Robust propane demand limiting inventory build

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains propane supply and demand trends ahead of the winter heating season.

In last week’s Trader’s Corner, we looked at U.S. propane inventory. Inventory is building at a below-average pace. As of Sept. 3, U.S. propane inventory was 70.099 million barrels. That puts it 27.281 million barrels, or 28 percent, below last year.

Robust propane demand this summer, both at home and abroad, has been key in limiting weekly inventory builds.

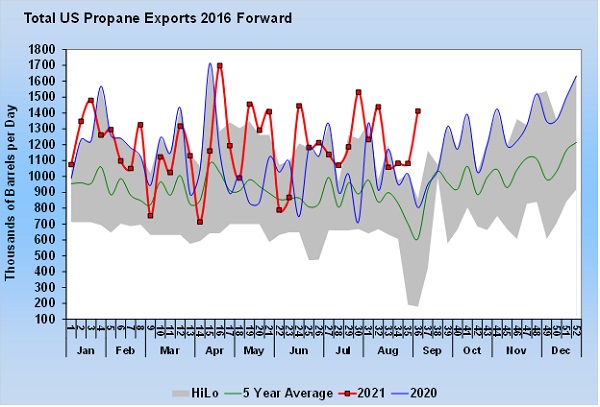

Chart 1 shows U.S. propane exports.

Note the sharp gain last week despite Mont Belvieu propane hitting new highs for the year during that week. Propane exports have set a new five-year high for the week, reported in each of the last three weeks. Many weeks this year have set new export highs.

So far this year, propane exports have averaged 1.192 million barrels per day (bpd). That is up 98,000 bpd from the same period last year.

New propane demand from Japan and China, especially to supply new propane dehydrogenation units that convert propane into higher valued propylene, has been instrumental in keeping exports robust despite higher prices.

At some point, high prices will hurt this demand. Apparently, we have not reached that point given the current rate of exports.

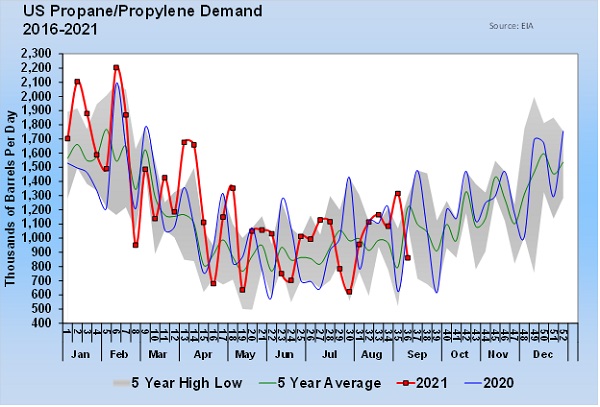

Thankfully there was a big drop in U.S. propane demand this past week to offset the big gain in export volumes or there would have likely been an inventory draw rather than a below-average 817,000-barrel inventory build, which was just over half of the five-year average build for week 36 of the year.

The weekly change in domestic propane demand is volatile. On average this year, domestic demand has been 1.223 million bpd, up 94,000 bpd from last year.

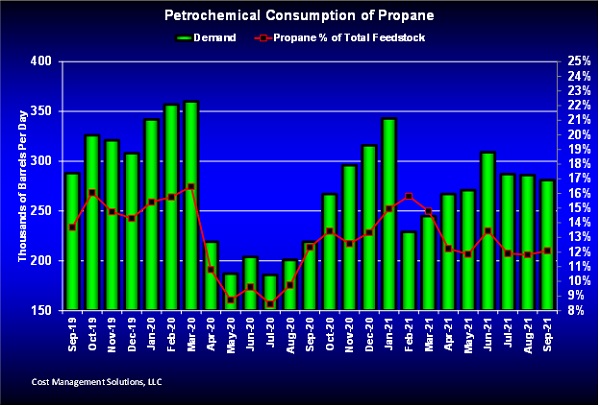

Part of the demand comes from petrochemical companies.

Chart 3 shows U.S. petrochemical company consumption of propane.

Currently, U.S. petrochemical companies are consuming 281,000 bpd. The average consumption rate has been 280,000 bpd so far this year. During the same period last year, the consumption rate was 253,000 bpd.

Petrochemicals appear to account for 27,000 bpd of this year’s demand increase of 94,000 bpd. The rest appears to come from the retail side.

Despite the steady rise in prices throughout the summer, propane demand has remained robust, limiting the build in inventory. Now, seasonal demand from crop drying and heating are upon us, with inventory just 72 percent of what it was at this time last year.

As seasonal retail demand rises, so will prices unless something gives with petrochemical and export demand. So far, those sectors have not shown any sign of yielding their spot at the feed trough.

Propane retailers must go into their peak demand period assuming they will continue to see strong competition for the available supply.

Retailers have to hope export markets will respond to higher prices and lower their demand at crunch time.

If not, there is the potential for things to get a bit hairy out there.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.