Timely propane inventory build puts downward pressure on prices

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, discusses propane inventory and price protection.

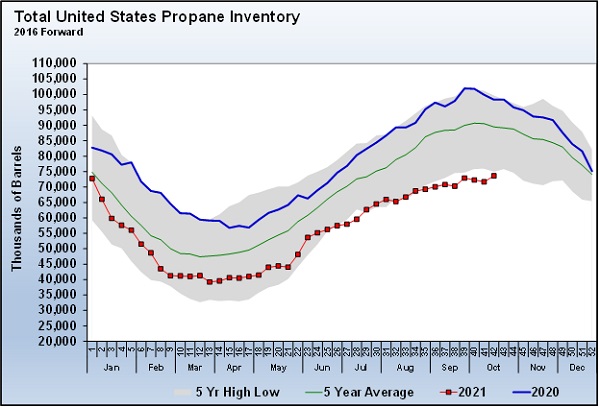

On Wednesday, Oct. 20, the U.S. Energy Information Administration gave the U.S. propane market some much needed and timely good news. U.S. propane inventory increased 1.920 million barrels to 73.620 million barrels for the week ending Friday, Oct. 15. What made the build particularly good is that it came just as propane prices were stalling from their recent rebound. That provided a little extra push to the downside.

The build was also positive in that it came in a week that had averaged a more than million-barrel draw over the past five years. If we combine the amount of build with the fact it is a week that normally draws a million barrels, it was a positive 3-million-barrel shot in the arm for propane inventory.

Chart 1: Cost Management Solutions

As Chart 1 shows, U.S. propane inventory is still setting a five-year low for this time of year. Propane buyers are hardly out of the woods for this winter, but the build did break a very concerning downtrend in inventory from the previous two weeks.

You may also recall the list of six headwinds that we mentioned for propane prices over the previous two Trader’s Corners. Despite those headwinds being discussed in the market, they were not showing up as a decrease in demand that would allow inventory to build. This week, those headwinds did appear to show up in the data. Both domestic and export demand were lower.

Exports were particularly noteworthy with a 324,000-barrel-per-day drop. It would be very good for domestic propane buyers if the export number would stay low for a few more weeks. It’s probably too much to hope for, but it would be just what the market needs to help keep upward pressure off of prices.

Once again, while propane retailers hope for the best-case scenario with prices, they should probably prepare for the worst. In that vein, let’s look at the one-month price protection strategy that has been the theme of recent Trader’s Corners.

Price protection

At the end of September, a retailer could have struck a swap or call option for October at 143 cents. As we write, October’s Mont Belvieu LST price is at 142.5 cents, which is below the strike. But remember the swap or option settles against the monthly average. The monthly price average for October Mont Belvieu LST is at 147.15 cents and for Conway at 147.425 cents. If October ended today, the holder of the swaps or options would still receive about 4 cents per gallon payment from those hedging tools.

If the price keeps going lower through the end of the month, the monthly average will move down and may be near zero. If the financial positions result in zero gain or even a loss, does that mean retailers and their customers get nothing from having taken the position? We would say that retailers and their customers get a lot even if the swap or call does not pay.

The premise for the strategy is that propane retailers delay passing on price increases during rapidly rising markets, thus seeing their retail margins shrink. First and foremost, the strategy is to prevent that from happening. In that respect, the price protection strategy would have worked perfectly. Retailers would have established October sales prices when they entered the swap or option, basing that sales price on the 143-cent strike price. At that point, it does not matter if prices go up or down, retailers’ margins are locked as long as they do not change their sales prices during the month.

What of the customer? The customer benefits as well. By using this strategy, retailers protect their customers from a potential spike in prices during October. Remember, the market was very bullish going into October. Customers cannot protect themselves from higher prices short of not using the propane. However, propane retailers do have tools at their disposal to protect the customer. It’s a win-win scenario.

We are nearing the point of decision on whether to implement this strategy for November. Propane prices are currently in a downtrend, so should we avoid the strategy? In our opinion, no. While the inventory build and export decline were encouraging, inventory is still setting a five-year low, and exports are near five-year highs. The outlook for crude remains bullish. There is still plenty of upside risk.

The risk to the month-to-month margin protection strategy is a major fall in propane prices. If our price set for November becomes significantly higher than the market, the risk to the retailer is that customers leave for competitors. If that is a major concern, use the call option and implement it on the last trading day of October, which is Friday. That should be at or near the lowest premium cost for the October 2021 call option. (Note: Unfortunately, we checked the anticipated call option premium for November if purchased on the last trading day of October this morning, Oct. 25, and it was 6.5 cents. Earlier this month, that premium was expected to be 4 cents, but the recent volatility has caused the premium to increase.) Don’t forget to add the price of the call option to your November price. The call option protects both retailer and customer from higher prices, but unlike the swap, the retail price can be lowered with no risk to retail margin since there is no obligation at the end of the month. The premium transfers the risk of lower prices to the option writer.

Frankly, in current conditions, we would not be concerned with a retailer using a swap to set a price for November anytime between now and the end of the month. In other words, the retailer would accept the risk of falling prices. Retailers would hold their retail prices in a falling price environment and thus assume the risk of customer pushback. Retailers only have to hold prices to the end of November, and we believe they could do that even if propane prices continue to fall. We believe that there remains significant enough upside price risk to assume the downside price risk for 30 days. If the retailer disagrees, we encourage the use of the call option.

All risk can never be eliminated. For example, if retailers do nothing and prices spike, they will probably lose margin and may lose customers as they are jolted into shopping for a better price. If retailers buy the call option, they must add around 6.5 cents to their November sales prices to cover the cost. That may put them 6.5 cents above their competitors. They assume the risk customers will leave because of that 6.5-cent difference. If they avoid the call option premium by using the swap, they make their customers assume all downside price risk, thus risking loss of customers in a sharply falling market. We are not eliminating risk; we are managing risk. We choose the best risk management strategy based on current conditions and what is most likely to happen. And we leave ourselves flexibility to adjust as soon as possible should the market go against our assumptions.

The short-term strategy eliminates what we believe to be the worst risks, which are lower retail margins and price spikes for customers. It assumes what we believe to be the more manageable downside price risk in the case of the swap and the option premium in the case of the call option. The one-month duration provides flexibility and allows prices to be reset at the end of that period.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.