The weak propane export trend continues; prices still trend up

U.S. propane production is much higher than domestic propane demand, leaving propane exports to play the role of balancing U.S. supply with demand. Last week, the U.S. Energy Information Administration (EIA) reported U.S. propane production at 1.875 million barrels per day (bpd) and propane imports at 138,000 bpd for a total supply of 2.013 million bpd. U.S. production was 146,000 bpd higher than the same week last year.

Domestic demand was 977,000 bpd, which was actually high compared to last year during the same week when domestic demand for propane was just 707,000 bpd. Last week, 1.036 million bpd of propane was not needed to meet domestic demand.

The surplus supply has two destinations: storage caverns or export docks. Where the surplus supply ends up goes a long way in determining the value of propane this winter. The more surplus going to storage, the less upward pressure on domestic prices.

Propane retailers must monitor inventory levels and export volumes to help guide their decision-making concerning how to manage propane price risks for the upcoming winter.

Fortunately, propane fundamentals are going the retailers’ way. Last week, while 707,000 bpd of propane went to export docks, 329,000 bpd went into storage facilities, producing a weekly build of 2.301 million barrels in U.S. propane inventory. That build was more than double industry expectations. It was also well above the five-year average build of 1.741 million barrels for week 18 of the year.

The relatively light export volumes last week were part of an overall trend. Official monthly data for February export volumes has been released by EIA.

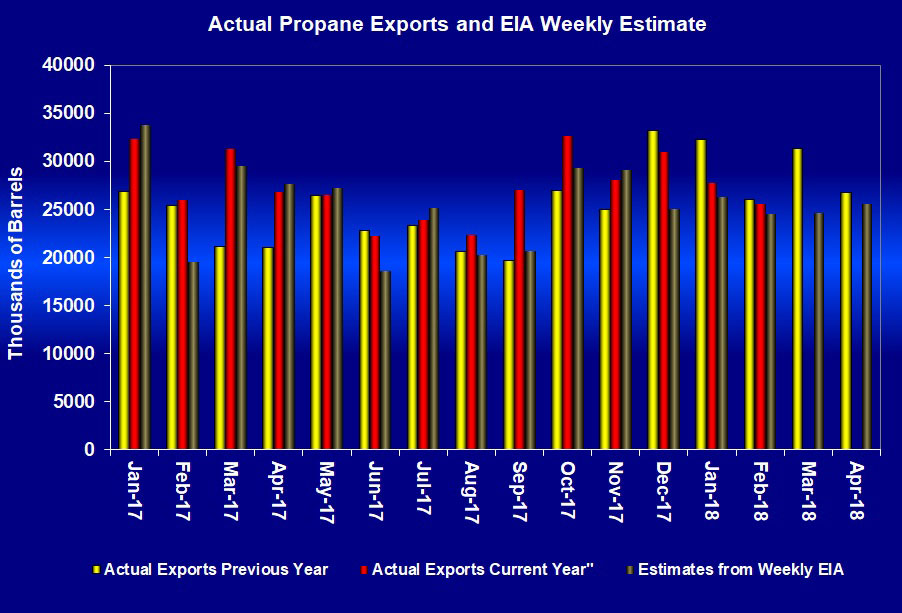

In the chart above, the yellow bar is last year’s monthly export volume. The red bar is this year’s export rate and the brown bar is the expected export rate based on EIA’s weekly estimates.

February marks the third month in a row that exports were lower than the same month the previous year. Further, weekly estimates from March and April suggest the trend has continued during those months.

Greater propane production and lower exports than last year can only yield good results fundamentally for propane retailers. Unfortunately, though propane’s own fundamentals are looking favorable, propane prices have been trending higher. The villain in this case turns out to be higher-than-expected crude prices.

With crude prices suddenly running amok, a favorable trend in propane fundamentals is needed to keep propane prices from getting unwieldly, as well. A strong price backdrop as a result of high crude prices means price protection for this winter could be very important. That will be especially true if the path to the export docks starts getting more traffic than has been the case since December.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.