Review of propane fundamentals shows strong inventory builds

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explores the strong inventory builds recently.

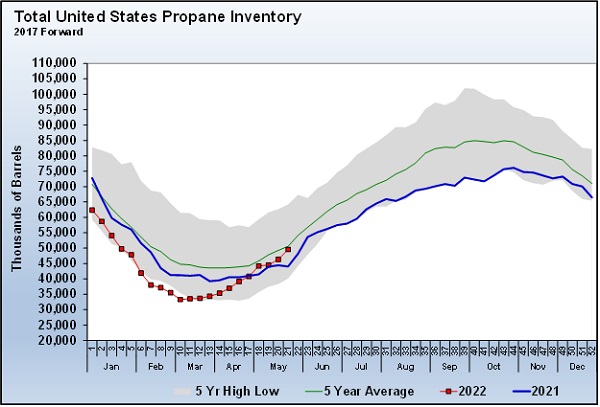

For six weeks, we focused on the macro energy picture, specifically as it relates to Russia’s invasion of Ukraine. It is time to get back to basics and look at propane fundamentals. Frankly, we are not sure the inventory build period to this point could have gone any better. The build period started early this year, and the builds have been above average.

U.S. propane inventory reached its low during the first week of March this year at 33.308 million barrels. As of May 27, inventory was up 16.265 million barrels to 49.572 million barrels. Inventory was setting a five-year low during the first week of March and is now above last year and near the five-year average.

During the first of March, Mont Belvieu ETR propane reached 163 cents and Conway 162.375 cents. Currently, they are down to 124 cents and 122 cents, respectively, reflecting the improved supply situation. Indeed, propane prices are still high, which is reflecting high energy prices overall. But propane has fared very well compared to other energy sources. At the first of March, propane was valued at 60 percent of WTI crude. Today, it is around 45 percent of WTI. That means, compared to other energy sources, propane is faring much better on a Btu basis. That’s good for propane consumers – even if the price remains a challenge.

For example, on March 1, Mont Belvieu ETR propane was valued at 163 cents. Heating oil was at the equivalent of 293 cents propane and gasoline at 270 cents propane. Today, Mont Belvieu ETR is at 124 cents, down 39 cents, while heating oil is at 280 cents equivalent propane, down 13 cents, and gasoline at 306 cents, up 36 cents on a propane Btu equivalent basis. Propane’s fundamentals have generally been moving in favor of buyers, with propane production outpacing demand.

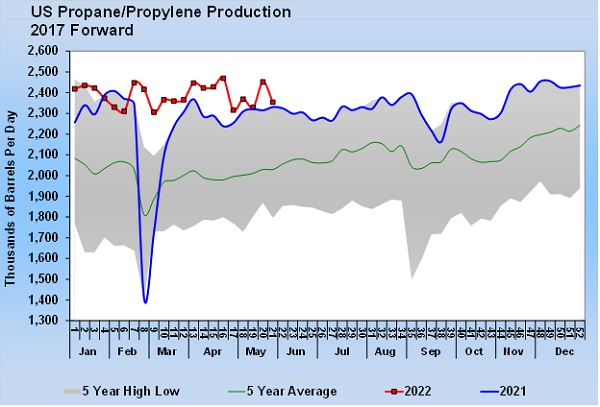

U.S. propane production has averaged 2.388 million barrels per day (bpd), up 155,000 bpd from the same period last year. To be sure, the winter storm last year that hurt supply so badly in February and March has skewed the numbers in favor of this year. But, outside that, inventory has generally been setting five-year highs this year. Production is on a pace to be up nearly 33 million barrels for the year.

Staying on the supply side, propane imports are down, having averaged 26,000 bpd less this year. Most imports come from Canada, and producers there are improving netbacks by sending their production to Mexico and Asia. Even with the lower imports, supply is up 129,000 bpd over the same period last year. That number could decline given the challenges of last year’s supply, but we can expect U.S. crude and natural gas production to increase this year, which should keep propane production at least near where it has been running, if not higher.

Propane demand has simply not kept up with the increases in production, which has led to the strong inventory builds. U.S. domestic propane demand is down 17,000 bpd so far this year. It averaged an 86,000-bpd increase over 2020. Propane exports are up 44,000 bpd year to date. Combined with the drop in domestic demand, that is just a 27,000-bpd increase in demand compared to the 129,000-bpd increase in supply. Again, any way you look at it, that is a good number for propane consumers. Had the recovery in inventories not been so positive, the pricing environment could be entirely different. If propane were still valued where it was relative to crude at the first of March, it would be tipping the scales at more than 170 cents. The only reason it isn’t is because of the positive supply fundamentals.

We have seen reports that propane exports have not been as strong as they otherwise might have been because netbacks to producers on butane exports have been better. That means butane has been taking up a higher percentage of tanker capacity at propane’s expense. That could change, but industry reports have butane inventories high, so the incentive to export, even if netbacks aren’t great, remains high. In May, butane accounted for 22.88 percent of the combined propane/butane exports. That is higher than the year’s average of 20.07 percent and higher than the annual rate of 22.68 percent last year.

Also, China has not been as strong of a propane buyer this year even though it is still favoring U.S. supply over the Middle East. If China’s demand stays muted, and butane exports take up a higher percentage of export capacity, propane export growth may be limited. That would be excellent news for the continued improvement in propane inventory.

In conclusion, if the next three months of the propane inventory build period go as well for buyers as the last three months, the pricing environment to start next winter might be as good as we could expect relative to the rest of the energy marketplace. That doesn’t necessarily mean lower propane prices. If crude and refined products prices continue to climb, propane prices could get pulled along by their wake. If that is true, we can only hope the gains in propane lag such that its relative Btu value remains favorable.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.