US propane inventory situation intensifies after going against industry expectations

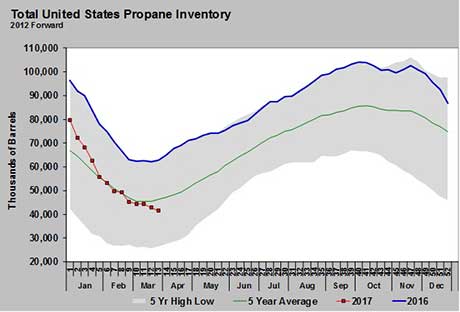

For the week ending March 31, the U.S. Energy Information Administration reported a 1.213-million-barrel draw in U.S. propane inventory. The draw was more than industry expectations for a 500,000-barrel decline. It also went strongly against the five-year average inventory change – a 766,000-barrel increase – for week 13 of the year.

In four of the last five years, U.S. propane inventory was already building for the next year before week 13 of the year. Of the past five years, only in 2013 did inventory decline as late as mid-April before building for the next year.

The drawdown to 41.582 million barrels of total U.S. propane inventory leaves it more than 21 million barrels below the same week in 2016.

Propane inventory spent much of 2016 setting record highs for individual weeks of the year, but that changed toward the end of the year. The result was a net drawdown in inventory for 2016 after seeing a net build in 2015. The change in direction for inventory accelerated in 2017, as it is now below the five-year average.

It is a remarkable change after years of inventory builds and oversupply. What makes the change even more notable is that the falls in inventory follow two very mild winters.

The changes in inventory are reflected in propane’s price. On this date in 2016, Mont Belvieu propane closed at 43 cents and Conway closed at 39.125 cents. Today, Mont Belvieu is trading at 65 cents and Conway is trading at 60.5 cents.

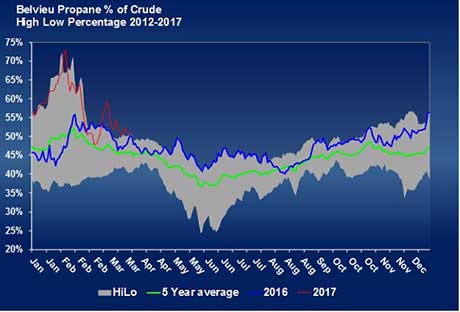

The changes are showing up in propane’s relative value to crude, as well.

Currently, propane is setting five-year highs in relative value to West Texas Intermediate (WTI) crude. (The chart above is for Mont Belvieu, but Conway is similar.) In this relative valuation, it is obvious that changes in propane fundamentals are having an impact on the way the market perceives its fair value.

In regard to propane’s relative value to crude and after coming out of back-to-back mild winters, setting five-year highs is very telling of the impact of slower growth in U.S. propane supply, along with significantly higher exports.

Propane markets have been tending to value Mont Belvieu’s relative value to WTI crude at just above 50 percent. Recent spikes put propane’s value higher, but the default valuation when demand is not pushing prices too much is about 50 to 53 percent.

We think last week was significant in that propane markets are shifting focus more and more to next year. The markets reacted to last week’s inventory draw with much less the laissez-faire attitude of an industry at the end of its high-demand period. Instead, it was reacted to by an industry starting to look further down the road.

The relatively low state of inventory compared to the last couple of years, the drawdown of inventory in a mild winter and the continued drawdown of those inventories beyond the normal drawdown period are getting the deserved attention.

Anyone in the retail propane business or consumer of propane does not want to see prices going higher. However, in this case, increases in prices now that might have the impact of slowing exports over the summer might be preferred over low inventory at the beginning of the high-demand period during the fall and winter.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.