Traders’ position conflicts with Midwest price movement

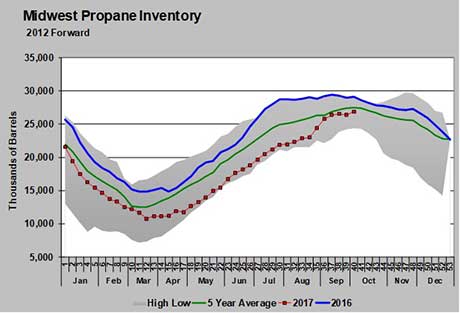

As winter approaches, the Midwest, like the rest of the nation, has propane inventory levels that are below the five-year average and well below last year’s.

We have been receiving conflicting reports on crop drying, so we assume moisture content varies across the Midwest, but let’s say it ends up being an average crop drying season.

Crop drying and weather are the key drivers of Conway pricing this time of year. At this point, weather is relatively mild, so it looks like it could be a slow start to winter heating demand. However, Conway propane prices have been quick to rise with Mont Belvieu prices. Mont Belvieu has the additional support of petrochemical activity and exports to boost its price.

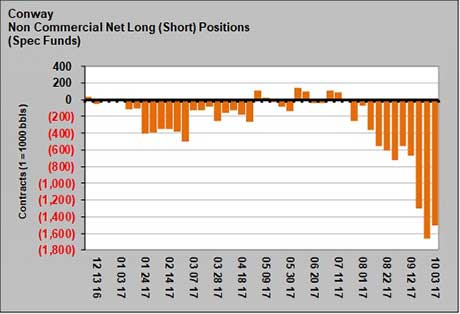

Current prices and price movement do not seem to indicate any significant bearish undertone for the Midwest. For that reason, we find the current position of speculative traders concerning Conway propane a bit curious.

The chart above plots the net trading position of speculative traders for Conway propane. Data below zero means traders are net short. A short position means the trader has committed to sell propane at a certain price, but has yet to acquire the product to fulfill that commitment. The trader believes he or she will be able to buy the propane at a lower price in the future and make a profit. In other words, short positions are betting on lower prices in the future.

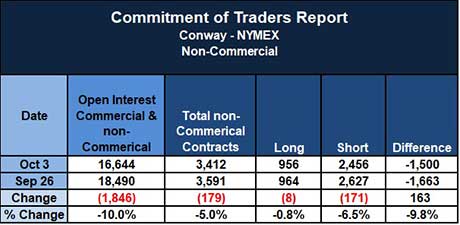

The table above provides the data behind the chart that precedes it, but gives a better look at the positions. As of Oct. 3, there were 16,644 contracts (1,000 barrels per contract) held by both commercial and speculative traders. Commercial traders are in the propane business in some way as retailer, processor, producer, etc.

Of the total contracts, speculative traders hold 3,412. Speculative traders are not in the propane business in any way. They are banks, investment groups and traders that are simply betting on the future price movement of the commodity.

Of the 3,412 contracts held by speculative traders, 2,456 are short, meaning they are betting on lower prices in the future. The question is: Why are these speculators, who must be right about price movement to make money, betting so strongly against Conway propane? An industry report released last week may shed some light on the subject.

One reason for the pessimism could be the delay in putting the Mariner East 2 pipeline into service, according to a report by the Oil Price Information Service (OPIS). The pipeline was designed to transport mostly propane and butane out of the Midwest (Ohio, West Virginia and Pennsylvania) to the East Coast, to then be exported.

The line has a capacity of 275,000 barrels per day and was supposed to go into operation this quarter. However, according to OPIS, pipeline owner Energy Transfer Partners/Sunoco is mired in lawsuits. Opponents of the pipeline filed lawsuits for constitutional rights violations. In addition, the Pennsylvania Department of Environmental Protection claims the Sunoco Pipeline violated drilling restrictions in an agreement with the state.

Some are betting that the delayed start of the pipeline could cause the products to back up in the Midwest and put downward pressure on prices this winter. It is an interesting bet given the line is new. We can only assume that sellers passed on other options to move their products, expecting the line to be open and give them increased access to export markets.

If that option is not available, sellers could be scrambling to move product and may have to look for less cost-effective ways of dumping production. That could put downward pressure on local Midwest supply and, ultimately, on Conway prices, which reflect conditions in the Midwest. It is hard to predict how all of this is going to play out because strong domestic demand this winter could resolve a lot of issues for Midwest producers. However, it is important to be aware that at least some speculators are willing to bet this is going to be an issue at some point this winter.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.