What propane retailers should expect from early winter build

U.S. propane retailers got an early Christmas present on Wednesday when the U.S. Energy Information Administration (EIA) reported a surprise 1.316-million-barrel build in U.S. propane inventory. To build this time of year is unusual, and the size of the build was remarkable.

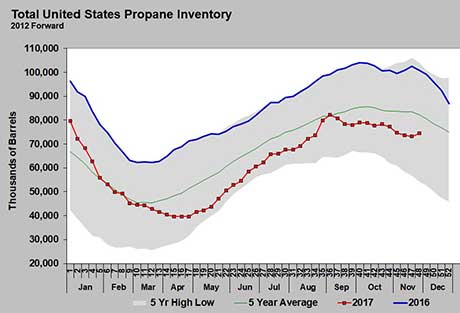

The build pushed U.S. inventory to 74.47 million barrels, compared with 99.252 million barrels during the same week last year. Inventory is still 25 percent below last year and 11 percent below the five-year average.

The build occurred partly because of weak domestic and export demand. U.S. demand for propane was 1.286 million barrels per day (bpd). That compares with a rate of 1.477 million barrels during the same week last year. The 191,000-bpd year-over-year drop is at least partly due to weak demand from U.S. petrochemical companies.

Petrochemicals consumed propane at a rate of 300,000 bpd in November. Somewhere between 250,000 to 275,000 bpd is the lowest propane consumption rate we are likely to see from petrochemicals. Consumption was at 286,000 bpd in October, so petrochemicals are certainly near the lower end of the consumption range.

This is both good and bad news. The low consumption rate is helping to maintain inventory, but it also means a decrease in consumption is unlikely to occur, even if prices start to rise.

As far as domestic heating demand goes, this heating season has been a bit stronger than the last two. Heating degree-days were down last week, contributing to the lower demand number reported in the latest EIA report.

Even though domestic demand contributed to the build in inventory, the key reason for the surprise build was a significant drop in U.S. propane exports. Exports dropped 446,000 bpd week-over-week from 1.127 million bpd to just 681,000 bpd. If that drop-off is already occurring, it would be very bearish for propane prices.

However, it is probably premature to believe that last week’s export rate is what should be expected for the remainder of winter. Export volume can have volatility due to many factors. Traders will probably need to see several weeks of weak exports to get bearish. That fact is reflected by an increase in propane prices since EIA reported the inventory build.

Not all of the build in inventory can be attributed to what was going on with propane domestic and export demand. Supply had its bearing as well. EIA estimated propane production at 1.973 million bpd, which was up 50,000 bpd from the previous week and 178,000 bpd higher than the same week in 2016. Official monthly production numbers are generally not as high as the weekly estimates, but there is still solid growth in supply.

Lastly, we can’t forget that the Mariner 2 East pipeline, which would have allowed more exports from the U.S. East Coast, may not become operational this winter, as expected. At this point, it is not likely to be operational until next winter. That reduces efficiency of export options and helps retain more propane in the domestic market.

The reality is that U.S. propane inventory is well below where it was at this point last year. It is also a fact that 64 million barrels of propane were drawn from inventory last winter. Because of those reasons, there remains a substantial upside price risk for propane prices. However, at least for this week, fundamentals suggest that there is reason to hope that dramatic upward price pressure on propane might be avoided. It’s a weekly vigil to monitor how the fundamentals are trending to help guide retailers with supply decisions. In the spirit of the holidays, retailers would love to see more of the same from fundamentals over the coming weeks.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.