The changing propane marketplace and you

Change has been in the works for several years now as the U.S. propane market has become a net exporter of propane. When we consider that one cargo of propane is about 21 million gallons, it’s clear the dynamics of what we used to determine price direction have changed.

Those of us who watch the market closely will not soon forget what transpired in January and February of this year. Prices at the market hubs began falling with strong inventory draws and cold weather. Many retailers have their supply costs tied to the market hubs through pricing formulas, so the resulting price drop in the middle of a period of cold weather with high demand was a great development. Pricing that was not tied to market hub formulas was high as supply and demand issues had their impact.

To clarify that drop in the Mont Belvieu market, on Jan. 10, the U.S. Energy Information Administration (EIA) reported a draw of 6.3 million barrels for the week ending Jan. 5. Prices fell 5.75 cents that day. Cold weather was still in play and that draw was followed by draws of 3.7 and 4 million barrels in the following two weeks, respectively. On the day the 4 million barrels were reported, prices had moved from the high point at the first of the month of 98.625 cents down to 81.75 cents, a drop of nearly 17 cents (Mont Belvieu TET prices) on the heels of a very good demand season and declining inventories. During this period, crude prices were moving higher – from just under $60 to over $66 a barrel.

We like looking at the three weeks of reporting data during that time frame, since the EIA reports are typically produced on the Wednesday following the previous week’s data. During the three weeks of the big price drop, exports were down 142,000 barrels per day (bpd) while demand was up 105,000 bpd from the previous year. The net impact is 37,000 bpd and yet, during that time, we saw a 17-cent price decline.

While you could say this decline was based on fundamentals, in my opinion, the market size of the propane industry hasn’t evolved to the size of the market participants. If a large market participant cannot find enough buyers or sellers, the result is larger price moves. In the crude market, the difference between the buyer and seller is typically 1 cent a barrel compared to 0.75- to 3-cent difference between buyers and sellers in propane. The delta between buyers and sellers at 0.75 cent (which is typically on the low end) is 31.5 times greater in propane than crude. The trading marketplace is often given a black eye in large market moves, but more market participants reduce market volatility.

So what do we do with all this information?

First, we must accept the fact that the propane marketplace is going to stay extremely volatile. Secondly, we must bring into our market evaluation a well-rounded process. Third, we must use solid disciplines in our market transactions concerning prebuys and long-term, financially-based purchases. A simple recommendation concerning hedges or long-term purchases is best. Mine is, “Can I live with this price regardless of the direction of the market.” If you can enter a pre-buy or long-term purchase and not worry about it, then you are in fact hedging and the volatility that is sure to be in the market will not impact you.

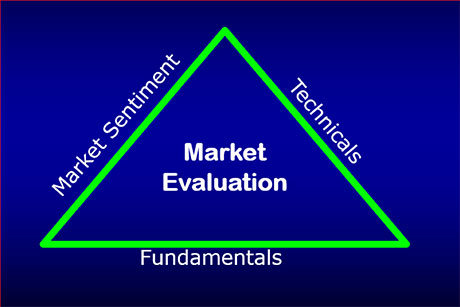

We discussed the first and third recommendations above and we will wrap up with our market evaluation process. As the chart below indicates, the market evaluation is based on three factors. Each will have different weights at times.

Fundamentals – A correct evaluation of fundamentals is an important step in evaluating the market as the fundamentals nearly always win, but it comes down to the timing and acknowledging if the fundamental backdrop is changing. It is also important to note what fundamental aspect the market is keying off.

Market sentiment – This is what is the general market believes and is often subjective. Recently, we had a good example of this in a discussion with a propane retailer. They thought there was no need to be concerned about pricing with all the production coming on board. At the present time, we believe this to be the overriding sentiment in both propane and crude. While it may be 100 percent correct, it is a perception and other factors may outweigh it. Market sentiment can influence the market, but it is fickle. It can change with each day’s newswires and concerns.

Technicals – Technicals are objective and are based on a numeric formula of some type. Technicals we monitor pointed to a market exit point in early January, but the fundamentals and market sentiment gave a different picture. Technicals identify trends, and we have learned you should never fight the trend.

As we close, recognize that the dynamics of the propane market have changed. The sheer size of the export market has brought more and larger participants, yet the market lacks enough liquidity to efficiently handle the needs of these large participants. As a result, we can expect large moves in the market that may not be based on fundamentals. Hedging remains a vital aspect, provided it is done with a look to the profits hedges provide your company and not a trade opportunity. Finally, our evaluaion methods must include a look at fundamentals, market sentiment and technicals. When all three line up with a buy indication, the buy has a good chance of being successful – this rarely happens, but occasionally you are given the opportunity.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.