Tight propane inventory deserves more attention than weekly expectations

U.S. propane prices are hammered when propane inventory data doesn’t line up with industry expectations. For example, on March 22, the U.S. Energy Information Administration reported a minor 135,000-barrel draw on U.S. propane inventory. Yet the industry expected a 1.7-million-barrel decline.

However, the five-year average inventory change for week 11 of the year, which corresponds to that March 22 report, was a small build of 41,000 barrels.

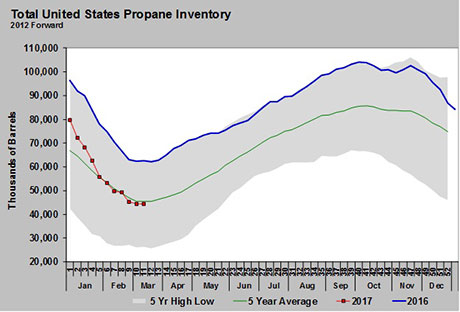

As the chart shows, even the slight draw kept inventory under the five-year average for week 11 of the year. That is quite remarkable given inventory has been much higher than the five-year average over the last couple of years. Note from the chart that in 2016 inventory was setting five-year-high marks and – in reality – record highs for the end of winter.

After the draw reported on March 22, U.S. propane inventory is now at 44.333 million barrels. Propane inventory was at 62.5 million barrels during the same week last year and at 54.584 million barrels at this point in 2015.

In the best case (i.e., inventory starts building with the next report), the inventory build for next winter will start at 18.167 million barrels below the build for the past winter. Even small draws add to this deficit, which we think has more significance than the inventory draw being below expectations one week or another. It was only three weeks ago that inventory fell 4.081 million barrels.

Since the first week of the year, inventory has declined 35.326 million barrels. During the same time last year, inventory fell 33.841 million barrels and in 2015, it fell 21.366 million barrels. At this point, any inventory draw is adding to an already tighter inventory situation when compared with the last two years. And each week that inventories draw is one less week for them to build to meet next winter’s needs. It is important to remember that this tightness in inventory is happening during a very mild winter.

U.S. inventory began the winter of 2015-16 at 106.202 million barrels. It began the winter of 2016-17 at 104 million barrels. There is a very good chance that inventory will begin the winter of 2017-18 at a substantially lower level.

Our concern is that deflating prices simply because an inventory draw is below expectations seems to be overlooking the bigger picture. The more prices are depressed in the near term, the more likely export volumes will remain high. Our fear is that this is only going to hurt this year’s inventory build and potentially create a far worse pricing scenario later this year.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.