The dreaded propane price spike

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, examines the recent price spikes in both crude and propane.

Catch up on last week’s Trader’s Corner here: A look back at 2024 propane pricing

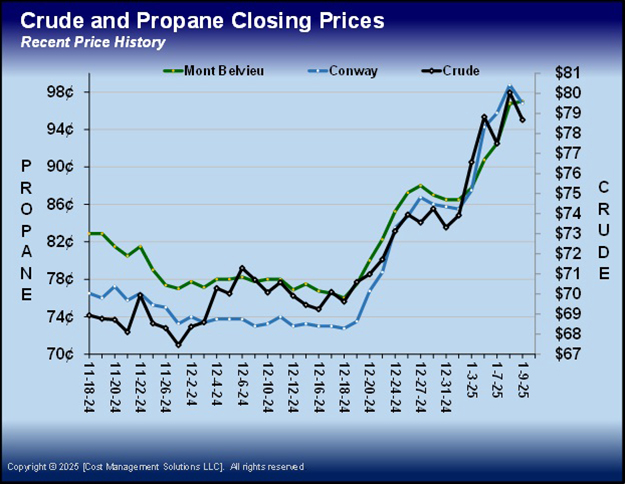

For one month, crude and propane prices have been surging. Since Dec. 19, 2024, Mont Belvieu ETR propane is up 20.125 cents, a 26 percent gain. Conway is up 23.75 cents, 32 percent, and that is with a 2-cent pullback on Jan. 16. The chart below provides a good visual of what a price spike looks like. Propane prices are up again as we write on Friday, Jan. 17.

The winter storm is blamed for the run-up in propane prices, but as the chart shows, the turn higher coincided with crude’s turn higher well before the January storm hit. It has been the combination of rapidly rising crude prices followed by the extremely cold weather across the Northern Hemisphere that has resulted in the dramatic increase in propane’s price.

Until about mid-December, the market was awash with the expectations that crude was going to be oversupplied in 2025, which had WTI crude’s price running between $68 and $72 per barrel. That was setting a reasonably low price base for the energy complex, keeping refined fuels and propane prices in a more consumer-friendly range.

The price spike was initiated by China announcing that it was going to take measures to stimulate economic growth in 2025. That was the primary driver of prices through the end of the year. Then the winter storm hit, causing increased demand for heating sources, which added fuel to the rally. Then reports that the United States and other Western nations were dramatically increasing sanctions against Russia and Iran aimed at limiting their exports of crude oil joined the other two drivers to reignite the rally, which seemed to be getting exhausted.

Thankfully, propane has been plentiful in the United States for several years, which has limited these dreaded price spike situations. Even with all the cold, propane inventories remain in good shape. And even if the bitter cold hangs on for a while and pulls propane inventories below last year and the five-year average (which they are still above for now), there is plenty of production capacity to replenish them. That should be made even easier because of the limited propane export capacity that will remain through the summer months.

If you are a regular reader of Trader’s Corner, you know that our primary focus is helping propane retailers manage supply-side price risk. Our articles include evaluating propane and crude fundamentals to assess what the pricing environment is likely to look like in the coming weeks and months. Also, we spend a lot of time looking at the tools available to manage supply-side price risk. Then there is a lot of focus on the timing of implementing those tools. We know when we take up the subject of price protection, it is likely unpopular. Let’s face it; taking measures to protect our customers from higher prices is a pain, and it is not without risk for the retailer. If a retailer takes measures to protect their customer base from higher prices, they immediately assume increased risk in a weak pricing environment. Just last week, we looked at how price protection bought for 2023 would have probably only been an asset for a retailer during a couple of months of the year. In 2024, price protection worked a lot better, likely being beneficial in eight to 10 months of the year.

We know it is a lot easier for a propane retailer to buy propane at a posted price from their supplier, add the desired margin and set a retail price accordingly. In other words, it is a lot easier to let consumers manage price spikes. Closing in on two decades ago, one of our first articles on this subject was titled “Checkbooks and sneakers.” Most consumers of propane have only two tools for managing propane price risk. They can accept the higher price and write a check, or they can walk – using a different supplier or using a different energy source for some or all of their needs.

Our view has always been that the business is about gaining a customer, building the relationship, investing in the tanks they will need and building goodwill over years of dependability and good service. For a propane retailer to have a valued customer walk because of several factors completely out of his control that conspired to spike propane prices is a tragedy. The retailer has already invested so much in that customer, so taking that final step to mitigate the potential that such a situation as we are in now has for ruining a valued relationship is, in our view, a necessary evil.

With an actual spike underway, it seems that our message about price protection is more real and meaningful. If a propane retailer had propane swaps and non-ratable prebuys in place for January, they can mitigate the higher spot or market prices to some degree. Remember, a retailer is almost never going to have all the expected volume protected. Somewhere around 40 percent is maybe the max unless the market has been providing good buying opportunities leading up to the event. The retailer’s prices are going to be higher, just like their competition, but they have the tools in place to mitigate the price increase and be positioned favorably with a competitor.

On top of the higher price, the customer is going to be consuming a lot more propane, so the propane bill could be quite high no matter what. But with some price protection in place, the retailer at least has a fighting chance to keep the customer happy and preserve the relationship.

To have this fighting chance, the propane retailer took downside price risk by establishing price protection. So, if instead of this price spike and extremely cold weather, let’s imagine the current condition is low crude prices and warm weather. The result would have probably been propane being priced lower than the price protection. In that case, to maintain their margin, the retailer would be sending out propane bills that are higher than their competitor that did no price protection, being content to let the customer manage all the price risk. We will admit that is not ideal.

We will contend that if prices are normal and a buyer of price protection followed the discipline we discussed last week, his pricing will be equal to the competitor. The risk to the buyer of price protection comes when prices are below normal. If propane prices are below normal, it means that crude prices are probably low, and the weather is on the warmer side.

In this situation (low crude prices), gasoline prices are probably lower and maybe the prices of other things are consequently lower. The consumer is likely feeling less stress on his budget because the broader energy market is low-priced. Then the propane bill comes reflecting lower usage and the low propane price environment. Yes, that bill from the retailer that buys protection may be a few dollars more than the competition. But is the consumer shocked and motivated to walk? Our contention is that they will not. Even if a competitor calls and points out the price would have been lower had the consumer been using him, the goodwill the retailer has built likely saves the day.

People don’t really like change and will generally stay with the status quo unless we shock them into action. That is what price spikes can do, and that is why we believe that whatever effort a retailer must take to mitigate their impact on their valued customers is worthwhile. It, at least, feels like a necessary evil.

Chart courtesy of Cost Management Solutions

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.