Setting propane price expectations

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, addresses price risk management.

Regular readers of Trader’s Corner will know that we have been sounding caution about getting too long propane for the remainder of this winter. We showed that, since 2013, propane prices have averaged 69.5 cents at the end of March. Further, we pointed out that in years when propane prices are high like they are this year, there is a lot of pressure to move toward the average once winter demand starts waning.

Because current conditions with inventory positions and crude were supportive, we suggested we might still want price protection, but it should be done on a short-term basis. Subsequently, we have discussed how to use balance of the month swaps and physicals to manage short-term price protection.

In a Trader’s Corner from early January, we pointed out that because the current environment for propane prices is so supportive, hoping that propane would fall all the way to the 69.5-cent long-term average is a bridge too far. That expectation would probably have a propane buyer on the sideline through the entire buying period for next winter. We said the following in that article:

“In fact, a 15-cent drop between now and the end of winter would put propane at around 94 cents. If propane’s forward curve remains backwardated (prices lower in the future than the front), it would be time to consider first-tier price protection for next winter. That action would be conditional on two factors: When a propane price drop occurs, crude’s price is near or above where it is now, and propane inventory is below average. If crude prices are falling or below where they are now, and/or propane inventory has eliminated its deficit to the average, we would be less inclined to engage in first tier price protection at 94 cents.”

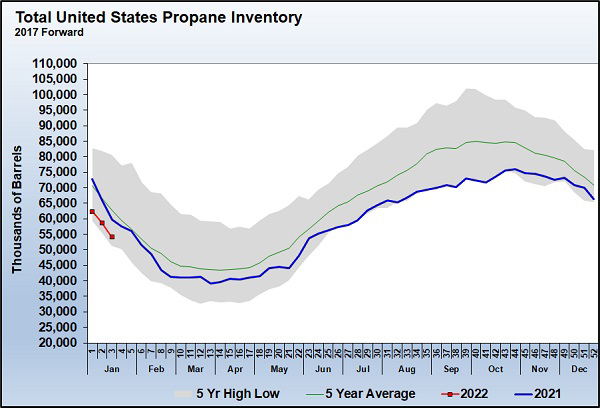

Propane prices are about 10 cents higher than they were when we made that statement. The bullish case where propane inventories are below average and crude prices are high remains in place. The last two weeks have seen U.S. propane inventory have above-average draws. At the beginning of last week, it looked like colder temperatures were moderating but, by the end of the week, the outlooks were showing the probability of below-normal temperatures in early February.

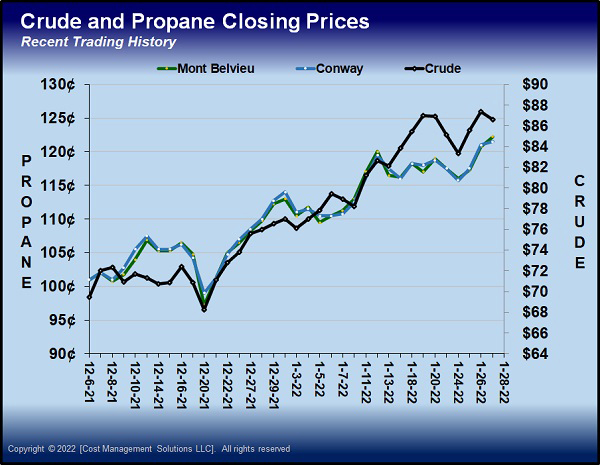

At the same time that weather has been supportive so has crude’s price. Chart 2 shows the recent price trend for crude and propane. Propane prices are supported enough by the low inventory position and colder weather to allow it to track higher with crude.

Eventually, the weather support will wane for propane, and that might allow some separation for crude, allowing propane prices to fall. Unfortunately, the outlooks for crude’s price remain very bullish. There are plenty of outlooks for around $98 WTI crude this year. Propane has been steadily valued at around 58 percent of WTI crude recently.

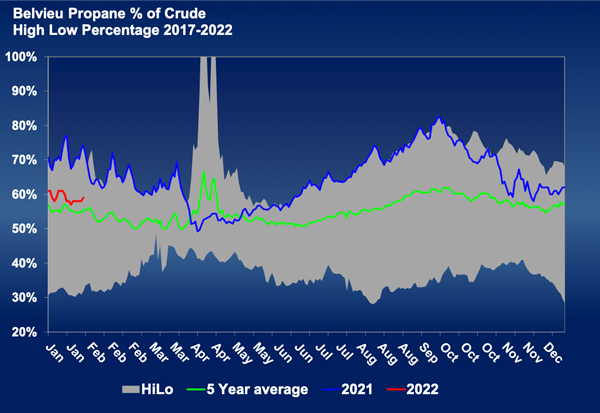

Chart 3 shows the value of MB ETR propane as a percentage of WTI crude. The green line is the five-year average. As you can see, propane valued around 50 percent of WTI is at the low end of that average. At $98 crude, propane at a 50 percent relative value would yield 116.67-cent propane.

Let’s say crude isn’t as bullish as predicted and stays around its current $88 per barrel beyond this winter. Then let’s assume cold weather goes away, and propane separates from crude and becomes valued at 50 percent of WTI. That puts propane at 104.76 cents. Our 94-cent entry point that we hoped for in early January is looking harder to achieve.

Keep in mind, though, that the crude and propane futures price curves are currently backwardated, meaning the prices are lower in the future. Currently, next winter can be bought at 110.54 cents. As we get closer to those months, the price will rise if crude’s price and propane fundamentals remain equal to where they are now.

At this point, for propane buyers to get any “deals” for next winter’s propane, we have to hope for something out of the ordinary to occur – for example, propane falling below 50 percent of crude’s value after winter demand wanes. The current inventory position works against that, however. There would have to be significant changes in the supply/demand balance for that to occur. The most likely help would be more propane production. The high price of crude and natural gas is likely to cause more drilling this year, which should increase propane production. If the economy weakens because of higher interest rates, then propane demand could suffer. A combination of the two could greatly improve the inventory situation and perhaps drive propane prices below the 50 percent relative value to crude.

The other hope would be that crude prices turn lower instead of going higher as predicted. Other than an economic collapse, it is hard to see where that is going to come from. Investment in the oil and gas sector remains down, and we think producers are going to remain disciplined with their capital spending. By the time OPEC gets back to full production around April, its spare capacity is going to be relatively low. That is a support for crude prices. Currently, there are threats to Middle East and Russian crude supplies due to geopolitical events. It’s hard to predict how those will turn out.

As things stand now, which is what we must base decisions upon, it is looking more like an entry point to hedge winter propane anywhere sub-dollar is feasible. We would never say that getting to 69.5-cent propane before next winter can’t happen. In this business, as soon as you say “can’t,” it does. But what we can say is that, given the current environment, the odds don’t favor a price anywhere near that level.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.