Why propane prices don’t always follow natural gas prices

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, examines why propane prices don’t always follow natural gas prices.

In recent Trader’s Corners, and in our daily reporting, we have written more than normal about natural gas and natural gas pricing. The primary reason for this focus has been the war in Ukraine. Europe is trying to wean itself off of Russian energy, and natural gas is a huge component in that equation. The fact is there is no alternative to Russian natural gas for Europe. Europe has created a dependency on Russia in that respect – limiting the amount of pressure Europe can put on Russia because of its invasion of Ukraine.

As a consequence of this focus, we have had some questions about how much impact higher natural gas prices are having on U.S. propane prices. Currently, U.S. natural gas is trading at a 13-year high at just over $7 per MMBtu. It is a logical question, since so much of the nation’s propane production comes from natural gas processing. In January, 87 percent of U.S. propane production came from natural gas processing, and the remaining 13 percent from crude refining. This fact makes it seem that propane prices would naturally be impacted significantly by natural gas prices. However, that is not the case.

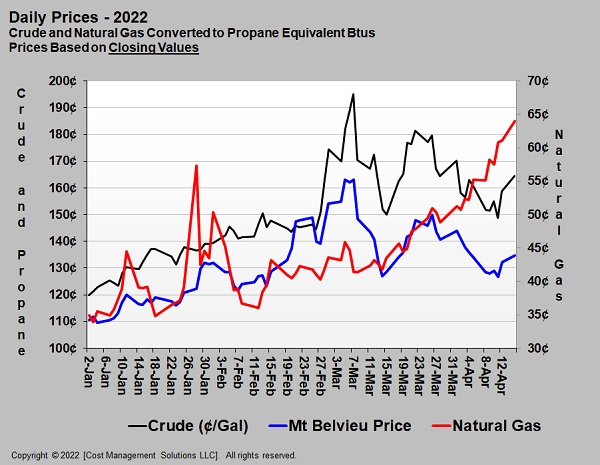

Natural gas liquids (NGLs), once separated from methane, price relative to crude, not natural gas. Chart 1 converts crude and natural gas to a propane Btu equivalent so their prices can be compared.

Even though all three are being converted to the same propane Btu equivalent, we had to put natural gas on its own scale so you can easily see the comparison we want to make. Natural gas’s value relative to crude and propane is so much lower that, if put on the same scale, it would be hard to see the separation in pricing we want to reveal.

If you look at the crude (black) and propane (blue) lines, you can see the strong correlation in price movement. There are separations at times, but the overall trend is together. Now, look at natural gas (red) compared to propane (blue). The correlation simply isn’t there. Note how natural gas prices have increased consistently since Russia invaded Ukraine, but propane moved lower with crude since March 23.

Despite the major gains in U.S. natural gas prices this year, it is still valued at the equivalent of 64-cent propane. There is a price point where natural gas will have a direct impact on propane prices, but it is still a long way from that point. In fact, natural gas would have to more than double to $14.60 per MMBtu for its price to be equal on a Btu basis. If natural gas prices started approaching that price, then natural gas processors would start rejecting propane. Rejecting means they would leave the propane in the methane stream and sell it to the natural gas utility companies rather than taking it out to be sold as fungible propane. There is a cost to separate the propane from the methane, so the price point at which propane would be rejected would be closer to $14 per MMBtu.

Prior to the rapid rise in crude production in the U.S., natural gas was valued much higher. With all the drilling for crude, associated natural gas was produced, which oversupplied the U.S. with natural gas and drove its price lower. Before all the development of shale fields, high demand could push natural gas prices high enough to cause rejection to occur. Where contracts and specifications allowed, propane was left in the natural gas stream being delivered to natural gas utility companies. This would “rob” fungible propane supplies to the retail propane industry that would result in propane prices going up enough to discourage the rejection. Thankfully, we have not reached these conditions in more than a decade. Natural gas prices need to nearly double to see a direct impact on propane prices from rejection.

To this point, higher natural gas prices are more likely to put downward pressure on propane prices. How in the world could that be? The higher natural gas (methane) prices can actually encourage the drilling of natural gas wells. Remember, the oversupply of natural gas came from associated natural gas production from crude wells. There was a significantly decreased need to drill natural gas wells that were just going after methane and NGLs (ethane, propane, butane, etc.).

Despite the high price of natural gas, there still isn’t a major rush to drill natural gas wells. For the week ending April 8, Baker-Hughes reported 141 rigs were drilling natural wells while 546 were drilling crude wells. The number of active natural gas drilling rigs is up 48 from last year, while the number of active crude rigs is up 209. Keep in mind that back in 2008, at the height of the shale gas revolution when natural gas was priced at over $10 per MMBtu, there were as many as 1,600 rigs drilling for natural gas. Drilling for crude in shale formations lagged, but once it started in earnest, there was less of a reason to drill for natural gas alone. In 2008, rigs drilling for crude were around 400. By 2013, the script had flipped – there were 1,400 rigs drilling for crude and less than 400 drilling for natural gas.

With all this information on the U.S. market, we need to keep in mind the global picture. Europe needs more natural gas from the U.S. if it is to successfully wean itself off of Russian natural gas. But as we have pointed out in previous Trader’s Corners, the limitation is export capacity for both liquefied natural gas and propane. Until there is more export capacity, new natural gas production would only drive the price of natural gas down until it is no longer economically viable to drill for the methane. Natural gas prices in Europe are four times higher than they are in the U.S., so there is every reason to send it there, but the issue is transportation. This keeps the U.S. market somewhat disconnected from the European market, though overall higher natural gas prices globally are supporting to a degree the upward trend in U.S. natural gas prices. If the capacity to export to Europe were higher, we would see the U.S. and European natural gas prices moving toward each other and finding a happy medium. To this point, the higher price of natural gas in the U.S. is more of a reflection of less crude production providing less associated natural gas production despite the geopolitical influences we have seen since February.

Heating demand for April is looking above average; exports are maxed out, and inventories are low. In the summer, the U.S. consumes a lot of natural gas for electrical power generation. If inventories don’t recover after heating demand ends and before power generation begins, natural gas prices could remain elevated. But for now, the price of natural gas has not reached a point that is directly impacting the price U.S. retailers and their customers are paying for propane. We can still blame the elevated price of propane on higher crude prices and tighter inventories resulting from strong demand.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.