Weak fall demand spurs additional inventory build

The Energy Information Administration’s (EIA) Weekly Petroleum Status Report for the week ending Nov. 6 reported a 1.563-million-barrel increase in U.S. propane inventory, raising it to a record high of 103.974 million barrels.

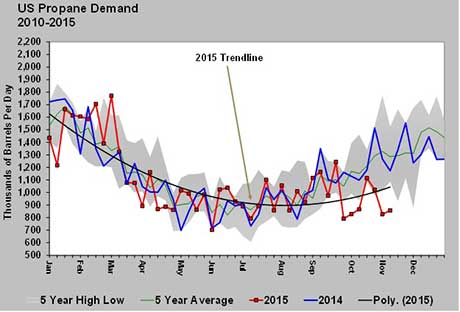

The story was much the same as last week, with propane demand running well below normal.

In five of the last seven weeks, propane demand has set five-year lows. The two weeks that did not set new lows were well below average, as well. Last week, propane demand improved by 30,000 barrels per day (bpd) from the week before.

However, that was more than offset by increases on the supply side. Propane imports rose 33,000 bpd to 101,000 bpd, while exports held steady at 680,000 bpd, according to EIA estimates. The real surprise may have come from propane production, which increased by 99,000 bpd to 1.659 million bpd, putting it above the same week last year by 34,000 bpd.

There are reports that petrochemical consumption of propane fell from 390,000 bpd in September to 302,000 bpd in October. Combined, it has made for a weak propane pricing environment and an atypical inventory change period this fall.

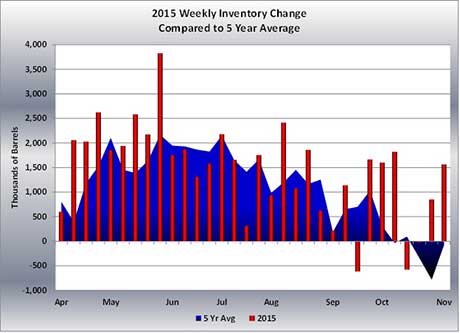

The chart above plots this year’s weekly inventory changes since April (red bars) against the five-year average weekly inventory changes (blue shaded area).

The table illustrates that builds in inventory have been, for the most part, well above average this fall. From the first week of September through Nov. 6, U.S. propane has risen from 96.556 million barrels to 103.974 million barrels, an increase of 7.418 million barrels. On average over the last five years, inventory has increased 1.545 million barrels over that same time frame.

Since 2003, there have only been two winters in which propane inventory was still building into November. Even in those years, the 1.563-million-barrel build experienced last week would have been exceptional.

We note that during the first part of the traditional inventory-build period during April and May, propane inventory was building at a well-above-normal pace. However, during June and July and to some extent into August, propane inventory was building at a below-average rate. During the last five years, inventory from June through August had increased 18.564 million barrels. This year, inventory gained about a million barrels less at 17.549 million barrels.

Based on reports from retailers, we believe that during this period, they were filling their storage and their customers’ storage to higher-than-normal levels to take advantage of very low spot gas prices. If that theory is true, it means that high inventory positions coming into the fall have worked with low fall demand to cause the abnormally high inventory builds this fall.

At some point, the believed high inventory levels will return to normal and demand is likely to return closer to normal, resulting in more typical inventory changes. However, with 93 percent of the corn harvest completed as of Nov. 8 and expectations of above-normal temperatures in the higher-consuming northern states due to El Niño, it is not unthinkable that inventory could build a while longer.

This week’s EIA data was for week 45 of the year. The latest we have seen inventory build since 2003 was through week 48 of the year in 2005. With new propane export capacity not expected to have an impact until after the first of the year and other fundamentals looking bearish, one has to wonder if inventory might not peak until December this year.

Week in review

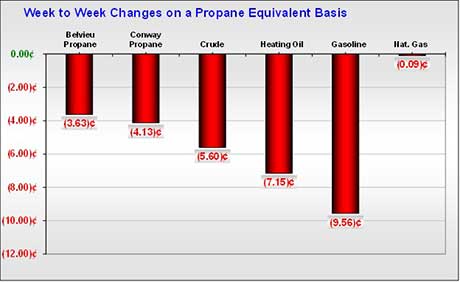

Fundamental and technical trading conditions remain bearish for crude and propane. Both experienced large builds in inventory. U.S. propane inventory is at record highs and is still building. Globally, crude inventory is also at record highs. We remain bearish in our outlook.

Last week’s highlights

- Monday: Propane prices fell with crude to start last week as current inventory levels give no reason for propane to separate from crude. EIA projections that U.S. crude production would fall again in December were not enough to offset weak Chinese economic data, causing crude prices to move down.

- Tuesday: Crude prices moved up after four straight days of posting a loss, but propane prices remained unchanged on the day, matching Monday’s close. Reports of decreased spending for oil exploration and production supported crude, as did an oil workers union strike in Brazil.

- Wednesday: Crude prices tumbled as they reacted to a report from the American Petroleum Institute (API) of U.S. crude inventory increasing 6.3 million barrels. EIA’s Weekly Petroleum Status Report was delayed a day because of the holiday. However, in its Short-Term Energy Outlook, the EIA lowered its projected price for Brent crude for next year by $2 per barrel to an average of $56 per barrel. It expects West Texas Intermediate crude to average $5 less than Brent crude next year.

- Thursday: Propane prices dropped around 4 percent after EIA reported a 1.563-million-barrel build in U.S. propane inventory. Crude also dropped as EIA data confirmed a large build in Cushing, Okla., crude inventory that had been reported by the API on Tuesday. Propane demand remained very weak, while both propane imports and propane production increased.

- Friday: Crude and propane prices continued to slide with weak fundamentals, providing little reason for traders to buy either commodity. The weekly rig count report from Baker Hughes showed fewer rigs were operating in North America, but two more rigs were drilling for oil in the U.S. than during the previous week. Declines came in Canada and natural gas drilling.

Cost Management Solutions LLC (CMS) is a firm dedicated to the analysis of the energy markets for the propane marketplace. Since we are not a supplier of propane, you can be assured our focus is to provide an unbiased analysis.

For more Cost Management Solutions analysis of the energy market that helps propane retailers manage their supply sources and make informed purchasing decisions, visit www.lpgasmagazine.com/propane-price-insider/archives/.