Upward pressure on propane prices continues

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, addresses propane inventory and production trends.

For one day this past week, it looked like the upward momentum in propane prices might finally be broken. On July 7, Mont Belvieu LST propane dropped 4.5 cents, and Conway dropped 3.75 cents. On that day, traders told us they were seeing propane producers become much more interested sellers.

Retailers are generally propane buyers, so when prices start going up, they begin to feel the pressure to get protection from rising prices. It’s the opposite for propane producers. They tend to not want to sell when prices are going up because they are hoping to sell their propane for even higher as the price rises. But, when prices have been rising and reached a high level, as they are now, any pullback in prices can put pressure on producers to start selling their future production before the price falls any lower.

That seemed to be what was happening on July 7. We wrote in our daily report that day that it would be timely if the U.S. Energy Information Administration (EIA) would report an above-average build on propane inventory. The EIA Weekly Petroleum Status Report was delayed by a day because of the holiday and did not get released until July 8.

Our thought was a big build in propane inventory on July 8 following the pullback in prices on July 7 just might cause a more sustained downward move in propane prices. It might have been just the motivation to keep producers as aggressive sellers.

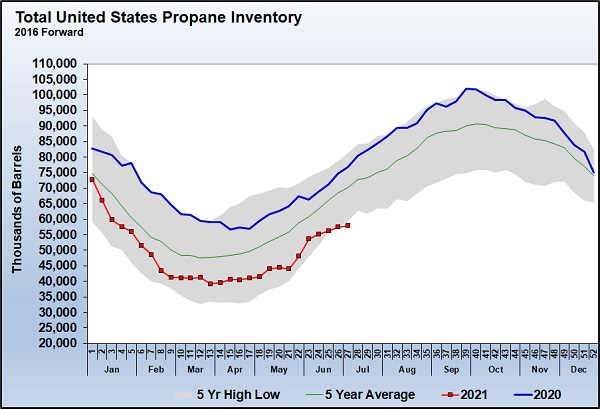

But, alas, it was not to be. The EIA reported just a 492,000 barrel build in propane inventory. That was about 1.2 million barrels below industry expectations and the five-year average build for week 27 of the year. It was the fourth week in a row that propane inventory had built below expectation and the five-year average. It also pushed inventory to a new five-year low for week 27 of the year.

In late May and early June, propane inventory gained nicely, helping take some of the upward momentum out of propane prices. But in the backend of June and so far in July, the inventory builds have been disappointing, and the upward pressure on prices has resumed.

At this point, U.S. propane inventory is 18.852 million barrels, 24.5 percent below last year and 17.5 percent below the five-year average. Certainly, the inventory deficit is concerning, but it is the trend of light inventory builds that has really ratcheted up the price pressure. If inventory builds were trending above average over the past four weeks and the inventory deficit was the same, we believe prices would likely be several notches below where they are now.

The demand side has certainly contributed to the tight supplies. U.S. exports are running 46,000 barrels per day (bpd) higher through the first 27 weeks of the year than during the same period last year. U.S. propane demand is up a surprising 136,000 bpd during the same period versus a year ago.

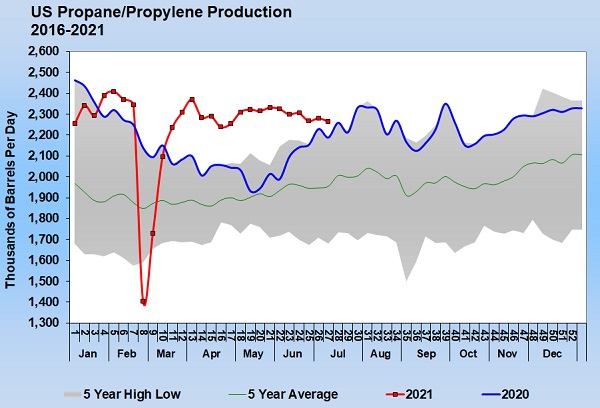

Perhaps more concerning to us right now, though, is the trend in propane production.

It was the growth in propane supply that had driven propane prices lower prior to this year. Propane production over-performed coming out of the pandemic. Propane supply grew faster coming out of the pandemic than did its sources, natural gas production and refinery throughput.

We believed that over-performance might have been due to a backlog of Y-grade (natural gas liquids mix) that had accumulated and was awaiting fractionation.

But, over the past couple of months, U.S. propane production has been flat to lower. Though production so far this year has been 101,000 bpd higher than through the first 27 weeks of last year, it is trending toward being below last year’s production. Further, it is still 198,000 bpd below peak production and trending away from that peak, not closing the gap.

Prices can get high enough to eventually slow demand, but we will still need to see propane production stabilize or even grow to really change the pricing environment and see prices fall again.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.