Taking a deeper look at propane price uncertainty

In last week’s Trader’s Corner, we discussed why Mont Belvieu propane’s relative value to West Texas Intermediate (WTI) and future price curve were not reflecting the reported issues regarding purity propane supply. You may want to review last week’s Trader’s Corner to see our entire argument.

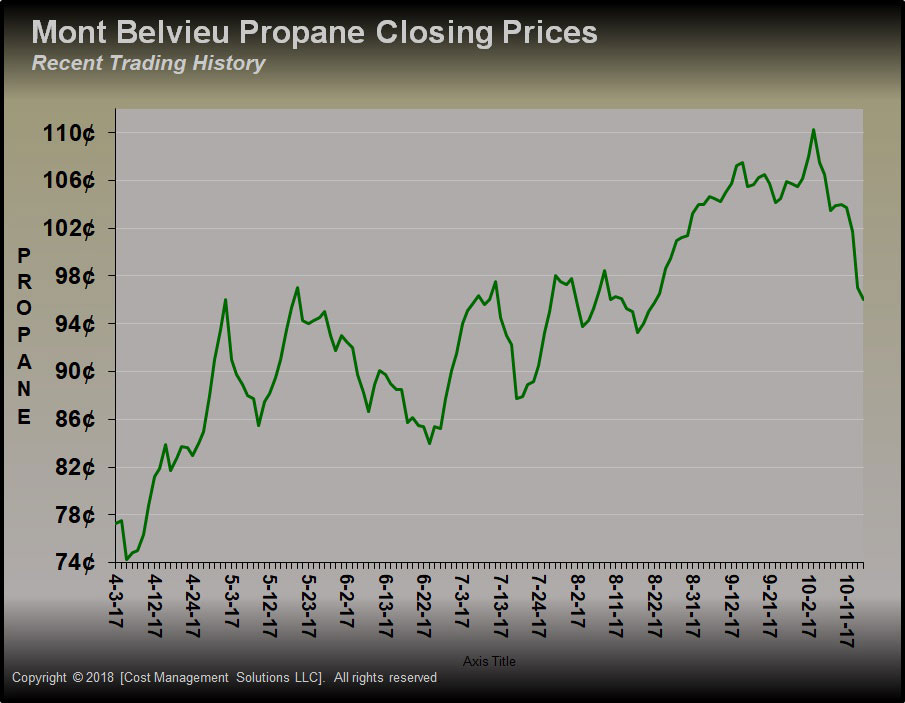

Throughout last week, Mont Belvieu’s price correction deepened and its value relative to crude continued to deteriorate.

Last week, Mont Belvieu LST propane fell 7.875 cents. It also dropped from being valued at 59 percent of WTI crude to 57 percent of WTI. The lower relative value came with WTI crude in a major downward correction of its own.

Since reaching its high for the year on Oct. 1 at 110.25 cents, Mont Belvieu LST propane has fallen 13.5 cents, or 12 percent. On Oct. 12, even with crude rebounding, Mont Belvieu LST propane continued lower, which suggests some weakness in propane fundamentals.

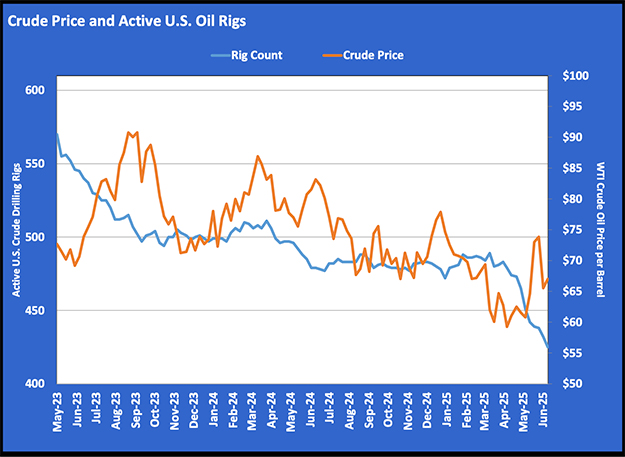

This week has further supported our view that all propane price increases this year have been directly related to the rise in crude prices. As we said last week, “It still appears higher crude prices, not propane fundamentals, present the highest upside risk for propane prices.”

The fact that Mont Belvieu propane continued to lose value relative to crude, even in a downward correction, supports the view that traders are not worried about a lack of propane supply. If traders thought that propane lagged the upswing in crude’s price too much, propane would have lagged the fall in crude last week. Instead, it outpaced crude’s fall.

There were two bearish pieces of fundamental data for propane in the U.S. Energy Information Administration’s Weekly Petroleum Status Report for the week ending Oct. 5. U.S. propane exports fell 239,000 barrels per day (bpd) to 666,000 bpd. That was 220,000 bpd below the same week last year. The other was a 1.539-million-barrel build in U.S. propane inventory that was more than double the five-year average build for week 40 of the year.

In last week’s Trader’s Corner, we said, “If a retailer takes longer-term positions in the midst of this uncertainty, they should be vigilant in watching two things. The first is the news concerning crude. Look for signs that traders are becoming less worried about the impacts of U.S. sanctions on Iran. If that develops, consider exiting longer-term positions taken at this price point. Also, monitor U.S. propane export volumes. If those start falling off as they did at the end of November last year, guard against a similar fall in propane prices in the second half of winter. Should these conditions not develop, we would expect positions already owned – and even those bought on this pullback – to be relatively safe.”

In addition to the fall in propane exports last week, crude prices corrected lower. Worries about the global economy overwhelmed worries about crude supply, at least in the short term. However, this does not mean we should expect a bearish pricing environment for propane for the remainder of winter.

First, data on propane exports shows them to be erratic. One week of relatively low exports is not a trend by any means, so guard against overreacting. Industry data still shows robust export activity, so wait for a longer-term trend of reduced exports to develop before making significant moves in your price protection positions. Second, while crude is in the midst of a significant correction, the impact of U.S. sanctions on Iran’s crude exports is not yet known. Those sanctions are not fully in place until Nov. 4. At this point, we have to remain cautious about a rebound in crude that could push prices to yearly highs again – propane would almost certainly follow that rebound.

While propane and crude have weakened considerably during the month of October, it’s not unusual. There is some history of weakness this time of year. While we can all breathe a little easier with propane finally ending its long uptrend, it is still too early to dump our price protection for this winter. For those short of price protection at Mont Belvieu, this pullback may still represent an opportunity to get better balanced, but wait for a signal that the downward correction has run its course.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.