Revisiting propane inventories

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, is happy to say that propane inventories could be considered fixed … almost.

Catch up on last week’s Trader’s Corner here: Bad propane pricing environment could have been worse

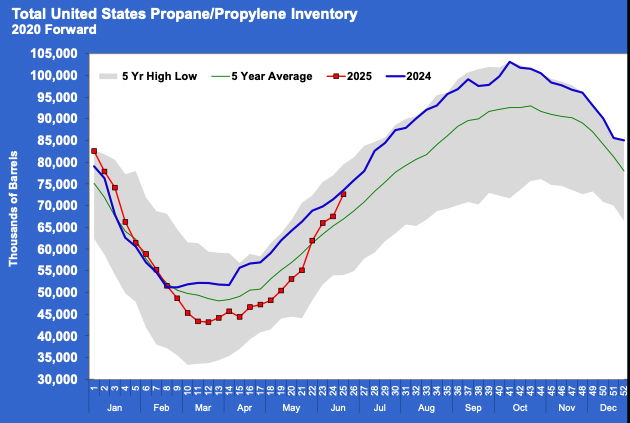

You will recall that just three weeks ago, we wrote a Trader’s Corner showing how U.S. propane inventories were starting to recover. We titled the article “Propane inventories helped, not fixed.” We are going to revisit inventories again in this Trader’s Corner because we are happy to say that inventories could be considered fixed … almost.

The U.S. Energy Information Administration (EIA) last reported inventory positions on June 25. It was data collected for the week ending June 20. On June 20, U.S. propane inventories were just 920,000 barrels below this time last year. Remember that last year, propane inventories went on to be at a record high before winter.

It’s hard to believe inventories are at this point after where they were just five weeks ago. At that point, inventories were 11.189 million barrels below last year and below the five-year average. Inventories are now 5.684 million barrels above the five-year average. Five weeks ago, they were 3.869 million barrels below.

Like U.S. inventories overall, Gulf Coast propane inventories are above last year and the five-year average as well. But there are still areas in need of improvement.

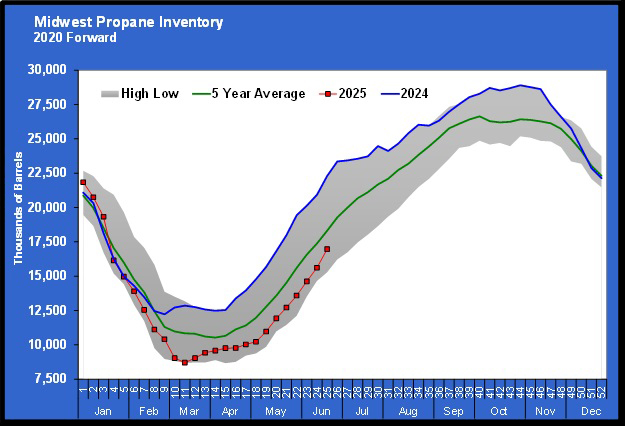

Midwest inventories are still lagging below the five-year average and well below last year. There were some odd gains in Midwest inventories last year in March. We would be happy to see Midwest inventories reach the five-year average before winter. They are 6.21 percent below that now. That is 1.334 million barrels, which is not an insurmountable number to make up before winter.

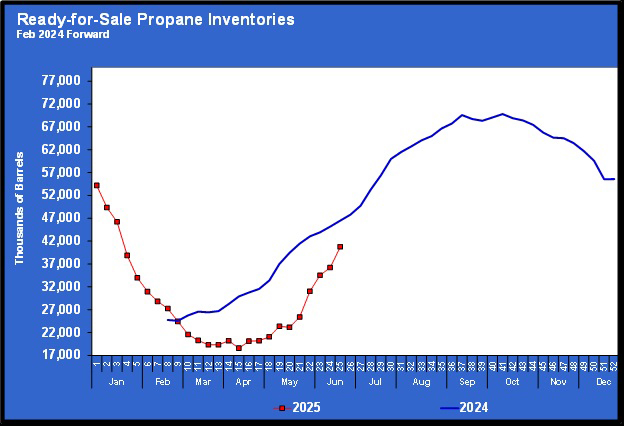

The other area that is still a concern is ready-for-sale (RFS) propane inventory.

Like overall inventories, RFS inventories have been improving rapidly, but unlike overall inventories, the RFS portion is below last year. That means that more of the inventory remains upstream of the fractionators this year than last year.

The green bars in Chart 4 show the percentage of the overall inventory that is fractionated and ready for sale. Currently, 56.1 percent of total propane inventories are fractionated and in caverns downstream of the fractionators and ready for sale. That is 40.75 million of the total 72.615 million barrels of inventory. The remaining 31.865 million barrels of inventory are still mixed with other NGLs upstream of the fractionators and are therefore not ready for sale.

Last June, RFS inventories were 63 percent of the total inventories. Unfortunately, we only have this data back to February 2024. Nonetheless, the market is going to trade on what it knows, and it knows that this year’s RFS inventory is lagging last year. So, that is a support for propane prices overall. The gains in RFS have been quite good over the last four weeks, as the second chart shows. We have some degree of confidence that fractionators will keep processing at a rate that will bring the RFS inventories back in line to last year as the weeks building up to this winter pass.

If you recall, we wrote several Trader’s Corners coming out of winter that acknowledged that high exports and a winter storm had hit inventories hard. Inventories were well below where they were coming out of the previous winter, yet we expressed confidence that inventories would replenish quickly. They did not, and we struggled to figure out why. It took a lot longer to get back to last year’s levels than we expected.

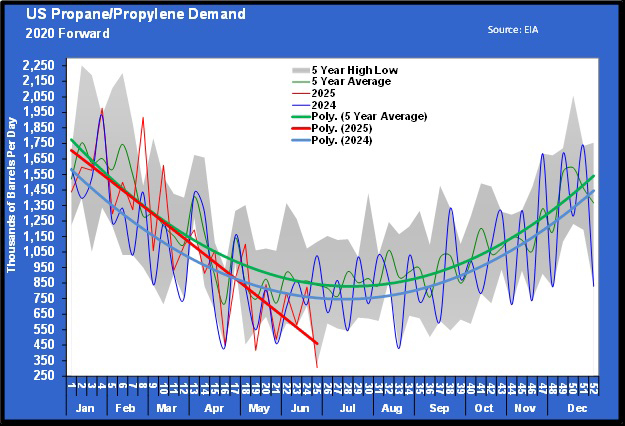

Equally, we struggle to figure out why inventories have improved so much over the last few weeks. The EIA has shown a significant fall in domestic demand. That is not surprising for this time of year, and yet last week’s domestic demand was just 305,000 barrels per day (bpd). That’s down 520,000 bpd from the previous week and 722,000 bpd below the same week last year.

Demand set a five-year low for last week at the 305,000-bpd mark. But let’s remind ourselves that the domestic demand number is a calculated number. The EIA doesn’t collect data on domestic demand. It collects data on imports, exports, production and inventories. It then calculates what domestic demand must have been to balance the numbers.

But let’s say a storage operator underreported an inventory position for a few weeks. In that case, the EIA would say that domestic demand is higher than it really was. Then the error is found, and the operator starts increasing the inventory level to correct the mistake. That would make the EIA report domestic demand lower than it was while this adjustment is going on. What we are saying is that very low domestic demand in the last few weeks certainly helped with the inventory builds. But it is always possible that adjustments are made to other data points that distort the demand number.

In any case, it is a fantastic development for propane buyers that inventories are getting back in line with last year’s record levels. There are still a few weak points, but there is still time to correct them before winter demand kicks in. Now buyers just need to see this improved demand situation better reflected in propane prices.

Believe it or not, propane prices were lower than at this time last year with crude about $16 per barrel below where it was last year at this time. Front-month crude was at $81.74 at this time last year, and propane was around 80 cents. Crude is $65.80 now, and propane is between 71.25 and 74.125 cents. October 2025 through March 2026 MB ETR propane is currently valued at 76 cents. At this time last year, October 2024 through March 2025 propane was valued at 85.5 cents.

The buying environment for this winter price protection has improved for propane buyers, and it is better than last year. Even so, this winter’s propane is still valued higher than what prices have averaged over the last 10 years. If crude stays tame and propane inventories continue to improve as they have been the last four weeks, there is still a chance price protection for this winter will be had in the 73.5 cents range (the 10-year winter price average), which will feel much better.

Charts courtesy of Cost Management Solutions

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.