Two propane industry relationships worthy of our attention

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, examines two propane industry relationships that are worth monitoring.

Let’s talk about a couple of relationships that are worth monitoring. Don’t worry; we aren’t going to analyze the boring and belabored relationship of Johnny Depp and Amber Heard. We are certain you will find our relationship discussions about propane and crude, and then Mont Belvieu propane and Conway propane, far more entertaining and intriguing. Who wouldn’t?

We are seeing changes in these relationships that are indeed intriguing and worth monitoring by any avid propane buff, which is surely most of the world’s population. Once we reveal what we have seen, we can only imagine the issues we are going to have with the paparazzi. But look, we are willing to put up with what we must to make sure you have the story. We are nothing here at Trader’s Corner if not bold and fearless.

First, let’s look at what is happening in the relationship between propane and WTI crude. We are going to use the Mont Belvieu ETR pricing point, but you would find a similar relationship between Conway and WTI.

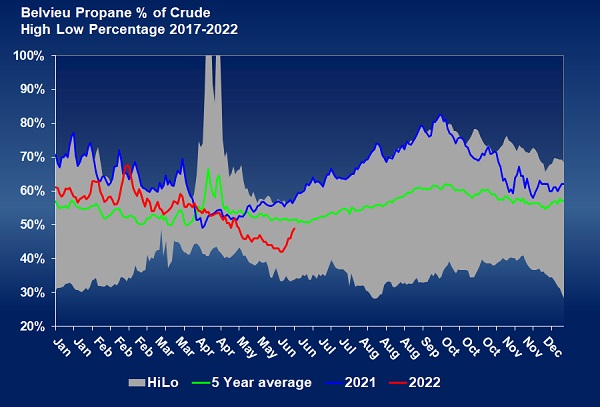

In previous Trader’s Corners, we have discussed how well the inventory-build period for propane has gone. At the same time, inventory conditions for crude were not going nearly so good. Chart 1 shows the value relationship for MB ETR propane and WTI crude in a simple percentage. The green line is the five-year average. You can see that over the last five years, propane’s value has averaged roughly between 50 and 60 percent of WTI crude’s value.

This value comparison can provide a lot of insight into the health of propane supply. In general, if propane is undersupplied, its value will increase relative to crude’s value. This year (red line), there were plenty of concerns about propane’s supply situation during the winter. Inventories were relatively low, causing propane’s value to crude to be above the five-year average. Fortunately for propane buyers, the draw on propane inventory ended early this year – at the first of March. After that, inventory built at an above-average pace during March, April and May. With crude’s fundamentals not faring nearly as well, propane’s value started dropping relative to crude. Despite coming off the year’s high, propane prices remained elevated. Relatively speaking, though, propane was becoming a cheaper source of energy compared to crude and refined fuels, which is a positive for propane buyers/consumers.

The month of June has not been so bad for buyers as the price today is slightly less than where it was at the start of the month. The drop this month has been even better at Conway. But we can see in Chart 1 the recent increase in relative value. That could mean a shift in the perception of the health of propane inventory. If that occurs, propane buyers may not enjoy the same type of price decrease over the next couple of months as they have since propane set its high for the year at 163 cents in March, just before the above-average inventory builds began.

We want to look at another relationship that is a little more incestuous. It’s between Mont Belvieu and Conway propane. We are seeing movement there, as well.

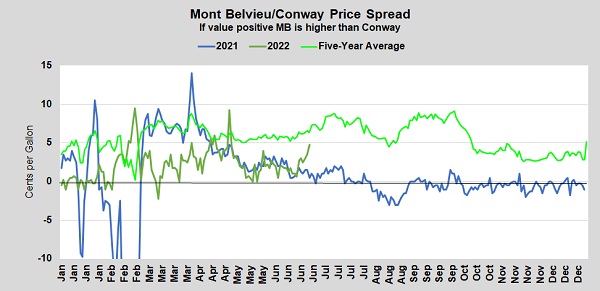

First, look at the five-year average (lime green) line in Chart 2. That shows how much higher Mont Belvieu propane has averaged than Conway propane over the last five years. That relationship over that longer time has been 5.68 cents on average and a little higher in the summer. This reflected the oversupply in the Midwest, necessitating moving propane supply out of the Midwest to the coasts. A price differential occurs to cover the cost of that movement.

But last year, the tables turned. The spread for the year averaged just 0.3855 cents. During the second half of the year, Conway averaged 0.4104 cents higher than MB ETR. The drawdown of Midwest inventory over the years finally appeared to be hitting a bottom.

But so far this year, the inventory build in the Midwest has been better than it has been on the Gulf Coast. Note how this year (darker green line) is higher than last year. So far, MB ETR has averaged 2.16 cents higher than Conway. The relationship has become even more tumultuous during June. The couple is really growing apart now. The spread is up to 4.75 cents. Midwest inventory is 741,000 barrels, 5.5 percent, higher than where it was at this time last year. Meanwhile, Gulf Coast inventory is 1.747 million barrels, 5.5 percent, lower than at this point last year.

There seems to be some jealousy and resentment growing, and that is resulting in the separation. It was nice to see the couple come together last year, but it appears the relationship is reverting to what has been over the long term. Ever the romantic, we would like to imagine the cozy relationship of last year will win out. Unfortunately, there is a third party involved now – high export demand. High export demand is the devil, and that could keep a chill on the relationship for a while.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.