will and instead settle for disbelief if they do.

Despite the two great builds, U.S. inventory is still at a five-year low for this point in the year – at 75.666 million barrels. From this point last winter until inventory started building again, U.S. propane inventory declined 59.144 million barrels. A repeat performance would have inventory at 16.522 million barrels at the end of this winter. That would be half of the lowest inventory seen in the past five years. We are not projecting that much inventory draw will happen or even suggesting that it will, but given that it happened in the very last winter, we can’t completely discard the possibility.

Propane buyers and consumers should recognize how quickly the pricing environment could change should winter heating demand finally arrive. One should seriously consider whether this pullback is an opportunity.

Even with this pullback, the current price of propane is leaving a bitter taste in the mouths of buyers. But, upon signs of this pullback ending, we are suggesting that at least some action to protect against the worst-case scenario above might be warranted.

Many analysts are expecting crude to move to $100 per barrel during the course of this winter. At this point, we shouldn’t expect a crash in crude to help us out like it did when those 20-cent propane lows were set. On the propane fundamentals front, even if this winter’s inventory draw is 73 percent of last year’s inventory draw, the winter will end with inventories at the five-year low.

October has been a good month for propane buyers, but it’s only good if we buy the opportunity that may have been presented. We shouldn’t be too quick to believe we are headed for 75-cent propane, and we shouldn’t be in disbelief if prices turn higher once again.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.