Where propane prices will start next winter

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explores what factors will affect propane pricing the rest of the winter.

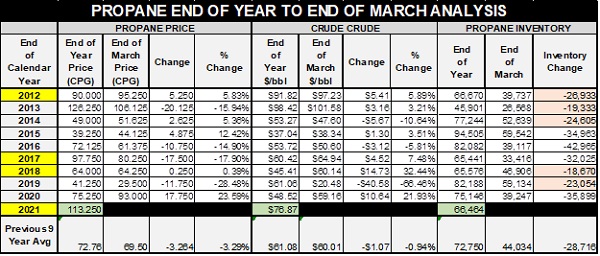

Last week’s Trader’s Corner was titled “What propane prices will do for the remainder of winter.” We used Table 1 in our analysis.

We noted that there were three winters in the study that had similar end-of-year inventory levels as this year. Unfortunately, we found that end-of-year inventory position provided little guidance on where to expect propane prices by the end of March. We also found that propane demand over the past three months of winter didn’t provide consistent guidance either.

One of the more consistent patterns was that the majority of the time (six out of nine), propane prices went in the same direction as crude’s price. But, even trying to use that as a guide had its limitations.

What we did find useful was knowing the average price of propane at the end of the year. We noted that if propane prices were significantly above that average, as they are this year, in two of three winters, prices fell significantly by the end of March. The exception was the lowest of the “high-priced” years, and propane’s percentage gain was almost exactly the gain in crude’s price.

With that realization, we cautioned that propane buyers need to be very careful about getting too long propane for the remainder of the winter. We suggest protecting against higher prices by taking a series of shorter-term positions rather than taking positions that cover through the end of March – basically, the one-month-at-a-time buying strategy we talked a good deal about last year.

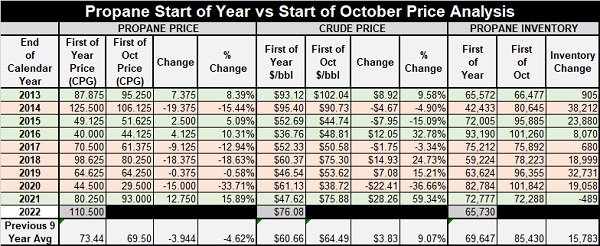

For this week, we decided we would expand our study to determine guidance on where propane prices might start next winter. To make the years easier to follow, we changed our price from the last day of the year to the first day of the year. The price changed little, but now when you look at a given year, you are going to see where the price was on the first day of the year and the first day of October for the same year. The years propane moves higher are highlighted in green, and lower in red.

From 2013 through 2021, propane has had an average price of 73.44 cents on the first trading day of January and an average price of 69.5 cents on the first trading day of October. It is right at a 4-cent drop, or 4.62 percent. The market is valuing October 2022 Mont Belvieu ETR propane at 100.875 cents currently. That is 8.5 cents, or 7.77 percent, lower than the current January price. The good news is that October propane is valued very well against the current front month. It is better than the typical decline of 4 cents, or 4.62 percent. The bad news is the price is 31.375 cents above the 9-year average October price.

Propane was higher to start October than at the beginning of the year in four of the nine years in the study. In three of those four, crude was higher. In the year it wasn’t, propane started the year at 49.125 cents, well below average. Analysts aren’t quite as bullish on crude now as they were a couple of months ago, but we see very few that are bearish about crude’s prices for this year. Crude averaged 9 percent higher in October compared to the first of the year. After a number of years in which crude prices have been relatively low, it looks like it is set up to be pricing above average in October of this year.

We must say the lack of correlation between inventory build ahead of winter and the price is a bit perplexing. For example, in 2013, there was little inventory build. Despite the price being above average to start the year, there was a 7.375-cent gain in price, with the light inventory gain likely a factor.

When you isolate that year, you think a lack of inventory build trumps all else. Yet, in 2017, propane prices were below average at the beginning of the year, inventory didn’t build, and propane prices dropped more than 9 cents. That is a year that is strange in many ways.

By the way, the inventory at the end of winter was just over 39 million barrels in both those years. The current inventory is below average, so it at least has the potential to support higher prices at this point.

We do have some solid takeaways from this study:

1. When propane prices are above the 73.44-cent average at the beginning of the year, there is a lot of pressure to go lower. Thus, we think there is considerable risk at a current price of 109.375 cents for prices to have a 15-cent downward correction if winter continues at current temperature trends.

2. The years 2013 and 2021 were exceptions. Propane prices started the year above average and were higher by winter. In those years, it took both rising crude prices and very low inventory builds to create a bullish enough environment to lift prices from an above-average starting point. In other years when prices start the year above average, neither higher crude nor low inventory builds alone where enough. It appears to take both happening concurrently when prices start the year above average.

3. Because we believe crude prices will be higher this year than over the past seven years and because propane inventory is below normal, we do not think it necessary for propane’s price to drop to the 73.44-cent level to be a good buy. In fact, a 15-cent drop between now and the end of winter would put propane at around 94 cents. If propane’s forward curve remains backwardated (prices lower in the future than the front), it would be time to consider first-tier price protection for next winter. That action would be conditional on two factors: When a propane price drop occurs, crude’s price is near or above where it is now, and propane inventory is below average. If crude prices are falling or below where they are now, and/or propane inventory has eliminated its deficit to the average, we would be less inclined to engage in first tier price protection at 94 cents.

This study shows convincingly that a propane buyer can’t base decisions on just one factor, such as inventory position. Begin by looking at prices relative to their average. Then, consider the crude pricing environment. Next, consider inventory positions and trends. Put all of them together and you will improve your odds of being properly positioned on supply and supply price protection.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.