The story of winter so far: No winter

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, shares a heating season update.

Everyone in the industry keeps waiting for winter to get underway. Unfortunately, it appears we may be waiting a while.

Oh yeah, it’s colder than it was in July, but we are talking about a winter that makes propane retailers burst out in uncontrollable laughter for seemingly no apparent reason from time to time. This winter heating season has been more laughable from that respect.

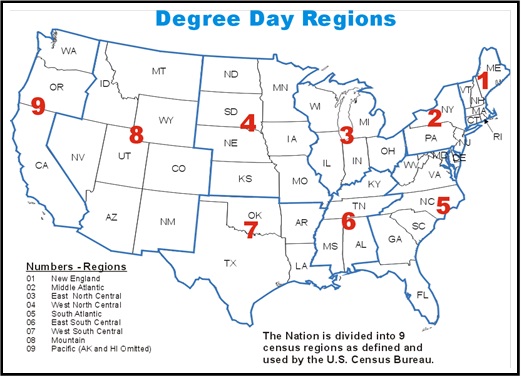

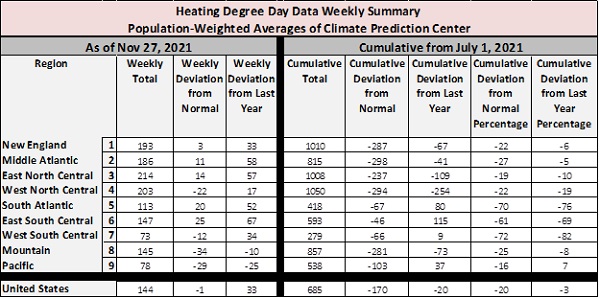

Map 1 identifies degree-day regions, and Table 1 is a comparison between this year, last year and the long-term average.

According to this population-weighted average for calculating heating degree-days (HDD), there have been 685 HDDs from July 1 through Nov. 27. That number is 20 HDDs, 3 percent, below last year. It’s 170 HDDs, 20 percent, below the long-term average.

It isn’t overwhelmingly bad compared to last year, but last year’s winter started mildly also. In early October, U.S. propane prices reached their highs for the year at more than 150 cents per gallon. Light inventory gains leading up to winter had elevated propane prices. The fear of strong winter demand coupled with low inventory pushed propane prices higher.

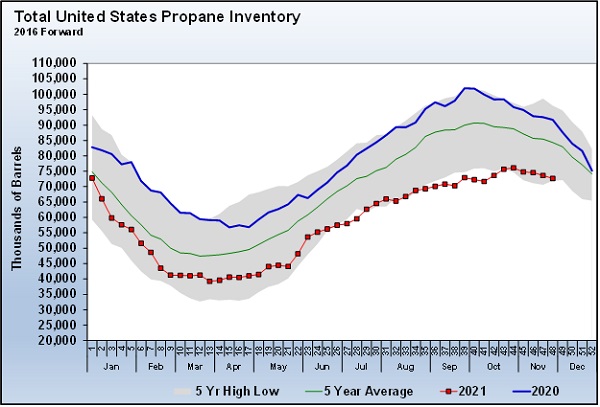

We noted when the Energy Information Administration reported its inventory number last week that it actually showed the inventory deficit to last year’s increase.

Despite the relatively mild winter so far, U.S. propane inventory is at a five-year low. Last week, the deficit to last year’s inventory position increased to 19.058 million barrels, 20.8 percent. Even as the inventory deficit increased, propane prices moved lower. MB LST had rallied ahead of the report to 106 cents. By Thursday, MB LST was closing at 96.5 cents.

The market responded to an inventory draw of nearly a million barrels that kept inventory near five-year lows and increased the inventory deficit to last year by going lower. That is bearish and shows that the fear of tight supplies that were present in October are long gone.

It is not just propane that is seeing the fear of winter demand subsiding. Natural gas markets watch the spread between March natural gas futures and April natural gas futures very closely. March generally ends the natural gas inventory drawdown period, and April generally is the start of the inventory-build period. When the market is concerned about winter supply, the spread between the two months can be quite significant, as it was in October. With the market fearing winter demand would tax relative low beginning-of-winter inventory, the spread was $1.80 per mmBtu. That spread is now under 20 cents per mmBtu.

From the beginning of October until now, propane markets could not be any different. They have gone from extremely bullish to extremely bearish in relative short order. A lack of winter will certainly promote such a shift.

With all this said, it is worthwhile to revisit last year at this time to make sure we don’t get too complacent. At the first of December last year, MB LST propane was at 59.5 cents and Conway at 55.75 cents. By February, MB LST hit 104 cents and Conway spiked all the way to 134 cents. Of course, that was a result of a major winter storm that not only increased demand but also hurt supply as well, and processing facilities suffered from the deep freeze.

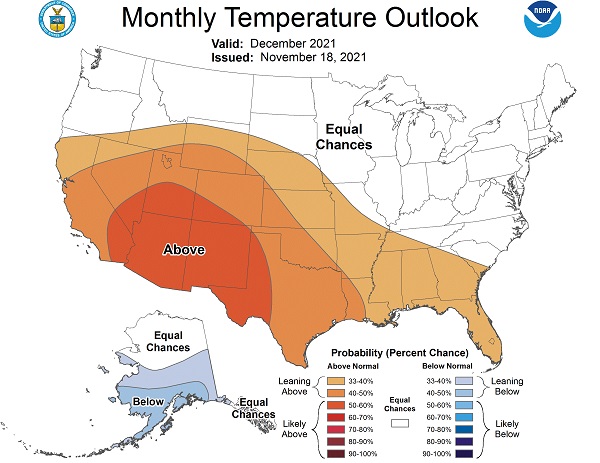

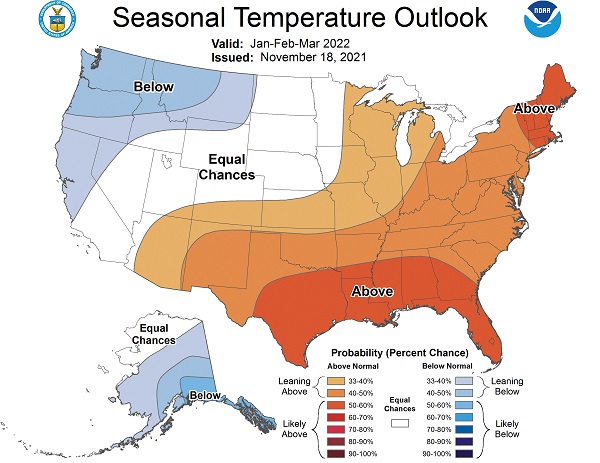

Is it possible that the same kind of late winter demand could occur this year? Anything is possible, but it doesn’t appear probable. Maps 2 and 3 are temperature probabilities. First is for this month and the second for the first quarter of next year.

The National Oceanic and Atmospheric Administration is projecting normal temperatures in the higher-consuming areas this month, but after that, most of the nation is projected to have above-normal temperatures through the end of winter. There is nothing about these temperature forecasts that will scare the market. Unless there is some sort of unexpected weather development, the price outlook doesn’t look foreboding at the moment.

Nonetheless, both propane and crude have already logged major price corrections. As we write on Dec. 3, both are showing signs those downward corrections could be finding a floor. Overall, the price outlooks for crude remain bullish. For that reason, even without a lot of winter weather support, we like taking at least some of the risk to higher prices out of the equation by taking advantage of this pullback. Whether we are covering one month or the remainder of winter, this deep correction has already taken much of the downside risk off the table.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.