Where have the propane inventory builds gone?

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, discusses where propane inventory builds have gone.

Propane inventory was at 33.308 million barrels when it began to build in the first week of March. That was 7.891 million barrels below where it was in the first week of March in 2021. By the end of May, the inventory deficit to last year had been completely erased. At that point, inventory was 5.505 million barrels higher than last year. As a consequence, propane prices had dropped from 163 cents during the first week of March to 120.25 cents by the end of May.

In June, the encouraging price decline in propane prices came to a halt. As we start July, Mont Belvieu ETR propane is at 121.75 cents. In this Trader’s Corner, we are going to look at propane supply/demand fundamentals to see what has happened to end the downward trajectory in prices.

Of course, when we are looking at propane price changes, the first place we look is at crude prices. The value of crude sets the base for refined fuels and NGL markets. In this case, the change in propane has not been dictated by crude. Since the first of March, WTI crude has averaged $108.44, and as we write this, it is trading at $107.55. Yes, there have been some ups and downs in crude over the period in question that have impacted propane’s price day to day, but propane’s value has been increasing and

decreasing relative to crude over that period. When propane changes in relative value to crude, we know to look at propane’s own fundamentals to see what is happening to impact prices.

First, we want to look at what was going on with propane fundamentals during the time its price was falling from March through May. Once we have established that baseline, we will compare it to what happened in June when propane prices leveled off and even increased for a while.

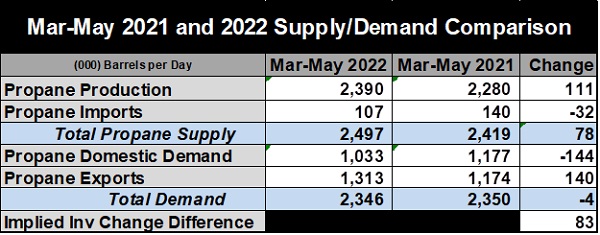

In Table 1, let’s look at the bottom line first. During the March-May time frame, U.S. propane supply and demand was such that inventory was improving an implied 83,000 barrels per day (bpd) against the same period in 2021. Now, let’s look line by line and see why.

In 2022, production was 111,000 bpd higher. That was offset some by a 32,000-bpd drop in propane imports, but net propane supply was 78,000 bpd better than in that period in 2021. At the same time, domestic demand was off by 144,000 bpd which was nearly offset by a 140,000-bpd increase in exports. Still demand was down 4,000 bpd year over year. Combined, we get the 83,000-bpd year-over-year improvement, and propane prices reflected the improving fundamental situation. We saw that not only reflected in the 40-cent drop but also by propane’s value relative to crude falling from near 60 percent to about 40 percent.

Now, let’s look at what happened in June.

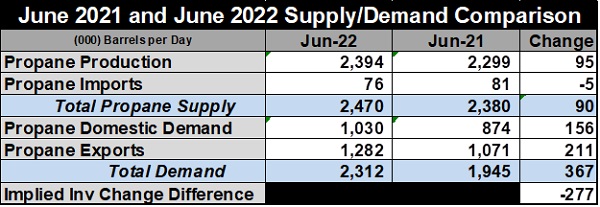

Again, let’s start with the bottom line in Table 2. During June, there was an implied inventory change of 277,000 bpd in the wrong direction. It does not mean propane inventory fell 277,000 bpd during that period, but it was underperforming 2021 by 277,000 bpd. That is about what inventory showed. In 2021, inventory was up 12.173 million barrels in June, but this year it was only up 4.431 million barrels. So, let’s see what happened.

Production held up well, besting 2021 by 95,000 bpd. Imports were down 5,000 bpd, but that was not nearly as much as they were off March-May. Overall, supply performed well in June. The problem: It was not equal to the increases on the supply side. U.S. domestic demand was up 156,000 bpd and exports were up 211,000 bpd. That is a 367,000-bpd increase in demand only offset by a 90,000-bpd increase in supply.

Propane prices reflected the increasing demand as they were flat to higher in June. We think the trends in supply will probably hold up. We are increasing crude and natural gas production as well as increasing refinery throughput. No reason to see that changing. Issues with a major LNG export facility could slow natural gas drilling in the short term, but probably not by much. Refineries are already operating at near-max sustainable rates, so there may not be much of an increase there, but also, we aren’t likely to see a drop. Crude’s price suggests more drilling for crude and the production of associated natural gas with that.

The demand side is far more difficult to predict. High prices could hurt demand. Worsening economic conditions could hurt demand as well. Either or both of those occurring could see propane inventories building better again and prices softening some as a result. What we can say: If the trends of June continue, propane prices will be higher as long as crude prices do not offset by declining. There are so many geopolitical scenarios in play that could dramatically impact crude’s price, it is tough to foresee where it will be tomorrow much less by winter. However, the general consensus is that supplies are likely to remain tight for the foreseeable future.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.