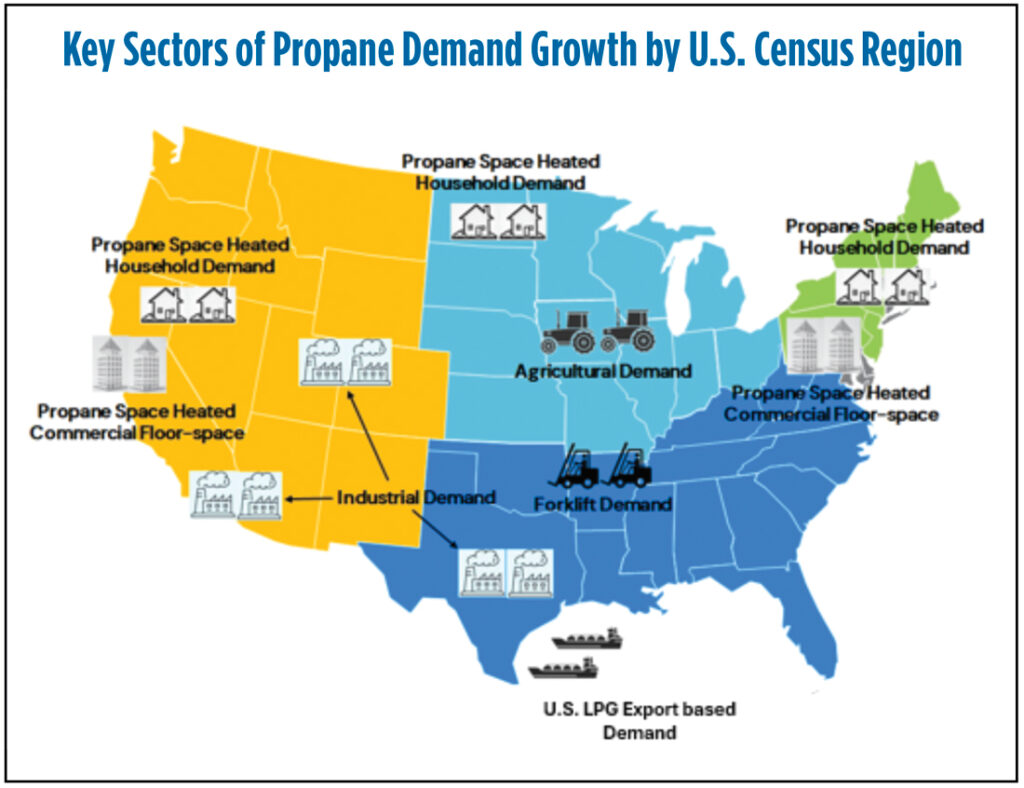

Sectoral overview of US propane demand trends

Propane is a versatile energy source across the U.S., with its utilization influenced by regional needs and infrastructure. Propane is essential in residential and commercial settings, particularly for space heating during harsh winters. In areas without natural gas pipelines, propane’s portability makes it essential for heating and backup power. It’s also used in agriculture and in industrial processes. Additionally, propane is widely used in recreational activities like grilling and camping. This article examines the future of U.S. propane demand by sector.

Commentary on sectoral propane demand outlook

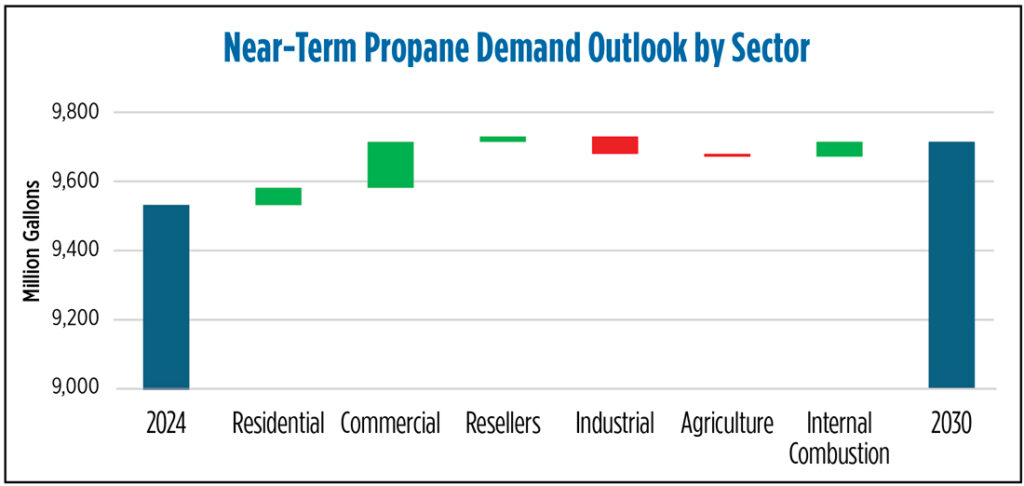

Overall, ICF is expecting modest growth in retail propane demand between 2024-30, which varies by sector:

⦁ Residential sector: In 2023, residential sector propane demand declined due to warm weather. Going forward, ICF anticipates continued strong competition from other fuels, with electrification posing a significant long-term challenge. The ICF outlook suggests electric heat pumps will continue to gain market share, particularly in new neighborhoods in certain states. However, propane is expected to maintain market share in many areas as electric heat pumps are most effective in milder winter regions. This factor contributes to propane’s sustained role in the residential heating market amidst growing competition.

⦁ Commercial sector: Commercial sector propane demand declined in 2023, due to warm weather conditions. ICF forecasts modest growth in propane demand due to its range of commercial applications, including heating, generators, restaurant equipment and various outdoor applications in the health sector and other service-based industries.

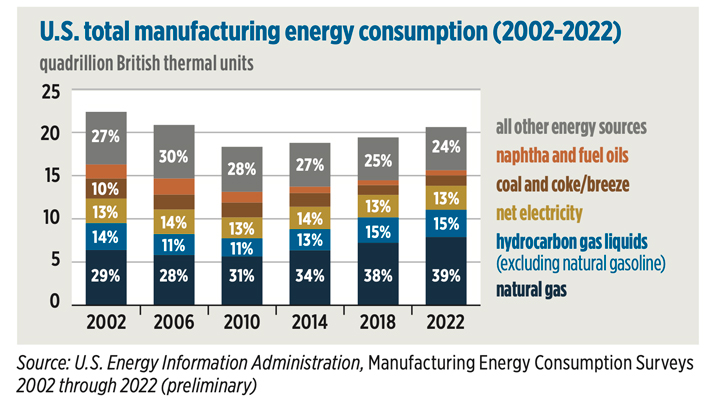

⦁ Industrial sector: ICF projects industrial sector propane demand to face competition from natural gas, electrification and efficiency gains. However, applications in the construction sector and industrial applications like manufacturing, metal-working and chemical production will continue to use propane.

⦁ Agricultural sector: Propane uses for grain drying saw a slight rebound in 2023 as regional precipitation levels returned to historical averages. Propane demand in agriculture remains mostly flat in the near term. States are promoting propane-based irrigation systems for their efficiency and cost-effectiveness over diesel. However, these programs face robust competition from electric alternatives.

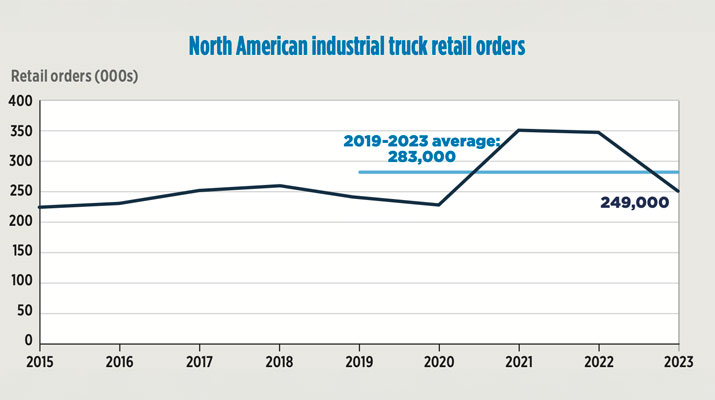

⦁ Internal combustion/transportation sector: In 2023, the e-commerce and warehousing industry, a major source of propane-fueled forklift demand, focused on operational efficiency and automation in urban areas. Propane demand from forklifts remains consistent, despite the presence of competing electric forklifts, as e-commerce expands into rural areas.

⦁ Propane cylinder sales/resales: Propane cylinders are valued for their portability and cost-effectiveness.

The evolving landscape of electrification, battery technology, alternative fuels and stricter emissions standards may influence propane demand over time. Despite these potential challenges, propane’s established infrastructure, dependability and immediate advantages position it as a competitive force in the market, ensuring its continued role as a practical and efficient option for consumers.

In the longer term, the health of U.S. retail propane markets will continue to vary by region due to regulatory differences, supply infrastructure and competition from electricity and natural gas. ICF believes that continued propane industry investments in developing a substantial renewable propane supply chain will be necessary to address climate concerns and meet clean energy goals, and to allow propane to remain competitive as a longer-term energy source.