When to use swaps versus physicals

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, addresses price risk management.

We were noting the volatility in propane prices over the course of this month, and we realized it provides a great opportunity to explain the difference between two financial tools: swaps and physicals.

As any regular reader of Trader’s Corner knows, we have recently been pointing out the downside price risk present for propane because it is so much higher than its average price for this time of year. For that reason, we have suggested only taking short-term positions and not locking down prices for the remainder of this winter.

We had talked about buying balance of the month swaps, but we hadn’t talked about physicals, so we saw this as our opportunity. It’s a timely discussion because physicals are a good way to make short-term plays.

Before we delve into the nuances of physicals, let’s take a quick review of swaps. Buyers and sellers of propane negotiate deals not just in the spot market (at this moment) but also for the future. Of course, there are sellers putting up offers on trading screens for propane they would like to sell today or deliver by the end of the month. There are buyers that are putting up bids for what they are willing to pay for propane they would take on delivery today or by the end of the month.

But there are also the same negotiations that determine the value of propane one month from now, a year from now or even three years from now. This is known as the futures market. When we go into the futures market to obtain a swap, we set our swap value at where the market has determined propane should be valued for that month at this particular point in time. The value of our swap is known as the strike price.

As we look at futures prices, if we went into the futures market to “buy” a swap for December 2022, we would likely get a strike price of 85.625 cents. At the moment we buy the swap and set the strike, nothing happens. No money exchanges hands. The amount and direction of money flow will be determined after December 2022, when the monthly average price for propane is known. If the monthly average price turns out to be less than our 85.625-cent strike price, then we as the buyer will pay the difference between our strike and the monthly average. If the monthly average is more than our strike, we will receive the difference. So, we are buying the strike and agreeing to sell at the monthly average for December on the day we enter into a swap.

The entry process into a physical is the same. We would get the same strike price as we would with a swap – 85.625 cents. However, we do not agree to settle against the monthly average for December. Instead, we will pick a day in December in which to close our position. It could be the first day, the last day or any day in between. We settle against the price we negotiate for our propane on that day instead of the monthly average.

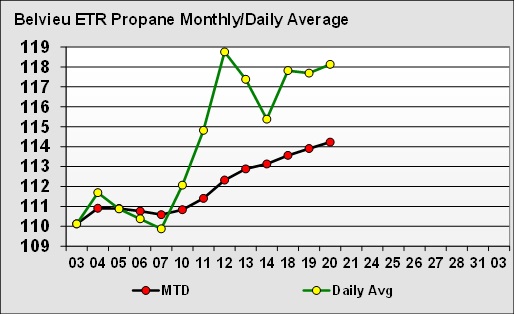

With that background, let’s bring in the chart that prompted this topic for this week’s Trader’s Corner.

Chart 1 plots the monthly average against the daily average for Mont Belvieu ETR propane for January 2022.

Let’s say at the end of December 2021, one retailer bought a swap for the month of January and another bought a physical. On the last day of December, a January 2022 swap or physical could have been struck at 113 cents. Prices started January down, so neither position looked great. But then there was the strong run between the 7th and the 12th. As you can see, the monthly average is slow to adjust, so it has taken all the way until Jan. 13 for a holder of the swap to be back to breakeven. However, on the 12th, a holder of the physical was up 6 cents.

Both positions are up now, but since the 10th, the holder of the physical has been in a better position. If the holder was astute enough to have closed the position on the 12th, there is a good chance, as it stands today, that it would have yielded the best result possible. However, if the holder didn’t make that decision, it is very possible the result could be worse before the month is over.

When a retailer is doing longer-term hedges, the swap is the best tool. You are simply establishing a price for supply so you can establish a sales price to the customer. And do you really want to have to watch that close each month and be forced to make a decision every day on whether to close the position? Over the course of many swaps or physicals, the performance of the swap would probably be better. However, if we are just looking at managing upside price risk for a short amount of time, the flexibility of the physical has some appeal.

Imagine it is Dec. 30, 2021. Forecasts are showing cold weather for the start of January, and crude is on a strong run higher. Propane prices look well supported for the next one to two weeks, but after that, with prices already high, the downside risk is significant if those short-term supports are lost. In that case, the physical may have the advantage over the swap because of the flexibility of settling the position on the day of your choosing.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.