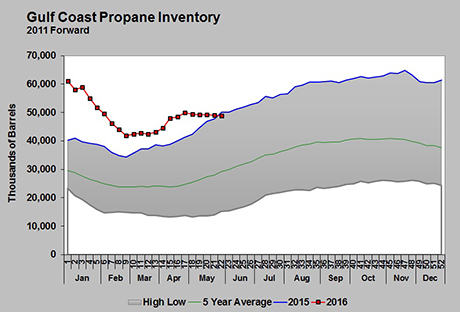

The effects of the Gulf Coast propane inventory decline

Propane prices in the United States have fallen into a downtrend since the middle of May. Exceptionally high demand for exports and higher crude prices in the first half of the month pushed propane prices up.

The fall in propane prices has developed despite a series of below-average builds and even a draw on overall U.S. propane inventory for the week ending May 20. For the week ending May 27, total U.S. propane inventories were building again, albeit at a below-average pace.

In its Weekly Petroleum Status Report, the Energy Information Administration (EIA) said propane inventory increased 1.252 million barrels, which was a dramatic turnaround from the previous week’s 84,000-barrel draw.

The build in inventory was aided by a 50,000-barrel-per-day (bpd) decrease in propane exports and a 196,000-bpd decrease in propane demand. Still, the build was on the light side with the five-year-average draw for the week reported at 1.659 million barrels.

Perhaps the most interesting aspect of the inventory data was how unbalanced it was regionally. The Midwest had an inventory build of 1.305 million barrels, while the Gulf Coast posted a 265,000-barrel draw.

For well over a year, Gulf Coast propane inventory has been setting new weekly highs. However, following a series of small draws, Gulf Coast inventory finally broke its string of record highs for the week ending May 27. Gulf Coast inventory stood at 48.798 million barrels compared to 50.195 million barrels for the same week last year.

The Gulf Coast draws over the past five weeks have certainly been against the seasonal trend and are reflective of the increased propane export capacity in the United States. However, most analysts believe propane exports, which were exceptionally high in early May, will fall sharply in June.

There were industry reports of exports running 1 million bpd in early May, though EIA never estimated anywhere close to that number. There are expectations that exports could drop to a rather pedestrian 600,000 bpd in June. If they do, it will cause a dramatic shift in the inventory trend, shifting from draws and below-average builds to very likely above-average builds.

But for now, the Gulf Coast inventory trend is on the supportive side and is a key reason that propane prices in Mont Belvieu are at 49.625 cents compared to 41.25 cents on the same day last year. However, last month Mont Belvieu reached 56.125 cents per gallon when buying for the robust export demand was so high. That is a 5.5-cent drop in two weeks of trading just based on the declining demand for propane exports.

The United States now has the export capacity to move as much propane as it needs to balance supply and demand. The key now will be how much U.S. propane the world will demand and at what price. As the pricing action from last year to this year and from last month to this month reflects, propane prices follow propane exports.

It is early in the process of figuring out just how much U.S. propane the world needs. At this point, it is possible that fairly substantial swings in propane prices could occur depending on how export demand is running.

Propane retailers should keep that in mind when buying this summer. The last month and a half has shown just how much influence exports are going to have on propane prices. If there are reports of reduced propane export demand, then it would probably be best to back off on buying or even consider taking profits on positions already held. As we discussed in last week’s Trader’s Corner, selling swaps is a way to capture profits or limit losses in falling markets.

If reports of higher export demand surface, then retailers may want to be buyers for at least short-term demand. For example, if by the end of this month export demand appears to be increasing (it appears to be decreasing right now), then a retailer should consider buying swaps, physicals (paper barrels) or call options, as well as filling local storage tanks for July.

On the other hand, if there are reports of light export demand at the end of June, a retailer may want to buy on a spot basis expecting a neutral to a potentially falling pricing environment. Retailers could also consider buying put options or selling swaps to protect inventory positions.

Graphic: Cost Management Solutions

For more Cost Management Solutions analysis of the energy market that helps propane retailers manage their supply sources and make informed purchasing decisions, visit www.lpgasmagazine.com/propane-price-insider/archives/.