Smart meters add advantages for propane retailers, customers

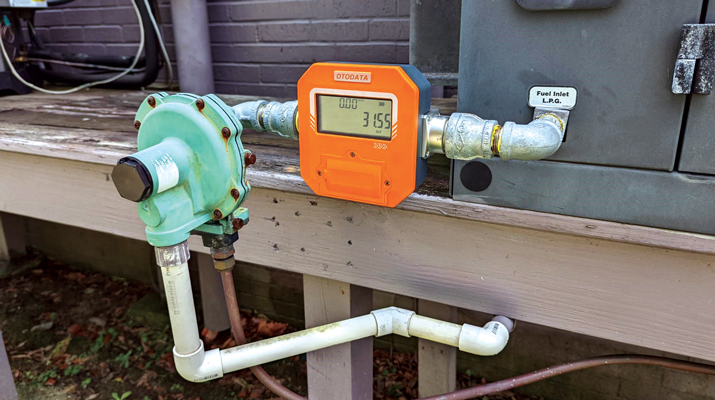

Smart meters allow propane marketers to receive a customer’s usage data remotely. (Photo courtesy of Otodata)

Jerry Monro is drawn to the convenience of smart meters.

He doesn’t worry about his team at Roach Energy having to physically read a customer’s meter every month, having to access a fenced-in backyard or coming face to face with an unfriendly dog. They can simply view the customer’s propane usage from the comforts of the office through the digital reading transmitted by the smart meter.

But there’s something else the general manager of the West Virginia company likes even more. If the customer reports a gas leak, the smart meter technology will allow the marketer to shut off the gas remotely – immediately.

“It’s worth the weight in gold for safety reasons,” he says.

In addition to the safety features offered today by smart meters, propane marketers are uncovering efficiencies for their delivery operations while giving customers new usage and payment options. Some industry leaders also say the application provides an outlet for marketers to better manage their propane inventory and avoid supply concerns during peak demand.

Smart meter discussions

LP Gas heard about smart meters during discussions at last year’s Southeastern Convention & International Propane Expo in Nashville, Tennessee.

“Metering as a whole on the propane side seems to be gaining some traction, and I think what’s driving that is [marketers] are looking to provide their customers with another option on how to receive a bill [and] differentiate themselves from their competitors,” says Jim Schwartzfisher, telemetry unit manager and customer support specialist at Bergquist Inc.

“Having that option as a marketer is just another tool in the box for them.”

Metered customers are giving rise to the idea of consumption billing, in which the customer pays only for the propane used and metered instead of paying one sum for a full delivery.

The concept, Schwartzfisher says, benefits the consumer whose budget may not allow for a full tank fill of propane.

“If the industry looks at how consumers today buy products, it’s not in bulk purchases. It’s generally a pay-as-you-use situation,” says Pete Dwyer, vice president of sales and business development for the propane division at Cavagna North America, referencing the payment structure of utilities such as electricity, water and natural gas.

Cavagna developed an ultrasonic smart meter for natural gas in Europe before bringing a propane unit to North America more than two years ago.

Traditional diaphragm (positive displacement) meters have been a workhorse for decades, Randy Warner, product safety manager at Cavagna North America, writes in a 2023 column for LP Gas, explaining how meters measure gas.

Ultrasonic meters, on the other hand, use static measurement technology that does not include mechanical or moving parts. As gas flows through the meter from demand downstream, it passes through a flow tube with a known diameter. The ultrasonic sensor is positioned in the tube to measure the flow of gas. The measurement signals are then stored until the smart meter communicates the values to an asset management platform.

Cavagna’s Prodigi ultrasonic smart meter can be used in most residential and small commercial applications.

“The technology has come a long way,” says Mike DelConte, vice president of sales at F.W. Webb. “Overall, given the improvements in technology of the smart meter, it’s definitely a tool to have in the toolbox of product offerings.”

Ultrasonic meters use static measurement technology instead of mechanical parts. (Photo courtesy of Bergquist Inc.)

The way of the industry

For more than 100 years, Dwyer says, the industry has enjoyed the process of setting tanks at single accounts, filling the tanks with propane and receiving payment from the customer to complete the sales transfer. While marketers are forced to meter accounts such as strip malls, town houses or other community systems – where a large tank or a set of tanks are feeding multiple end users – it’s rare for them to deploy meters on a large scale at single residential accounts.

“Ninety-five percent of propane gallons are pushed through non-metered accounts,” he says.

But could that change in the coming years?

“That’s what the big change in the propane industry is now – more point-of-use metering,” says Nicholas Kohart, owner of Pennsylvania-based IMAC Systems Inc., a gas meter supplier and manufacturer. “There’s always been jurisdictional systems with metering, but now we’re seeing more [marketers] starting to add point-of-use metering into their system.”

Those familiar with the technology say smart metering could aid in the industry’s transition toward more point-of-use metering and consumption billing because the technology modernizes the system for propane, allowing marketers to provide a metered bill for customers while transferring that usage data into their back-office accounting software programs.

Dwyer describes such a move, from the industry’s traditional methods where consumers pay for a tank load of propane to one where they could pay only for their usage, as a paradigm shift.

“The propane industry is not seen as a modern energy to some people,” he says. “This would help modernize that.”

Otodata President Andre Boulay says he’s unsure if the industry would ever fully adopt what he calls “propane as a service” or the process of “utilitizing propane” – again, the concept where customers pay only for their fuel usage and not by the tank fill.

“We’re not going to drive the direction of the industry; our customers are going to choose which programs they are going to implement,” Boulay says of the industry’s propane marketers. “We want to be in a position to be able to help them with metering, whatever their requirements are.”

Otodata, a Montreal-based tank monitoring provider, has moved into the metering space with two solutions: a new digital meter for remote readings and customer billing as well as an adapter that converts existing mechanical meters into a digital meter.

The adapter, available on a trial basis as Otodata develops the product, would allow marketers to continue using existing mechanical meters that would gain the ability to send consumption levels remotely to the back office.

“We want to be able to service the customers without them investing a lot of money in replacing all these meters,” Boulay says. “That’s why we designed this adapter for existing meters, and for new installations they’ll be driven to using more of the new digital meters.”

Marketer efficiencies

Not only does consumption billing give propane marketers another payment option for their budget-conscious customers, but smart metering also can help marketers add operational efficiencies and better manage their propane inventory, Schwartzfisher says.

The technology eliminates the need for marketers to read the meters on-site at customer locations. Instead, they can track the readings remotely while saving valuable time and resources.

“It’s really hard to read a bunch of meters each month, and it’s even harder to read them properly,” Kohart says. “Even though it seems simple, some of the meter windows might be dirty that you can’t see through them, or if you have different manufacturers of meters, they might read a different way. If you automate it all, you take out that potential for human error.”

Monro of Roach Energy says it’s “quite a process to switch them out,” something his company is doing at a 250-home community system that’s piped from 14 1,000-gallon underground propane tanks. But he feels the time and expense of the project are “worth every dime.”

Marketers also can add a revenue-generating fee for the customer’s use of the meter – $6 to $10 a month is what some are charging, according to Schwartzfisher.

“If you’ve got 1,000 older style meters, it would take a week, not days, to read them. Now you’ve committed those resources to something where you probably could have them do something else more constructive,” Schwartzfisher says.

On the inventory side, marketers serving metered, consumption-billed customers could fill their company-owned tanks in the slower months when prices are low, maximizing their tertiary storage availability at end-user locations.

Schwartzfisher clarifies the inventory strategy:

“If you have 300 tanks out there and you could put 100 gallons in each tank of storage, you’ve basically eliminated a 30,000-gallon storage tank,” he says. “All of a sudden, you’re not putting more capital into storage; you’re using what you already have out there as your storage.”

Tank monitor provider One-Tank says it’s important for marketers to fill customer tanks on their company’s schedule and avoid factors out of their control that could negatively impact their operations.

Fully using their tertiary storage with the help of technology advancements will ultimately give marketers a competitive edge to win new customers and improve current customer retention, according to One-Tank.

In addition, the company’s satellite- and cellular-based SkyTracker technology acts like a meter, allowing the marketer to retain ownership of the fuel inside the tank and then bill the customer according to their usage. The marketer could even bill the customer at market price, taking full advantage of a revised supply strategy, One-Tank adds.

“Our technology allows for consumption billing,” shares One-Tank CEO Brian Humphrey. “We are able to track temperature-compensated usage, and then we send that data to the marketer’s preferred accounting software.”

Because smart metering and consumption billing are concepts that marketers are “trying to wrap their head around,” Schwartzfisher says, they often start with a small number of meters to better understand the impact the product could have on their operations.

“With the new generation coming on board, I think adoption is accelerating,” Dwyer says of new technology in the propane industry. “If you offer a solution that saves money, increases efficiencies, increases safety, those are solutions people are looking for now.”

Smart meters are another tool in the box of product offerings for propane marketers. (Photo courtesy of Bergquist Inc.)

Meters by the numbers

Part of LP Gas’ discussion with propane industry leaders about smart meters centered on the quantities of meters in the field.

“Where the natural gas industry goes, the propane industry will follow” when it comes to metering, says Nicholas Kohart, owner of IMAC Systems Inc., a Pennsylvania-based gas meter supplier and manufacturer, comparing the tens of millions of existing natural gas meters to the hundreds of thousands of propane meters.

Andre Boulay, president of tank monitor provider Otodata, estimates 200,000 meters exist in the U.S. propane industry, as the Montreal-based company has begun to offer metering solutions to customers.

Meanwhile, Cavagna has been rolling out its ultrasonic smart meter for the U.S. propane industry over the past couple of years. Pete Dwyer, vice president of sales and business development for the propane division at Cavagna North America, estimates about 15,000 of the company’s smart meters exist in the field in the U.S.

Dwyer says 95 percent of propane gallons in the U.S. are pushed through non-metered accounts, but he envisions that percentage dropping with the increased use of smart meters. For the record, the propane industry sold 9.54 billion gallons in 2021. That would equate to 477 million gallons that marketers metered that year.