Water heater market opportunities heating up

Propane retailers looking to spur gallon growth and boost a sometimes-challenging residential business can turn to opportunities in the water heater market.

Tankless water heaters have gotten the industry’s attention. Photo courtesy of Navien

Those retailers diversifying a business built traditionally on a seasonal segment like home heating are being drawn to the year-round benefits of water heaters. It’s also hard to ignore the market potential.

According to ICF, nearly half of all U.S. households that use propane for space heating do not use propane for water heating. This equates to nearly 3 million customers that already use propane in the home.

The data point underscores the need for propane retailers to identify these customers as an attractive opportunity to increase the number of propane burner tips and sell them on the many benefits of the propane-fueled appliance.

“Marketers need to leverage existing customers and sell more gallons per installation,” says Randy Thompson, founder and senior adviser of Maryland-based ThompsonGas. “Given that propane marketers have already invested in the tank assets for these sites, these same marketers could significantly subsidize new water heater installations and still quickly see a financial benefit from this recurring revenue.”

Thompson calls the opportunity with water heaters the “low-hanging fruit” for the industry. As chairman of the National Propane Gas Association, he lists water heaters in a multi-part plan that he feels can help grow the industry by 4 billion gallons over the next five years.

“If you converted these existing customers into propane-powered water heater users, at an average of 275 gallons per year, the industry would sell [nearly] an additional 1 billion gallons annually,” Thompson says.

Water heaters – whether tank based or tankless – provide retailers with another burner tip in a propane home or an outlet to convert a residential customer that’s using another energy source. If retailers can get propane into the home, whether by replacing an appliance or during new construction, a whole host of possibilities await, for both the retailer and consumer.

“It’s something we’ve been seeing from the data and through conversations that it’s an attractive market and growth opportunity,” says Eric Kuhle of ICF. “When analyzing the housing market, there’s a large number of households across different regions that have propane for space heating fuel but are using electric water heaters. Those are, you would think, a relatively straightforward conversion opportunity, given that propane’s already there. There’s a tank and customers are used to [propane]. It’s a matter of increasing the number of burner tips at the household.”

Success story

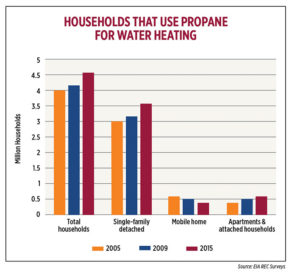

Click to enlarge. Source: EIA REC surveys

The water heater market is working for Georgia-based Conger LP Gas, which has been pushing tankless models successfully for the past several years. The way Dan Richardson sees it, the company didn’t have much choice.

Richardson, Conger LP Gas president and CEO, says the electric heat pump, prevalent in the Southeast, and the up-and-down nature of the winter heating season have dented sales of home-heating gallons. He’s also hesitant to rely on the agriculture market, even though the company has thrived in the area of tobacco curing.

“If [the residential home heating market] is not an option, what’s our second option?” Richardson asks. “The next largest energy user in a home is your water heater. In most homes, a water heater is at least 30 percent of energy usage.”

Richardson also thought a hot new market would increase his company’s value and position it for the future. In looking ahead, though, he also looked behind. He was curious how industry members of decades past kept propane sales strong. He discovered they were placing an emphasis on appliances as a way to generate more gallons.

“One of the things they used to do was, if you needed a 40-gallon propane water heater, they would give you [the customer] that 40-gallon propane water heater,” he says.

Customers would pay an installation charge and burn about 300 gallons a year with the water heater, says Richardson, who thought about how Conger LP Gas could recreate the sales strategy. In 2014, the company began giving away 40-gallon propane water heaters, charging an installation fee and securing new gallons. Now, most of its traction is with the Rinnai tankless water heater, supported with rebates from the manufacturer, the Georgia Propane Gas Association and the Propane Education & Research Council.

“What was happening, in so many instances, people forgot that we could install [water heaters] because we hadn’t advertised it,” Richardson says. “They were going to Lowe’s or Home Depot or calling a plumber. If it was someone else installing it, they didn’t want to deal with gas, so they would talk those people into electric water heaters.”

Conger went from selling 12 to 16 tankless water heaters per year before the program to 120 in the first year (2016), 150 in the second year (2017) and 206 last year. The sales goal, Richardson says, is 250 to 300 water heaters a year. More than half of the current installations are netting organic growth for the company, he adds.

“It might be because people are building a new home or it could be somebody remodeling a home or someone has already been researching tankless water heaters and they understand the efficiencies that are there to reduce their overall energy bill.”

Business strategy

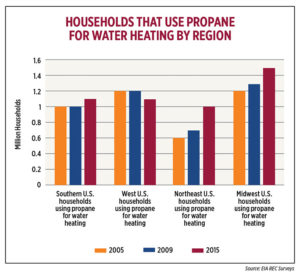

Click to enlarge. Source: EIA REC Surveys

Thompson agrees with the retail strategy in which propane marketers provide the appliance to customers in exchange for service and the accompanying gallon sales.

“Cell carriers often give away phones to customers or provide them at a very low cost because they are focused on the end game – the recurring revenue from service plans,” he says. “The same business strategy should be employed by propane marketers with water heaters.”

ThompsonGas is reaping success with water heaters, but not as quickly as Thompson says he would like. He feels consumers don’t prioritize replacing equipment that isn’t broken.

“The upfront cost is their main objection and our biggest hurdle,” he says. “We need to do a better job at incentivizing the transition to propane-powered water heaters and communicating that this reasonably low-cost change will equate to significant savings over time. This is a consumer-relations challenge that requires a high-profile, resonant message, coupled with a robust rebate program.”

For the propane industry to grow gallons in the water heater market, both industries must build partnerships that will ultimately make propane a common solution for the consumer and trade partner.

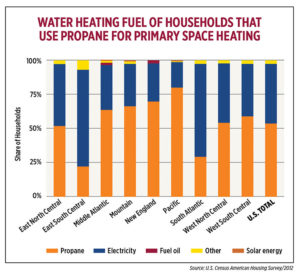

Click to enlarge. Source: U.S. Census American Housing Survey / 2012

“Rinnai continues to work alongside PERC and propane companies to drive awareness and visibility around the energy efficiencies associated with tankless water heaters,” says David Federico, brand director at Rinnai. “We work alongside many of the propane companies to drive programs and incentives to aid in the conversion of tank water heaters to tankless.”

Federico says the biggest issue today in growing the market is twofold: developing a qualified installer/contractor base and increasing the awareness of consumers that their propane company can and will provide equipment.

PERC, meanwhile, has been supporting the efforts to transition consumers’ water heaters to propane. It offers materials and marketing tools at propane.com to help the industry sell consumers on the benefits of propane-fueled water heating.

“PERC can provide consumer-facing materials that specifically support the water heater sales effort,” Thompson says. “They also offer robust market materials that will help companies create programs focused on sales extension through water heaters. Though PERC may be able to assist with a collaborative rebate program and a communications campaign to create urgency and spur consumer action, the real onus falls on marketers. They need to leverage the trust and loyalty of their customer base and communicate in ways they know their customers will embrace.”

Answering the heat pump push

The Propane Education & Research Council (PERC) approved a project at its July meeting in which it will partner with Rinnai to develop a hydronic air handler. In the project, a commercialized air handler control module is paired with a gas-fired tankless water heater unit and/or a boiler, a hydronic coil and a pump. The product would be installed as a retrofit solution to an existing air handler to add hydronic heating to any ducted system. It could provide whole-house or auxiliary heating by replacing strip heating in an electric heat pump. The solution for the repair-and-replace market would provide more comfortable, clean and efficient space and water heating, PERC leaders say. The propane industry also views the project as its response to the electric heat pump, which has been taking away propane market share, notably in the Southeast.

Tank or tankless?

Tankless water heaters have been gaining attention in the propane industry. In fact, ICF says propane has achieved a much higher penetration rate in the tankless water heating market than with traditional tank-type water heaters. According to Rinnai, some of the advantages of tankless water heaters include higher efficiencies, space savings, endless hot water, compatibility with the “internet of things,” longer warranties and a 20-year life. Still, that doesn’t mean there isn’t a place for tank models. “In a remodel or replacement, the tank-type water heater is a consideration. It’s often an easier installation, and you still get the benefits of gas,” says Tucker Perkins, president and CEO of the Propane Education & Research Council. “In new construction, and especially in green building, we prefer tankless because it is very efficient and so good for space savings.” Georgia-based Conger LP Gas offers giveaways on both a 40-gallon tank water heater and tankless models. “We continue to offer a free 40-gallon propane water heater because there are still a lot of people who have a 40-gallon tank water heater,” says Dan Richardson, president and CEO of the company. “All we have to do is unhook the old one, remove it and put the new one in. The home is already vented and has a gas line. As those wear out, we want to be there and offer an alternative to replacing it. We’re able to hold onto that 250 or 300 gallons a year that go through the tank water heater.”