Supply keeping crude markets calm

Recently, there have been significant threats to crude supplies, but crude markets have remained relatively calm. Crude prices are more than 20 percent below their recent peak, despite numerous attacks on Saudi Arabia and shipping near the Strait of Hormuz. The U.S. has tied these attacks back to Iran.

Houthi rebels in Yemen have made two attacks inside Saudi Arabia. A previous attack made with a drone hit a Saudi crude pumping station. This past week, Iranian-backed Houthis fired a cruise missile that hit a Saudi airport injuring at least 26 people.

Perhaps more supportive for crude have been attacks on six ships near the Strait of Hormuz. Two of those attacks were made last week. The Norwegian tanker, Front Altair, and the Japanese-owned Kokuka Courageous, were heavily damaged by magnetic mines. The crews on both ships were removed, leaving them adrift. The Front Altair is also on fire.

Later, the U.S. released a video showing an Iranian Republican Guards vessel approaching the Kokuka Courageous removing an unexploded magnetic mine before speeding away. Iran denies it had any involvement in any of these attacks, but there appears to be evidence against those claims. Iran certainly has a motive for the attacks. The U.S. has put severe sanctions on Iran that have cut its crude exports from around 2.5 million barrels per day (bpd) to 400,000 bpd in 14 months. It is believed Iran is making these attacks to try and force U.S. allies to get the U.S. to remove its sanctions.

The attacks are having some impact. Two shipping companies have said they are no longer taking new bookings to move cargoes in the Persian Gulf. About a fifth of the world’s crude supply moves on the Persian Gulf, so the potential to increase prices is significant, yet crude prices have uncharacteristically shrugged off these threats. The reason: crude is over-supplied and global crude inventories are higher than average. It appears the market is going to have to get crude movement to slow or stop to trigger a major market reaction.

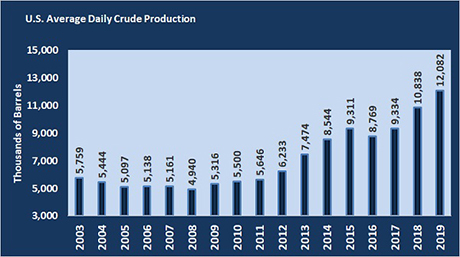

The surplus of crude can be directly traced to a revolution in U.S. crude production from shale formations that have significantly augmented overall U.S. crude supplies.

U.S. crude production fell to 4.94 million bpd in 2008, prior to the major push to recover crude from shale. With that push, U.S. crude production is at an average of over 12 million bpd so far this year. That has been tremendous for the U.S. energy industry, but there is more at stake.

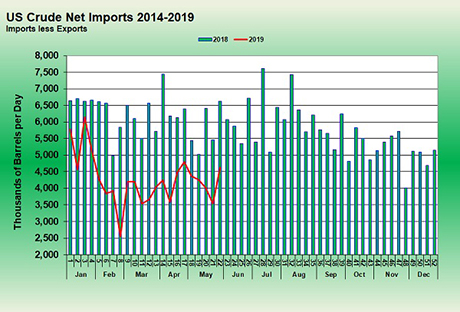

The huge gains in production have allowed the U.S. to become less dependent on foreign crude supplies.

The U.S. remains a net importer of crude, but is trending dramatically lower. The chart above shows U.S. net import-exports. So far this year, the U.S. has averaged net imports of 4.264 million bpd. However, that is less than half of the 9.769 million bpd of net imports in 2008.

The lower dependency on foreign crude supplies greatly improves U.S. national security. It also allows the U.S. to be more aggressive with its foreign policy since it is becoming less dependent on the region for crude oil. We would doubt that the U.S. would have been in the position to take the hardline stance against Iran and Venezuela in 2008 that it has over the last two years, without this lower dependency on foreign crude.

In 2008, before U.S. production increased, had the U.S. applied sanctions to Iran and Venezuela, crude prices would have surged causing more damage to the U.S. economy than to the countries it was trying to influence. The fact that the U.S. has taken these aggressive foreign policy actions, and crude markets have remained calm, even posting a 22 percent decline in crude prices since April, speaks volumes for the improved national security position the U.S. enjoys because of more domestic production.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.