Understanding recent crude fundamentals changes

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, looks at crude fundamentals and their importance to propane buyers.

Catch up on last week’s Trader’s Corner here: More on propane demand

In this week’s Trader’s Corner, we are going to look at crude fundamentals and discuss the importance of recent trend changes to propane buyers. If you get our daily report, you know that each Thursday, we cover propane fundamentals extensively. That coverage shows that 88.61 percent of propane comes from natural gas processing and 11.39 percent comes from refining.

As we have covered many times, folks see that and assume that most propane comes from natural gas wells. So, they wonder why there’s so much fuss over crude. As odd as it may seem, propane is valued relative to crude, not natural gas (methane), so that alone is a reason for extensively covering crude. By and large, propane prices go the way of crude prices.

But it is not just the pricing relationship that is important. Propane fundamentals such as supply are much more tied to crude fundamentals than the percentages above would suggest.

The Energy Information Administration (EIA) defines a natural gas well as one that has a gas-to-oil (GOS) ratio of 6,000 cu. ft. of natural gas or greater for every barrel of crude produced. Conversely, a well with a GOS of less than 6,000 cu. ft. of natural gas for every barrel of crude is considered a crude well. Natural gas that is produced with crude oil is called associated natural gas production.

According to EIA analysis released on Dec. 18, 2024, associated natural gas production was 36.7 percent of total natural gas production in 2023. In that analysis, the EIA said that associated natural gas production has a higher concentration of natural gas liquids than natural gas wells produce. In fact, some natural gas wells can be fairly dry, meaning they contain mostly methane and not much of the heavier gas liquids such as propane. That means the associated natural gas production from crude wells yields more of our propane supply on a per-well basis than a natural gas well.

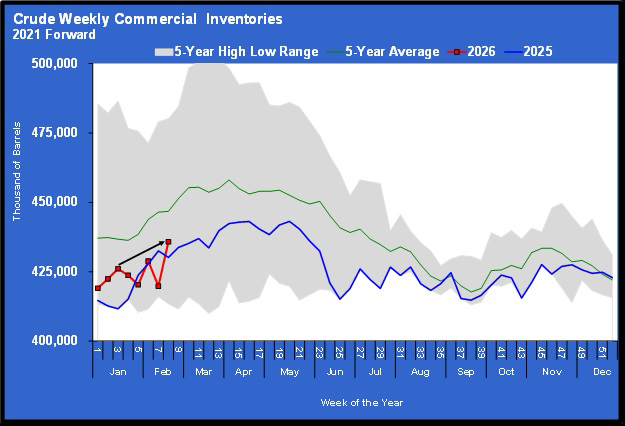

Propane buyers have benefited from strong crude production in the United States that has led to increased propane supplies, helping to keep prices low. Last week, there were 425 drilling rigs in the United States drilling crude wells (those with the lower GOS) and only 108 drilling higher GOS (natural gas) wells. But the recent trends for both drilling for crude and crude production have not been going in the right direction.

Chart 1 plots the number of rigs drilling for crude in the United States against the price of crude. Both have been trending down. Note the significant drop-off in drilling this year. That drop-off is related to OPEC+ increasing its production.

OPEC+ had been limiting production to support prices, which supports drilling for higher-cost U.S. shale production. Crude from U.S. shale takes about $47 per barrel to produce. Most OPEC+ nations are producing crude conventionally at probably under $10 per barrel. As prices come down, the economics for producing from shale formations gets tight, quickly causing producers to scale back on drilling. By the end of October, OPEC+ will have likely added about 2.2 million barrels per day (bpd) to global supplies. That 2.2 million bpd represented voluntary cuts above what was required by the group’s quotas. Those OPEC+ nations making voluntary cuts have been unwinding them this year.

If OPEC+ ends its manipulation of the market, then market fundamentals take over and set pricing. Higher-cost U.S. production declining to make room for lower-cost OPEC+ conventional production is how the market should work. As we have said, OPEC+ created the U.S. shale monster by artificially supporting prices. From time to time, it tries to cage the monster, and this is one of those times. Had OPEC+ just let the market work, we believe U.S. production would be far less than it is today and consequently propane supply would be far less than it is today. The U.S. shale revolution and an abundance of propane owes much thanks to OPEC+ greed.

U.S. crude production peaked in early December 2024 at 13.631 million bpd before OPEC+ started increasing its production to regain market share.

Since then, production has been strong, but the slowdown in drilling is slowly catching up. Production is steadily drifting away from the peak and came in at 13.385 million bpd last week.

The EIA predicts crude production will average 13.4 million bpd this year and next. But it has also stated it believes production has likely peaked and will continue to slow going forward. Much of whether that is true or not will depend on OPEC+ staying out of the market manipulation business. Every time we think OPEC+ has learned that it hurt itself more than anyone with its market manipulation, it does it again. But maybe this time will be different. Perhaps it will slowly unwind its production controls and live with the lower price long enough to relegate U.S. production to a lesser role in the global market.

The United States will still get the crude it needs by importing more of it if production continues to slide. In fact, we already import heavy crude and export our surplus of light crude. The surplus of light crude will dwindle over time. The difference is the associated natural gas production does not come with imported crude. So, if the United States produces less of its crude supply, it is also going to produce less propane unless more natural gas wells are drilled to meet growing liquefied natural gas (LNG) demand. If enough natural gas is exported, it could allow enough propane production from natural gas wells to replace what will be lost from lower crude production.

The LNG demand is not really in our control. In that respect, natural gas is like U.S. crude production from shale formations; it is dependent on market forces outside the United States. Europe says it will never buy Russian natural gas again like it was before Russia invaded Ukraine. That invasion has led to a boon in LNG exports from the United States. We still have our doubt in Europe’s resolve to not use Russia’s natural gas should the war end. It would be so much cheaper than U.S. LNG. We have found that money erodes resolve rather quickly.

Asia is supposed to be the next market clamoring for U.S. LNG. Potentially, if Europe returns to Russia for natural gas, U.S. LNG exports will continue to grow if the Asian market continues to develop. One way or the other, growth in LNG exports will be needed if natural gas well drilling is to increase, possibly offsetting lost propane production from lower crude production.

The current administration is pro-energy, so that should help drag out any slowdown in crude production and encourage more natural gas exports. Nonetheless, potentially negative impacts to propane supply could develop over the next few years. One help would be a strong U.S. economy that needs a lot of energy, which could keep both crude and natural gas production strong and less dependent on forces outside the United States. The current administration is confident its policies are going to result in economic growth, including more manufacturing in the United States.

U.S. retailers and their consumers continue to surf the wave of ample propane supply that has held prices in check. It looks like they will still be able to “hang 10” for a while longer, but there are sharks in these here waters, and one never knows when they might get a craving for toes.

Charts courtesy of Cost Management Solutions

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.